Featured News Headlines

Bitcoin Price vs Energy Value- Bitcoin Hash Rate Hits Record High While Price Trades Below Energy Value

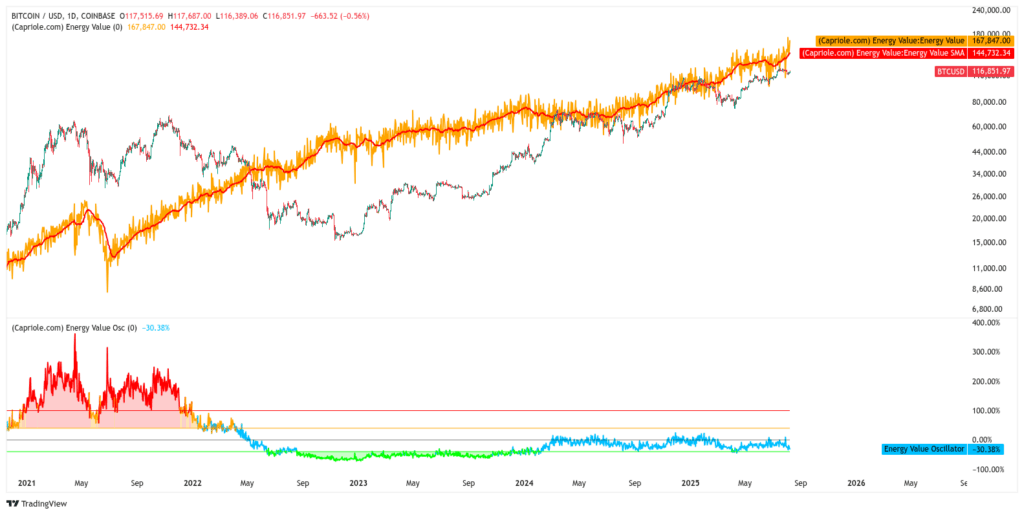

Bitcoin Price vs Energy Value– Bitcoin’s current price of $116,831 may be significantly undervalued according to a new analysis from Capriole Investments. The crypto asset manager’s founder, Charles Edwards, believes BTC should trade 45% higher based on energy consumption data.

What is Bitcoin’s Energy Value?

The Energy Value metric, developed by Capriole in 2019, calculates Bitcoin’s fair price using three key factors:

- Energy input from miners

- Supply growth rate

- Dollar value of energy consumed

This model suggests Bitcoin’s true value currently sits at $167,800 per coin, creating a substantial gap with market prices.

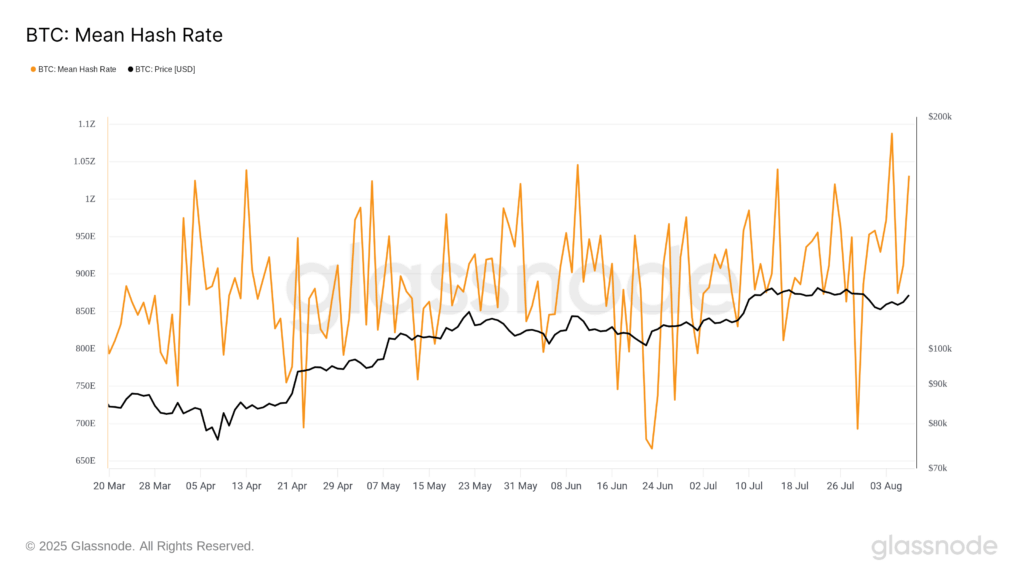

Mining Activity Reaches New Heights

Network data supports the bullish thesis. Bitcoin’s hashrate hit an all-time high of 1.031 zettahashes per second on August 4, according to Glassnode analytics. This record mining activity indicates strong network security and miner confidence.

Edwards noted that Bitcoin trades at a deeper discount to its energy value today than when it was priced at $10,000 in September 2020.

Historical Price Patterns

The Energy Value model has shown predictive power in the past. When Bitcoin’s market price rises without corresponding increases in energy input, corrections typically follow. The model acts as a baseline, with prices eventually reverting to energy-supported levels.

Market Timeline Concerns

Many analysts believe the current bull cycle has limited time remaining. This creates pressure for Bitcoin to reach its theoretical energy value quickly, as the metric could decline if miners reduce their operations.

The 45% price gap suggests either Bitcoin remains undervalued at current levels, or a significant catalyst is needed to justify the energy being committed to the network by miners worldwide.

Comments are closed.