BTC-Nasdaq Correlation Turns Negative – Capital Rotates

While traditional equity markets have surged in recent months, Bitcoin appears to be falling behind. The S&P 500 is up nearly 32% from its April low, and the Nasdaq Composite has soared 50%, setting a new all-time high. In contrast, Bitcoin [BTC] has dropped 38% from its recent peak.

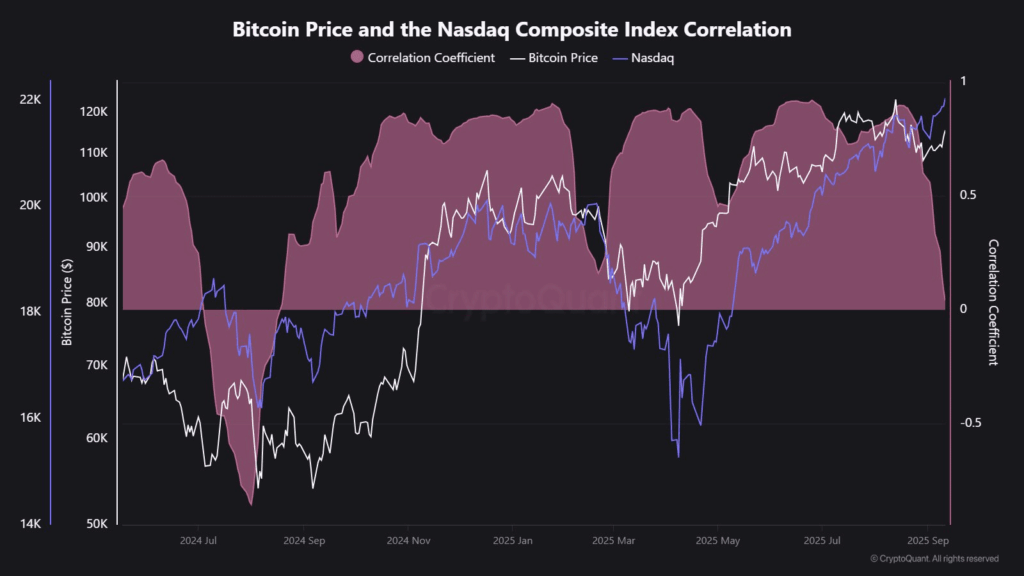

This divergence is now being reflected in on-chain data. According to AMBCrypto, the BTC-Nasdaq correlation has flipped negative, sitting at -0.14 — the lowest level since September 2024. This indicates that Bitcoin is decoupling from tech stocks, a rare move in recent years.

“It’s a clear signal that risk-seeking investors are looking beyond Bitcoin,” said David Hernandez from 21Shares, speaking to AMBCrypto.

The shift suggests capital is rotating back into equities, especially ahead of the U.S. Federal Reserve’s upcoming FOMC meeting. With a 96% probability of a 400–425 bps rate cut priced in, traders appear to be positioning early for a bullish run in U.S. stocks.

Altcoins Gain Market Share as BTC Stalls

While Bitcoin trades nearly 7% below its $124K all-time high, alternative cryptocurrencies are making notable gains. On 8 September, the TOTAL2 index — which tracks the market cap of all cryptocurrencies excluding Bitcoin — reached $1.74 trillion, capturing 45.8% of total market share. Meanwhile, the Altcoin Season Index surged to 80, its highest level since the 2024 election season.

Solana [SOL], in particular, has shown significant strength. The SOL/BTC ratio climbed by 10.5% over the past month, with SOL delivering nearly 3x returns compared to Bitcoin’s modest 6%. Currently, 16 institutional treasuries hold over 10.29 million SOL, further reinforcing capital flow into altcoins.

Comments are closed.