Featured News Headlines

Bitcoin Slips Below $112K Support as SOPR and NUPL Signal Market Stress

Bitcoin is showing fresh signs of weakness as long-term holders lock in massive profits and onchain metrics point to a potential cooling phase, according to data from Glassnode and market strategists.

Profit-Taking Reaches Cycle Highs

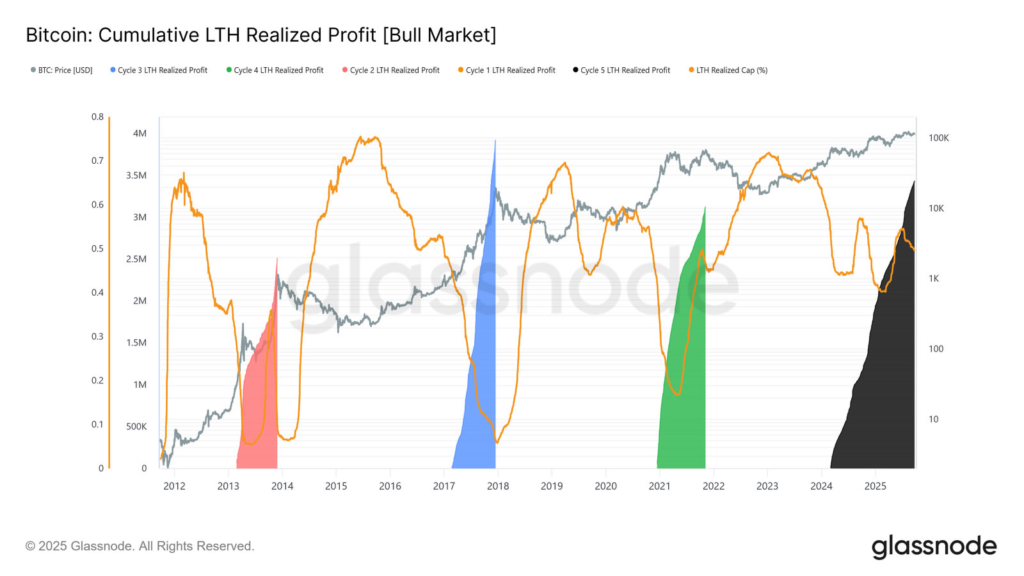

Onchain data shows that long-term Bitcoin holders have realized more than 3.4 million BTC in profit, a level last seen near major cycle tops. Glassnode flagged this as a sign of potential market exhaustion, especially with inflows into Bitcoin exchange-traded funds (ETFs) slowing in the wake of last week’s Federal Reserve rate cuts.

Bitcoin has already slipped below a key support area near $112,000, dropping to a four-week low of $108,700 on Coinbase. While it has not yet retested the $107,500 level seen on September 1, analysts warn it could head there soon.

Analysts Warn of Stop-Loss Selling

“Momentum from the last bounce quickly faded, and with prices hovering near support again, another wave of stop-loss selling could emerge,” said Markus Thielen, head of research at 10x Research. He added that many traders are positioned for a Q4 rally, meaning the bigger surprise could be a correction rather than a surge.

Key Metrics Point to Stress

Glassnode noted that the realized profit/loss ratio has exceeded 90% of coins moved three times this cycle, historically a marker of cycle tops. The firm cautioned that “probabilities favor a cooling phase ahead.”

Meanwhile, the Spent Output Profit Ratio (SOPR) has dipped to 1.01, showing that some holders are beginning to sell at a loss — often a sign of significant stress. Similarly, the Short-Term Holder Net Unrealized Profit/Loss (NUPL) is nearing zero, raising risks of liquidations as newer investors cut losses.

What’s Next for Bitcoin?

Unless institutional demand and holder conviction return, Glassnode analysts warn that the risk of deeper downside remains elevated. Thielen maintained a neutral stance, saying Bitcoin needs to reclaim $115,000 to shift sentiment.

Not all voices are bearish, however. MicroStrategy chair Michael Saylor expressed optimism earlier this week, predicting Bitcoin could regain strength in Q4 once macroeconomic headwinds ease.

At the time of writing, BTC was trading at $109,645, down 6.5% over the past week.

Comments are closed.