Featured News Headlines

Bitcoin Yield Opportunities: From Passive Holding to Scalable Returns

Bitcoin (BTC) exchange-traded funds (ETFs) have successfully addressed access issues for institutional investors, yet they remain largely passive instruments. The crypto market is now shifting focus toward credible, auditable, institutional-grade pathways that can transform Bitcoin exposure into scalable yield. As Bitcoin evolves, it is increasingly being seen not just as a digital store of value, but as productive capital capable of powering institutional participation in on-chain finance.

From Digital Gold to Programmable Collateral

Traditionally treated like digital gold, Bitcoin has often been held for long-term appreciation. Experts argue this approach misses its true potential as a reserve asset for the digital age. Bitcoin is programmable collateral — a base layer for institutional strategies, capable of generating yield through market-neutral, low-risk, and compliant frameworks.

The October 10 liquidation event highlighted inefficiencies in core risk management but also showcased how secure, simple Bitcoin yield projects can thrive during volatility. Strategies that avoided excessive leverage not only survived market disruptions but also profited from widening spreads and arbitrage opportunities.

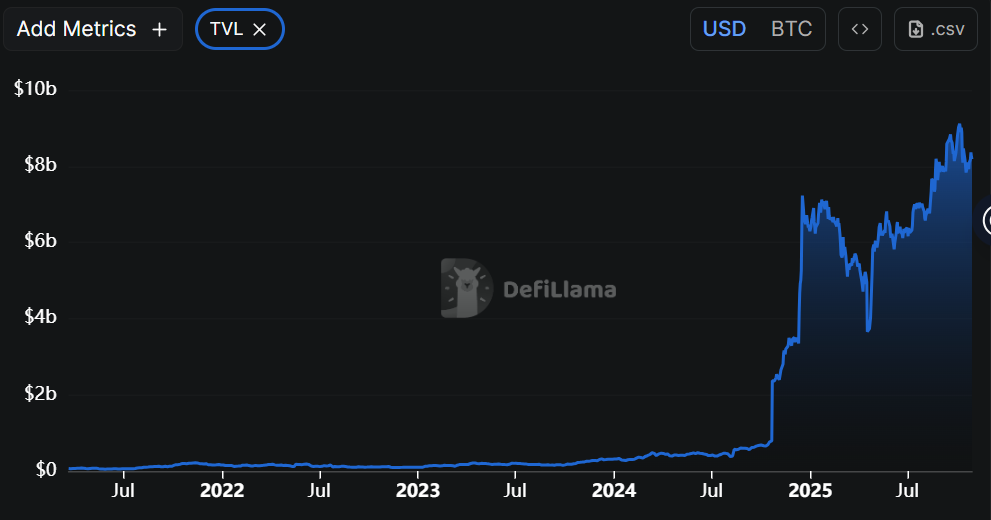

Institutional Infrastructure Matures

Today, transparent, auditable, and composable infrastructure exists, allowing institutions to deploy Bitcoin more efficiently. While most institutional Bitcoin remains in accumulation mode, the next phase will involve active deployment — short-term lending backed by collateral, market-neutral basis strategies, and conservative covered-call programs. Each approach emphasizes risk-adjusted yield, compliance, and liquidity management.

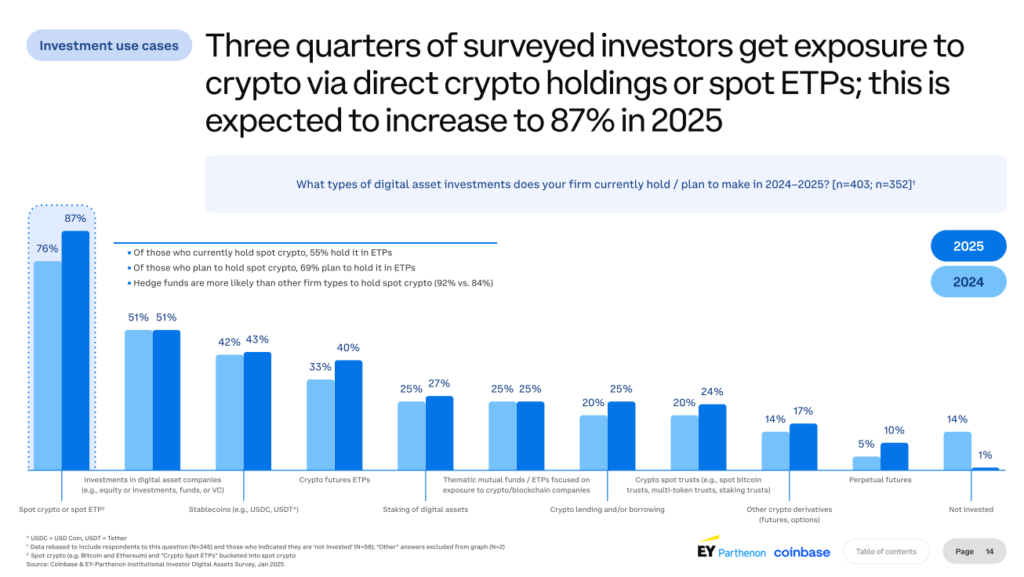

With global institutional appetite rising — surveys indicate an 83% increase in planned crypto allocations for 2025 — the need for operational infrastructure has never been greater. Companies like Arab Bank Switzerland and XBTO are already introducing Bitcoin yield products, while some centralized exchanges prepare structured BTC income funds for institutional clients.

The Future of Bitcoin as Yield-Bearing Capital

This evolution is structural, not speculative. Bitcoin is transitioning from passive allocation to a productive, yield-bearing asset, with compliant frameworks ensuring safety and transparency. Institutions that move early stand to capture the lion’s share of liquidity and composable infrastructure benefits.

The market is at a pivotal moment: it’s no longer about mere access to Bitcoin, but about turning exposure into deployment. As protocols, strategies, and legal frameworks mature, Bitcoin’s role in the institutional landscape will shift — from a passive reserve to a core component of on-chain yield and productive capital strategies.

[…] increases and volatility decreases. He contends that Bitcoin may finally achieve the status of digital gold by 2030. However, real-world testing, structural changes, and increased international trust will […]