Featured News Headlines

Bitcoin Price – Bitcoin Stabilizes Near $118K Ahead of Key FOMC Meeting

Bitcoin Price – Bitcoin (BTC) price action has settled near the $118,000 mark in the past several hours as investors cautiously await the highly anticipated Federal Open Market Committee (FOMC) meeting scheduled for later today. Market participants expect volatility around the event, which could impact the broader cryptocurrency ecosystem.

BTC Faces Volatility After Sharp Sell-Off

The start of the week has been a rollercoaster for Bitcoin. Following a sharp plunge late last week, BTC dropped from above $119,500 to a two-week low near $114,500 within hours. This steep decline coincided with news that Galaxy Digital was offloading approximately 80,000 BTC on behalf of a third party, sparking concerns about market liquidity and downward pressure.

Despite the sell-off, Bitcoin rebounded over the weekend, climbing back above $117,000 once the bulk of the sale was completed. The new week kicked off optimistically, with BTC surging to the $120,000 level — a promising sign of resilience. However, just as seen in previous weeks, bullish momentum failed to sustain, and bears reentered the market quickly.

Bitcoin’s price repeatedly dipped below $117,500 on Monday and Tuesday, yet managed to claw back, trading steadily around $118,000 at the time of writing. The market capitalization remains near $2.35 trillion, reflecting BTC’s dominant position as its market dominance over altcoins rose to 59.6% according to CoinGecko (CG).

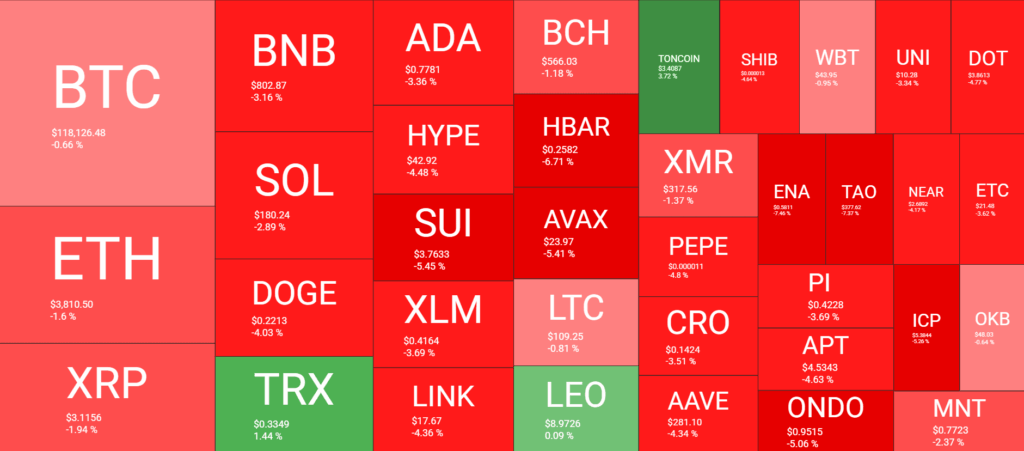

Altcoins Face Heavy Losses Amid Market Pullback

While Bitcoin maintained relative stability, the majority of altcoins have suffered significant price declines, putting the broader crypto market in the red. The total crypto market cap dropped by approximately $60 billion overnight to about $3.94 trillion on CoinGecko.

Major Altcoins Leading the Decline

Ethereum (ETH) faced resistance near $3,900 and is now nearing a break below the $3,800 support level after a 1.6% daily decrease. XRP (Ripple) fell roughly 2% to trade close to $3.10. Other prominent altcoins including Binance Coin (BNB), Solana (SOL), Dogecoin (DOGE), Cardano (ADA), Hype (HYPE), Stellar (XLM), and Chainlink (LINK) recorded even steeper losses.

Large Cap Altcoins Hit Harder

Some of the larger-cap altcoins bore the brunt of the sell-off. Tokens like SUI, HBAR (Hedera Hashgraph), and Avalanche (AVAX) each dropped over 5% within the last 24 hours. Similarly, ENA, TAO, and ICP (Internet Computer) experienced comparable declines, further weighing on the altcoin market sentiment.

Small Caps and Meme Coins Suffer the Most

Among smaller and more speculative assets, the pain was even more pronounced. BONK, a relatively lesser-known token, dumped nearly 13% in value in the past day. It was followed by TIA and SPX, both declining by around 9%. These sharp drops highlight the volatility and risk present especially in low-cap cryptocurrencies during periods of market uncertainty.

What Lies Ahead: FOMC Meeting and Market Expectations

All eyes are now on the FOMC meeting, where the U.S. Federal Reserve will announce its decision on interest rates and provide guidance on monetary policy. Although analysts widely expect no immediate rate changes, the meeting’s tone and outlook for future policy will be key drivers of market sentiment.

Given Bitcoin’s recent price fluctuations and the altcoin market’s struggles, the crypto community is bracing for increased volatility. Traders and investors are closely watching for any indications that might trigger either renewed buying or further sell-offs.

Investor sentiment remains cautious ahead of the Federal Open Market Committee (FOMC) meeting, with traders closely watching for any signals about potential interest rate changes. While a rate hike is considered unlikely, even a hint of tightening could trigger increased volatility across crypto markets. Analysts suggest that if the Fed maintains a dovish stance, Bitcoin and major altcoins could see renewed buying momentum. Conversely, any hawkish comments might deepen the current altcoin sell-off and push Bitcoin back below key support levels. Overall, the market appears to be in a holding pattern, waiting for clearer direction from the central bank’s policy decisions.

As the crypto market navigates these choppy waters, investors remain alert, balancing cautious optimism with the risks posed by macroeconomic uncertainties and the evolving digital asset landscape.

Comments are closed.