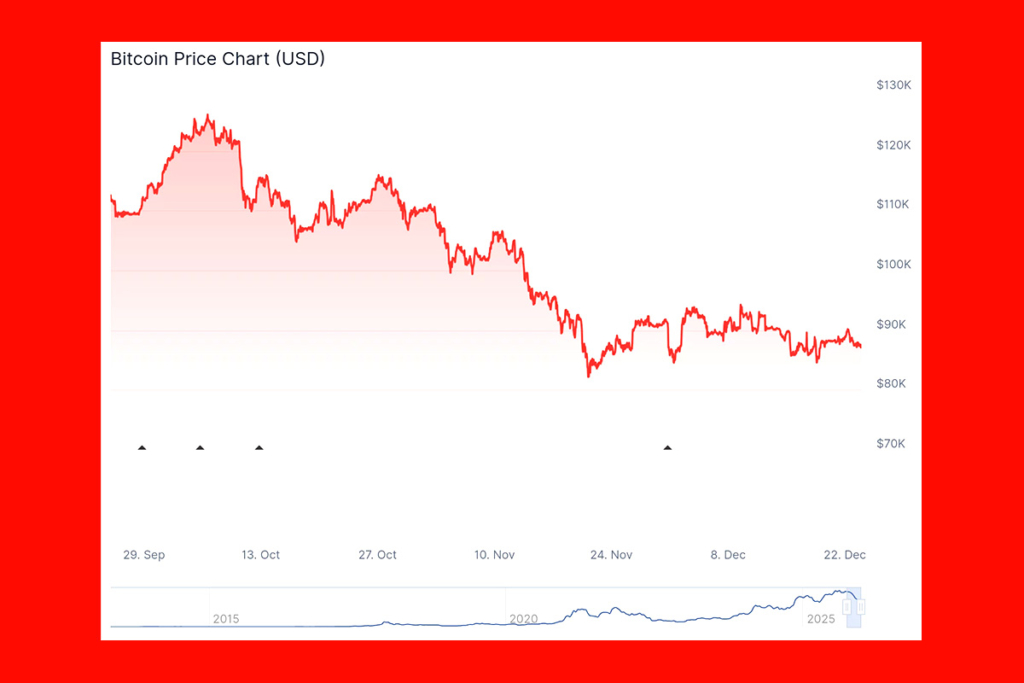

Bitcoin Fails to Attract New Buyers: Capital Rotates to Safe Havens

The market is still favoring conventional safe-haven assets. In the face of growing risk aversion and macroeconomic uncertainty, gold and silver continue to enjoy solid support as investors reallocate funds to protective assets. In this sense, BTCUSA claims that Bitcoin has had difficulty drawing significant new demand. New buyers are reluctant to establish positions at current price levels, according to on-chain data, which indicates limited accumulation. Thus, the upside momentum is being constrained.

Bitcoin Lags Gold and Silver as Risk-Off Sentiment Grows

The report stated that short-term holdings have become a significant source of selling pressure. These investors are more susceptible to changes in price. During recent declines, they expanded distribution, which made it harder for Bitcoin to maintain a recovery. A difference in investor sentiment between asset classes is highlighted by the divergence. Because of their well-established function as value stores in uncertain times, precious metals have profited.

On the other hand, the report pointed out that Bitcoin has trailed behind defensive alternatives and has been viewed as a high-beta risk asset. As long as capital keeps turning into gold and silver, it might stay range-bound. According to the analysis, before Bitcoin can confront greater resistance levels, there would probably need to be a change in risk appetite or a rebound in spot demand.

Macro Uncertainty Keeps Bitcoin Demand Weak

Bitcoin’s short-term prospects are still strongly correlated with general macroeconomic circumstances. Demand will probably remain muted as long as investors prioritize capital preservation. According to on-chain measures, accumulation is still selective rather than widespread. This reduces how serious any attempts at upside can be. Stronger spot inflows, improved financial conditions, or a distinct return to riskier assets would probably be necessary for a long-term recovery. Until then, it’s possible that Bitcoin will keep consolidating, with macro headlines driving volatility rather than organic demand.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.