Featured News Headlines

Bitcoin Holder Loses $91 Million After Falling for Hardware Wallet Scammers

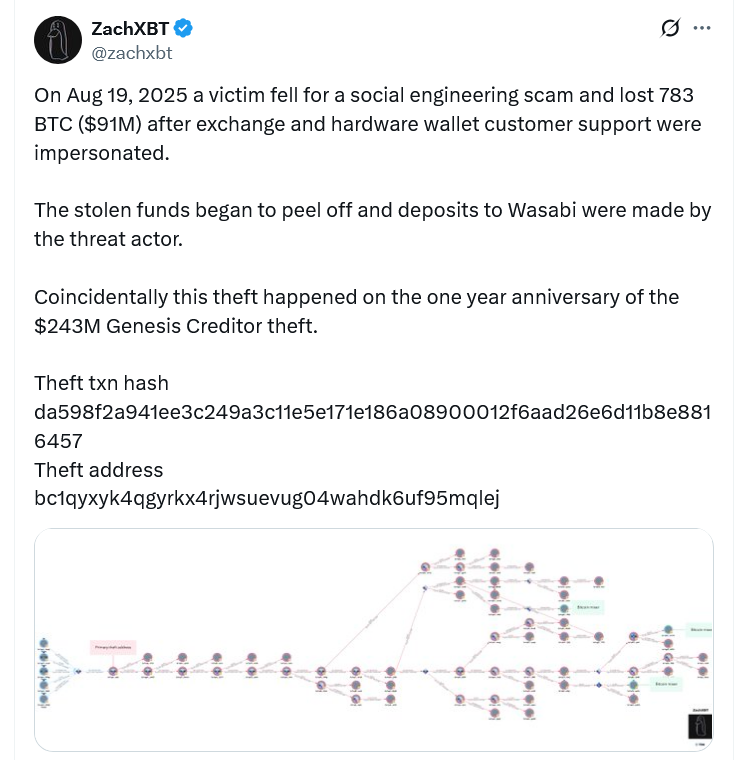

Bitcoin Investor Loses – A Bitcoin holder has lost a staggering $91 million in what appears to be one of the most devastating social engineering attacks of 2025. According to blockchain investigator ZachXBT, the victim was tricked into transferring 783 Bitcoin in a single transaction on Tuesday morning.

Sophisticated Scam Targets Crypto Holder

The attack occurred precisely at 11:06 AM UTC on Tuesday, with the perpetrators posing as representatives from both crypto exchange support and hardware wallet providers. ZachXBT revealed that the stolen funds were immediately moved to a clean Bitcoin wallet address beginning with bc1qyxyk before being laundered through privacy-focused services.

Within 24 hours of the theft, the attackers began using Wasabi Wallet’s privacy features to obscure the money trail, making recovery efforts significantly more challenging for investigators and authorities.

Expert Advice on Avoiding Crypto Scams

When asked about prevention strategies, ZachXBT emphasized a critical rule: treat every unsolicited call or email as a “scam by default.” This incident highlights the sophisticated nature of modern crypto fraud, where scammers impersonate legitimate service providers with convincing detail.

The investigator notably ruled out involvement from the North Korean state-backed Lazarus Group, despite their reputation for major cryptocurrency heists.

Pattern of Hardware Wallet Impersonation

This attack follows a disturbing trend of scammers targeting crypto users by impersonating hardware wallet providers like Ledger and Trezor. Recent incidents include fraudulent letters claiming “critical security updates” and requesting users’ secret recovery phrases.

The timing of this theft is particularly striking, occurring exactly one year after the $243 million Genesis creditor theft, suggesting possible commemorative motivation.

Industry-Wide Security Concerns

The incident underscores broader security challenges facing the cryptocurrency industry. CertiK reported over $2.1 billion in crypto-related thefts during the first five months of 2025, with wallet compromises and phishing attacks representing the primary attack vectors.

Even major exchanges aren’t immune, as demonstrated by February’s $1.4 billion Bybit exploit, proving that extensive security audits don’t guarantee complete protection against determined attackers.

This latest theft serves as a stark reminder that human psychology often represents the weakest link in cryptocurrency security, regardless of technical safeguards.

Comments are closed.