Strategy and Institutional Treasuries Continue Bitcoin Accumulation

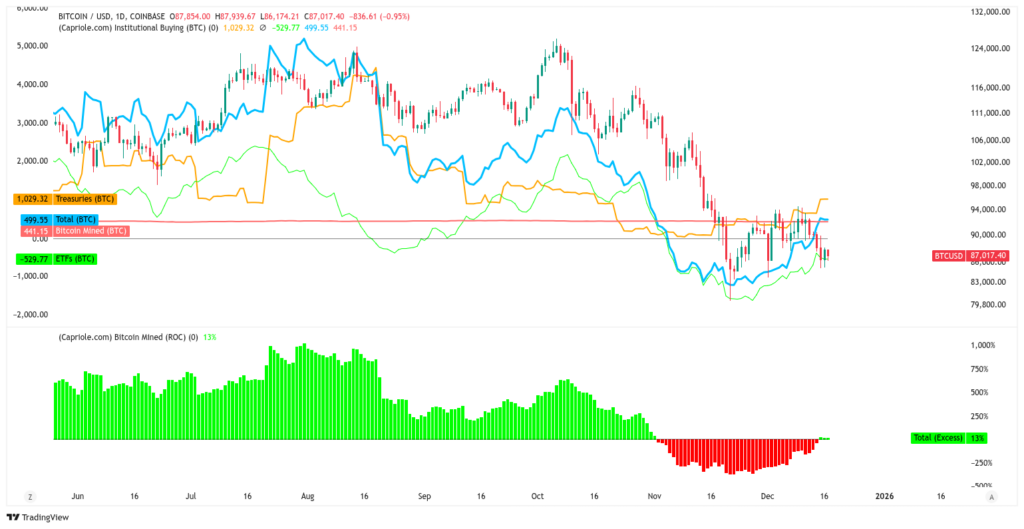

New data from quantitative Bitcoin and digital asset fund Capriole Investments indicates that institutional investors are currently purchasing more Bitcoin than miners are adding to the network. Bitcoin has once again become a focal point for institutions as its price trades over 30% below the all-time highs reached in October.

“For the past three days, institutional buying has surpassed the newly mined supply,” Capriole reports, highlighting a net reduction in BTC supply from corporate demand alone—the first since early November.

While the current pace of institutional buying is modest compared to the peak of the bull market just two months ago, it still represents a 13% surplus over daily mined supply. Capriole founder Charles Edwards emphasized that the period between the $126,000 highs and recent $80,500 lows has been challenging for market participants, prompting some businesses to establish corporate Bitcoin treasuries.

Attention continues to focus on Strategy, the company with the largest corporate BTC treasury in the world, which has kept accumulating despite declining Bitcoin prices and underperforming stocks.

Edwards also noted a “broken corporate ‘flywheel,’” citing record discounts to net asset value (NAV) among treasury companies and rising leverage. While network fundamentals make Bitcoin appear attractive, the activity of corporate treasuries could complicate the “path of least resistance” for price recovery.

Bitcoin ETF Outflows and Strategic Accumulation

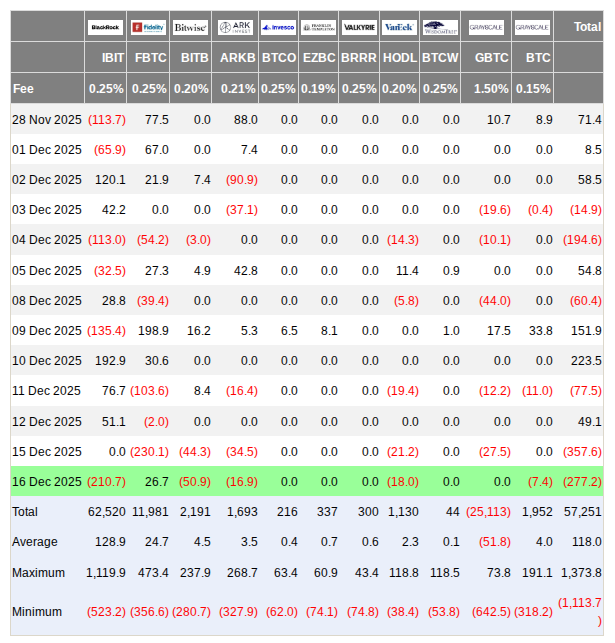

According to on-chain analytics platform CryptoQuant, the market is currently in a state of transition, where short-term pessimism coexists with strategic accumulation. Outflows from investment products, including US spot Bitcoin ETFs, contrast with long-term institutional conviction.

“This divergence between institutional outflows and the conviction of major players underscores that Bitcoin oscillates between immediate stress and long-term expectations of appreciation,” GugaOnChain wrote in a CryptoQuant Quicktake post.

The data illustrates that despite short-term selling pressure, key institutional players continue to see strategic value in Bitcoin accumulation. This dynamic highlights the nuanced behavior of the market, where immediate stress does not always dictate long-term positioning.

Comments are closed.