Featured News Headlines

Final Bitcoin Rally May Not Happen, Says Brandt

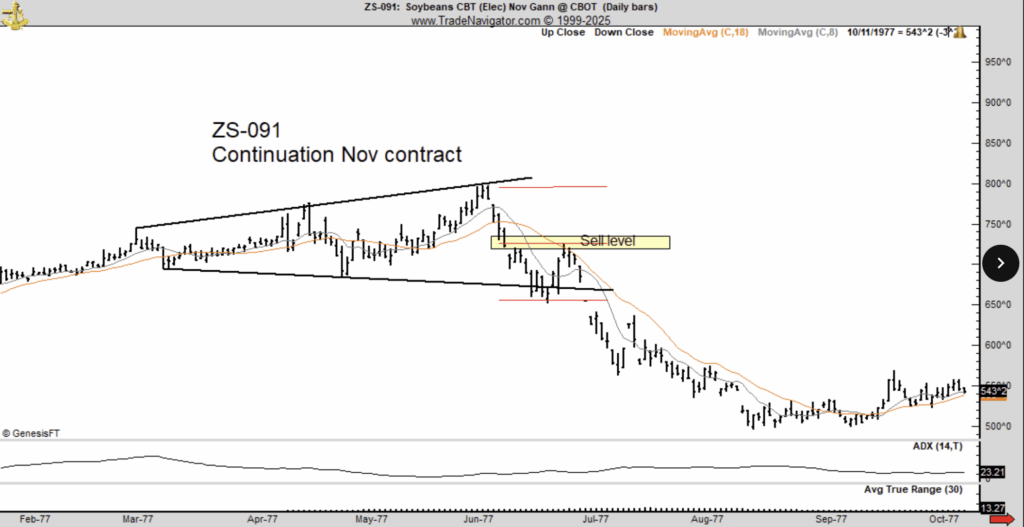

Veteran trader Peter Brandt has drawn a striking comparison between Bitcoin’s current price pattern and that of soybeans in the 1970s — a market that saw a sharp rise followed by a 50% collapse.

Speaking to Cointelegraph, Brandt said, “Bitcoin is forming a rare broadening top on the charts. This pattern is famous for tops.” He added that in the 1970s, “Soybeans formed such a top, then declined 50% in value.”

Brandt cautioned that if Bitcoin follows a similar trajectory, it could spell trouble for major corporate holders like Michael Saylor’s firm, MicroStrategy (MSTR), which is down more than 10% in the past 30 days amid growing pressure on corporate Bitcoin treasuries.

Brandt: Bitcoin’s Final Rally May Not Materialize

Contrary to widespread anticipation of a final surge in Bitcoin’s current cycle, Brandt expressed doubt that the long-awaited breakout will occur. He warned that Bitcoin could instead fall toward bear market levels, potentially revisiting $60,000.

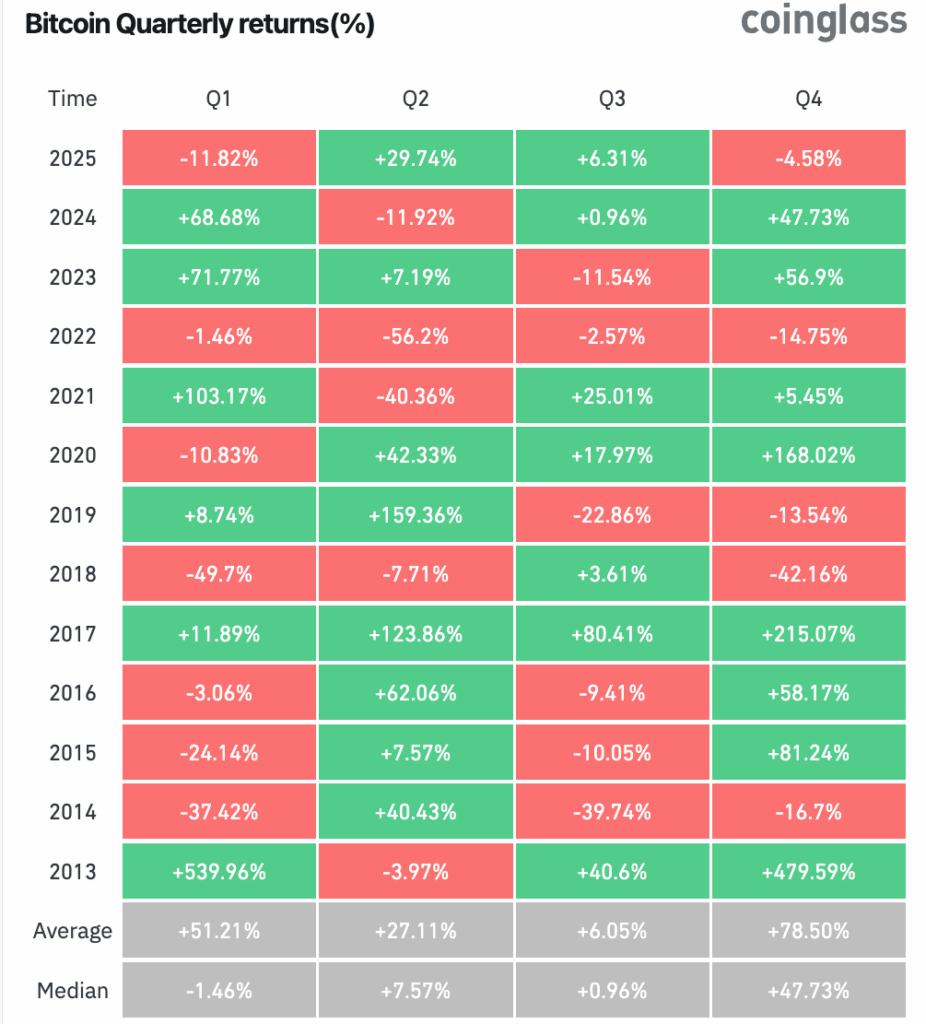

Such a scenario could undermine bullish expectations for Q4 — historically Bitcoin’s strongest quarter. According to CoinGlass data, Bitcoin has posted an average Q4 return of 78.49%.

Market Sentiment Shifts as Fear Creeps In

Despite October typically being a bullish month for crypto, broader macroeconomic pressures have caused sentiment to deteriorate. The Crypto Fear & Greed Index dropped to an “Extreme Fear” reading of 25 on Wednesday.

Trading account AlphaBTC commented on social platform X: “Bitcoin really needs to hold here, keeping the recent higher lows intact and have another attempt at the monthly open where it was rejected yesterday.”

This shift in sentiment follows a wider market pullback triggered by U.S. President Donald Trump’s recent tariff remarks, which rattled investor confidence and impacted risk assets globally.

Analysts Remain Divided on Bitcoin’s Direction

While some experts see warning signs, others maintain that Bitcoin’s upside potential remains intact. BitMEX co-founder Arthur Hayes is among those projecting a major rally ahead — with price targets as high as $250,000.

David Hernandez, a crypto investment specialist at 21Shares, told Cointelegraph that “Bitcoin’s opportunity window may open up quickly again” if the U.S. Consumer Price Index (CPI) shows signs of easing or supports the ongoing disinflation narrative.

“Bitcoin is coiled and ready to spring upward,” Hernandez added.

Meanwhile, Michaël van de Poppe, founder of MN Trading Capital, pointed to gold’s recent 5.5% pullback as an early indicator that a market rotation from traditional safe-haven assets into Bitcoin and altcoins may be underway.

Comments are closed.