Bitcoin Correction Clears Leverage – What’s Next?

Bitcoin’s recent correction has rattled newer investors, but long-term holders appear unfazed. After a steeper drop than April’s tariff-related dip, BTC is now attempting to stabilize above a crucial support level.

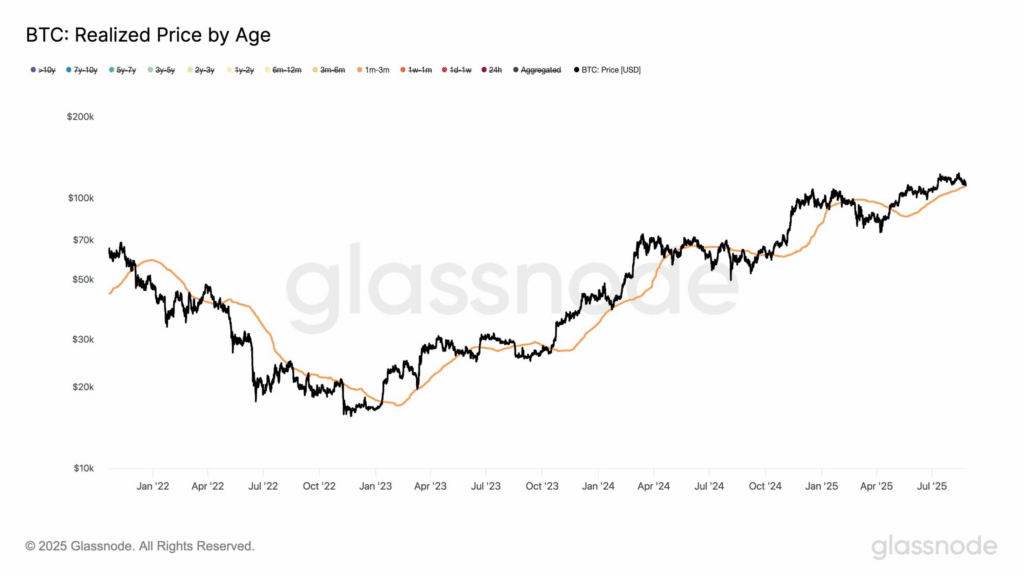

At the time of writing, Bitcoin trades just above $110,000 — a significant threshold representing the Average Cost Basis for holders aged 1–3 months, according to Glassnode. Whether BTC can maintain this level may determine if the market reset is constructive or the start of a deeper correction.

Flash Crash Clears Excess Leverage

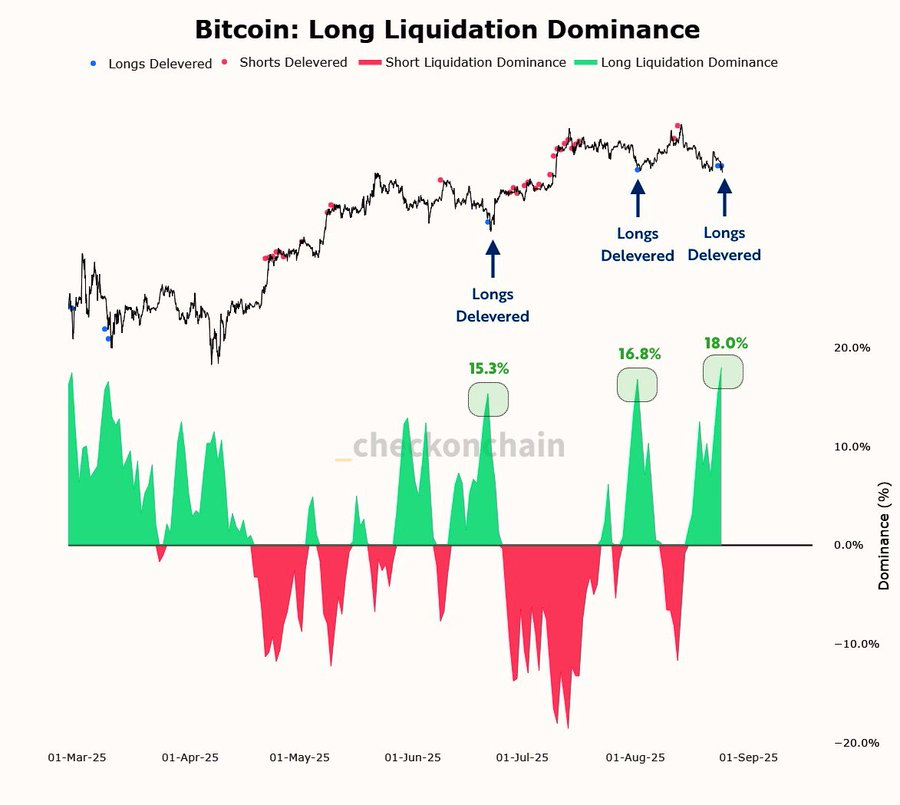

The sharp decline on August 24 triggered widespread liquidations. According to on-chain data, Long Liquidation Dominance spiked to 18%, the highest seen in several months. This surge reflects the flushing out of overleveraged long positions.

As CryptoQuant analysts noted, “This type of aggressive deleveraging can often reset market conditions, paving the way for healthier upside.” With speculative froth reduced, Bitcoin could potentially find more stable footing — but that depends on holding key support levels in the coming sessions.

Short-Term Pain, Long-Term Opportunity?

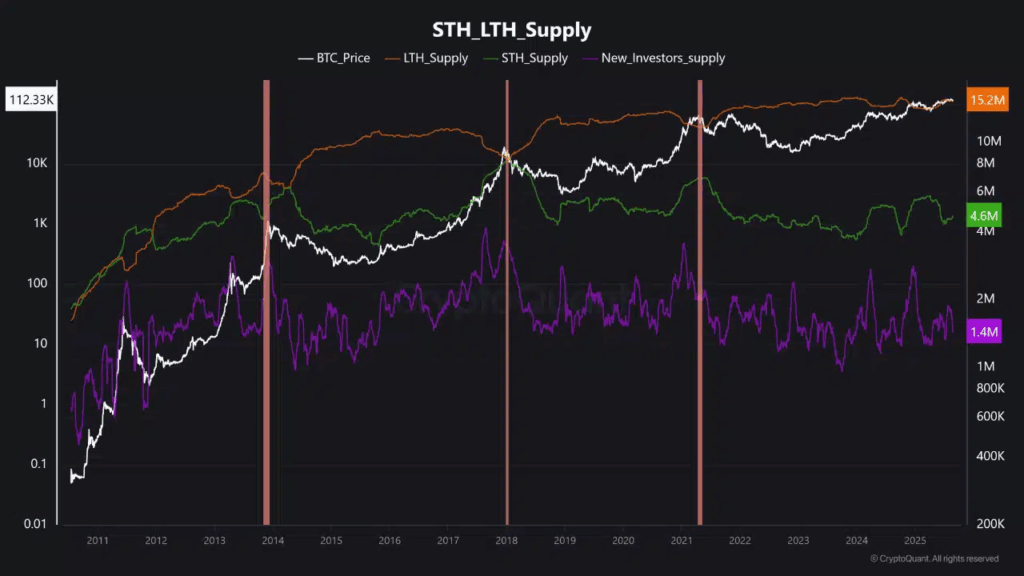

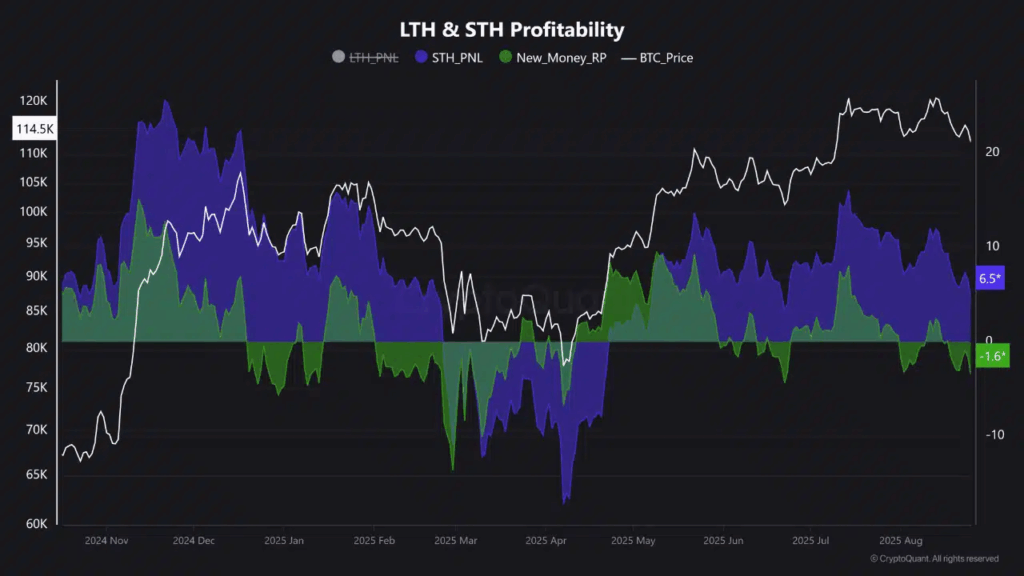

On-chain metrics suggest that the recent drawdown primarily affected new investors holding BTC for less than a month, who are now sitting on an average unrealized loss of 3.5%. Many have exited the market, leading to a visible drop in their supply share.

In contrast, short-term holders (1–6 months) remain in profit, with average gains of 4.5%, underscoring that the recent correction mostly flushed out speculative participants.

Glassnode points to $110.8K as a pivotal level. Holding above it could validate this shakeout as a healthy reset. A failure to maintain it, however, “has historically led to deeper, more prolonged corrections.”

Comments are closed.