Featured News Headlines

Bitcoin Technical Outlook: Is $125,800 the Breakout Point?

Bitcoin (BTC) continues to consolidate following the recent “Great Reset” liquidation event, with on-chain data signaling a potential shift from bearish pressure to cautious recovery. Market participants are closely watching key technical levels as Bitcoin’s trend remains fragile but shows early signs of stabilization.

Market Overview: Liquidations and Dominance

The broader crypto market cap sits near $1.15 trillion, with Bitcoin dominance steady around 46.7%, reflecting moderate investor preference for the leading asset amid ongoing uncertainty. The past week saw approximately $450 million in crypto liquidations, marking a significant decline from the $1 billion-plus wiped out during last month’s market shakeup. Notably, Bitcoin liquidations accounted for about 40% of this total, highlighting the recent volatility concentrated in the flagship asset.

On-Chain Metrics Point to Recovery Phase

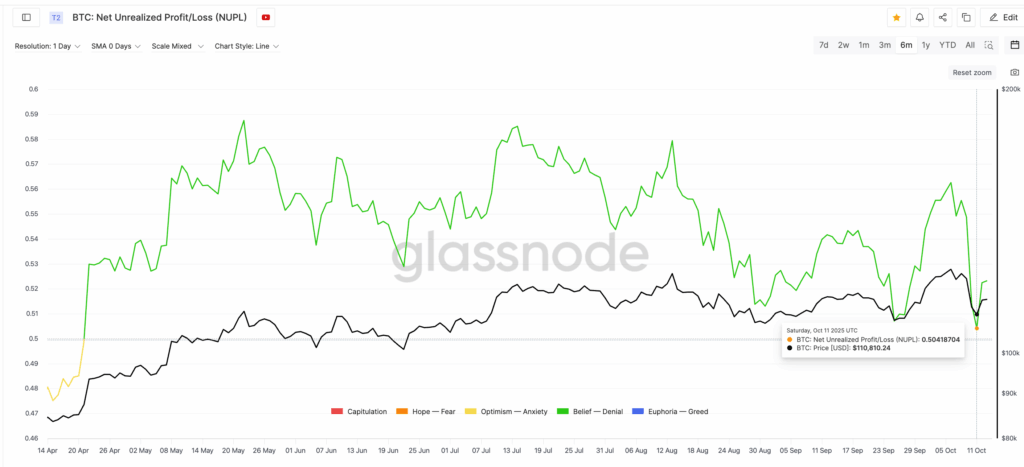

On-chain indicators provide a nuanced view of market sentiment. The Net Unrealized Profit/Loss (NUPL) metric recently touched 0.50—the lowest level since April—suggesting many investors have absorbed losses and that selling exhaustion may be near. Historically, similar NUPL troughs have coincided with local Bitcoin bottoms, as seen on September 25 when BTC rebounded 14% in two weeks after hitting a comparable low.

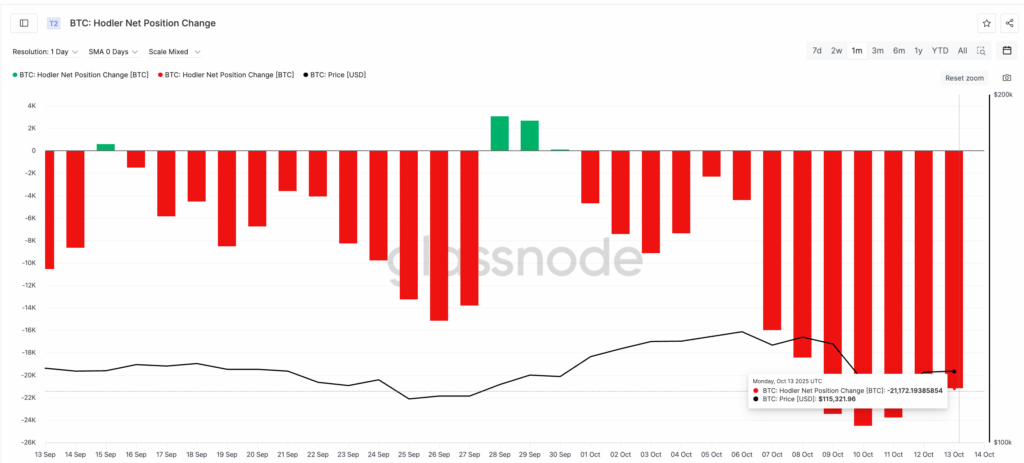

Long-term holder activity, measured by the Holder Net Position Change, is also showing signs of improvement. The metric improved 14% from –24,506 BTC on October 10 to –21,172 BTC on October 13, indicating that long-term investors are gradually resuming accumulation and easing previous liquidation pressure.

Shawn Young, Chief Analyst at MEXC Research, comments, “The ‘Great Reset’ served as a necessary market cleansing. The swift recovery to $115,000 after the largest liquidation event in crypto history demonstrates the market’s resilience and maturity. This phase removes speculative excess, laying groundwork for a more sustainable rally.”

Technical Indicators Signal Caution Amid Consolidation

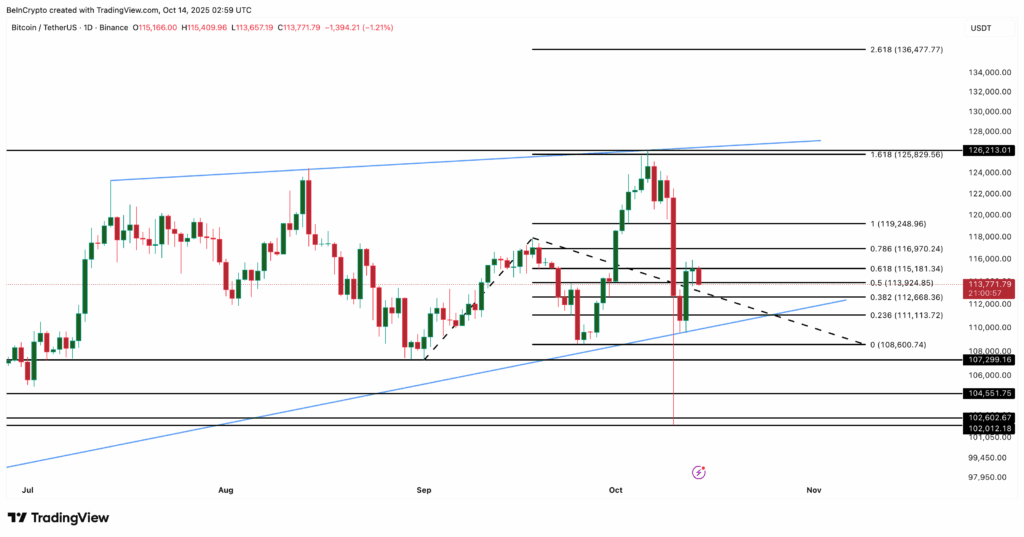

Technically, Bitcoin remains within a rising wedge pattern on the daily chart—a formation often associated with indecision and potential exhaustion following a rally. Key support is established near the $111,100 level, corresponding with the 0.236 Fibonacci retracement, which buyers have defended in recent sessions.

Momentum indicators present a mixed picture: the Relative Strength Index (RSI) hovers around 48, reflecting neutral momentum without clear bullish or bearish dominance. The Moving Average Convergence Divergence (MACD) shows a narrowing gap between the signal and MACD lines, signaling weakening bearish momentum but no confirmed bullish crossover yet. The Directional Movement Index (DMI) indicates a fragile trend with the -DI marginally above the +DI, highlighting lingering downside risks.

Price must surpass the immediate resistance at $115,100 to gain traction. A decisive daily close above $125,800 is the pivotal level that could confirm a breakout above the wedge and set the stage for testing previous highs near $126,200 and potentially extending toward $136,400, according to Fibonacci extension targets.

Young adds, “Holding above $110,000 support is crucial for momentum to rebuild toward retesting $126,000. Until then, Bitcoin’s short-term trend remains vulnerable, with downside risks toward $104,500 and $102,000 if key supports fail.”

Outlook: Watching Key Levels for Trend Confirmation

Bitcoin’s path forward hinges on its ability to break out of the current consolidation range. While on-chain data points to the groundwork of recovery, technical patterns counsel caution. Market participants should watch for a sustained move above $115,100 to gauge renewed buying interest, with a confirmed breakout past $125,800 necessary to flip the trend bullish.

In the near term, the market may continue to digest recent shocks, with altcoins and institutional flows offering additional clues on broader risk appetite. As always, investors are advised to monitor volume, liquidation trends, and key technical levels before positioning for the next major move.

Comments are closed.