Featured News Headlines

Bitcoin Hits $113K, But Fails to Hold Gains After NFP Shock

Bitcoin experienced sudden volatility after the release of the U.S. August nonfarm payrolls (NFP) data, which showed the economy added only 22,000 jobs—significantly below the forecasted 75,000. This weak labor market print had an immediate impact across multiple asset classes. While the U.S. dollar plunged and gold surged to new all-time highs, Bitcoin’s price action remained muted despite the macroeconomic shift in favor of risk assets.

BTC/USD briefly surged to a new September high of $113,400, only to retrace nearly $3,000 within an hour. Market participants were quick to assess the data’s broader implications, especially its potential to push the Federal Reserve toward a dovish policy pivot.

Rate Cut Expectations Accelerate

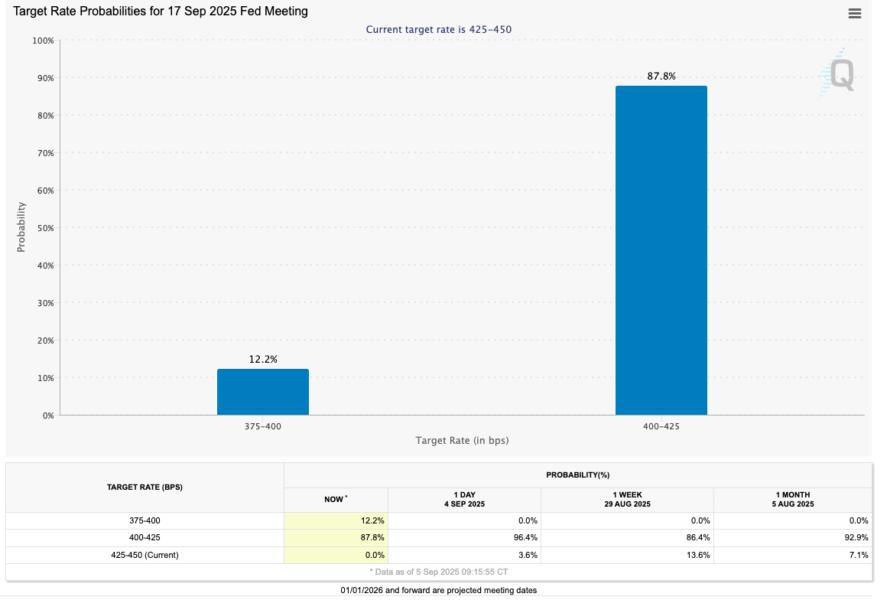

Following the underwhelming jobs report, traders turned their focus to the upcoming Federal Reserve meeting scheduled for September 17. A growing number of analysts now expect the Fed to cut interest rates, with market-based tools reflecting a sharp increase in the likelihood of such a move.

The market’s optimism for lower interest rates stems from the belief that the U.S. central bank may need to step in to support an increasingly fragile labor market and cooling economy. This sentiment was reinforced by the latest data and downward revisions to prior months’ job figures.

Analysts Warn of Deteriorating Labor Market

The Kobeissi Letter, a well-followed macroeconomic analysis platform, pointed out that the August report was the second-lowest NFP figure since July 2021. “The labor market is rapidly deteriorating,” the post read, highlighting broader structural weakness.

Adam Kobeissi, the platform’s founder, added context to the figures, noting that “not only was June’s jobs number negative, but the U.S. economy lost –357,000 full-time jobs in August.” These downward revisions have raised fresh concerns about the underlying health of the economy and cast doubt on earlier narratives of resilience.

Bitcoin Struggles to Maintain Momentum

Despite the seemingly bullish macro backdrop for Bitcoin—falling yields, a weaker dollar, and rising gold—price action in the crypto market failed to reflect the shift in investor sentiment. Bitcoin’s inability to sustain the $113,000 level signaled caution among traders.

Popular technical analyst Daan Crypto Trades highlighted the significance of the 200-period simple moving average (SMA) and exponential moving average (EMA) on the four-hour chart. “The 4H 200MA & EMA are generally seen as a good momentum indicator for the short to mid timeframe trend,” he noted. “These have both acted as resistance for the past few weeks and are now being tested again.”

Fellow trader ZYN agreed, stating that reclaiming these levels could signal the return of bullish momentum. “This is a very crucial level to reclaim for more upside… bulls will be fully back should $113,000 support return,” he added.

Bearish Views Remain Intact

While some market participants are optimistic about a recovery, others remain cautious. Crypto investor and entrepreneur Ted Pillows offered a more conservative outlook. “If this level doesn’t hold, BTC could go around $92K–$94K, the CME gap area,” he warned, referencing a common technical pattern that traders monitor closely.

Such perspectives suggest that while short-term fundamentals may appear to favor risk assets like Bitcoin, technical headwinds and lingering macro uncertainty could limit any immediate upside.

Broader Market Picture

Gold, often viewed as a traditional hedge during economic uncertainty, surged to new all-time highs following the release of the jobs data. The rally in gold underscored broader investor concerns about the economy and signaled a shift in capital allocation toward safer assets.

At the same time, the U.S. dollar weakened sharply, as the likelihood of lower interest rates increased. This shift traditionally bodes well for alternative stores of value like Bitcoin, but the crypto market’s subdued response suggests that investor appetite remains selective and cautious.

Comments are closed.