Featured News Headlines

Bitcoin Price Reaction to All-Time Highs: Profit-Taking by Short-Term Holders Increases

Bitcoin Price – Bitcoin (BTC) is showing signs of a potential local bottom as short-term holders (STHs)—those holding Bitcoin for less than six months—are actively moving their coins to exchanges, signaling classic profit-taking behavior. According to onchain analytics platform CryptoQuant, this surge in BTC inflows to exchanges, especially Binance, is linked with previous instances of market bottoms, suggesting retail investors may be cashing out after recent price rallies.

Binance Inflow Ratio for Short-Term Holders Crosses Key Threshold

CryptoQuant contributor Amr Taha highlighted that the Binance Exchange Inflow Ratio for STHs recently surpassed 0.4, a level that historically correlates with local bottom formations on BTC/USD charts. This means more BTC is flowing into Binance from short-term holders aiming to secure profits after the recent surge that pushed Bitcoin near the $120,000 mark.

Market Impact and Trading Volume Surge Post-All-Time High

Following Bitcoin’s recent all-time highs above $123,000, there was a notable spike in trading activity across multiple crypto exchanges. Binance led the charge, capturing a remarkable 52% increase in spot trading volume on July 18, the day after Bitcoin peaked. Other major platforms like Crypto.com, Coinbase, Bybit, and OKX also reported elevated trading volumes, reflecting heightened retail interest and profit-taking.

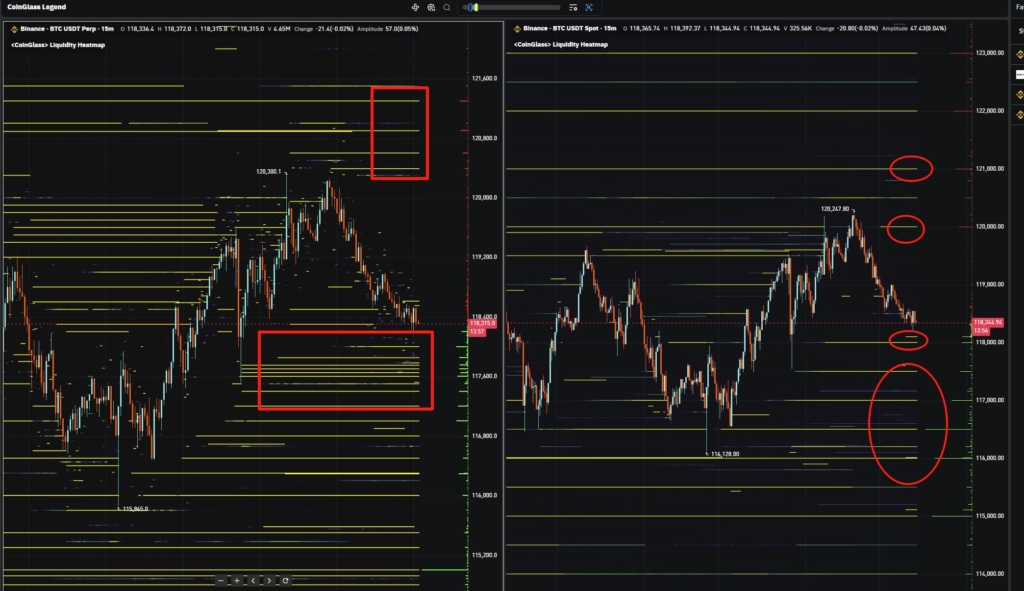

Price Magnet at $117,500 as Liquidity Clusters Shape Bitcoin’s Moves

Meanwhile, CoinGlass analysis revealed that a key bid liquidity cluster is forming around $117,500, acting as a price “magnet” on lower timeframes. This level may provide strong support as Bitcoin experiences volatility between $116,000 and $120,000. Traders expect Bitcoin to eventually resume its upward momentum, but for now, retail selling pressure and profit-taking dominate, shaping near-term price action.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.