Max Pain Level for Bitcoin Options Hits $114K

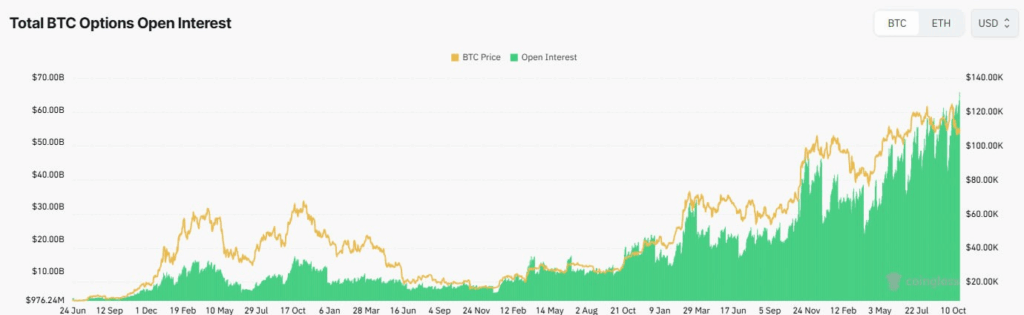

Deribit reports a notable concentration of open interest (OI) at higher Bitcoin strike prices, signaling a strong bullish sentiment among traders. While $100,000 strike puts are seeing activity worth approximately $2.17 billion, even more OI is present at $120,000, $130,000, and $140,000 strikes.

According to Deribit, “When OI concentrates at strike prices well above current levels, it indicates traders are predominantly betting on or hedging for substantial upside. This suggests strong bullish sentiment and expectations for continued price appreciation.”

Call Activity Signals Anticipation of Upside Volatility

Despite an increase in put OI at key downside strikes, call activity at $120,000 and above is building significantly. Luuk Strijers, CEO of Deribit, notes, “While put OI has increased at key downside strikes, there’s notable call activity building around 120K and above, suggesting traders are positioning for potential upside volatility or gamma exposure.”

Upcoming Expiration Adds Market Pressure

On Friday, approximately $5.1 billion worth of Bitcoin options are set to expire on Deribit. The put/call ratio is currently 1.03, reflecting a roughly balanced distribution between bullish and bearish contracts. The max pain point—a level where most options contracts would expire worthless—is at $114,000.

Deribit summarizes, “Positioning is balanced, with puts outweighing calls a bit. Traders are hedging downside but not positioning for a major sell-off.”

Comments are closed.