Bitcoin Price Struggles Below $94K Amid Institutional Caution

Bitcoin is approaching the end of 2025 under pressure, with the possibility of closing the year in negative territory if it fails to reclaim the $94,000 level by New Year’s Eve. The world’s largest cryptocurrency is down approximately 5.7% year-to-date, underperforming during the Christmas trading week even as U.S. equity markets pushed to fresh all-time highs.

This muted performance has fueled caution among traders, many of whom fear that Bitcoin’s lack of momentum could carry over into early January.

Options Market Signals Short-Term Uncertainty

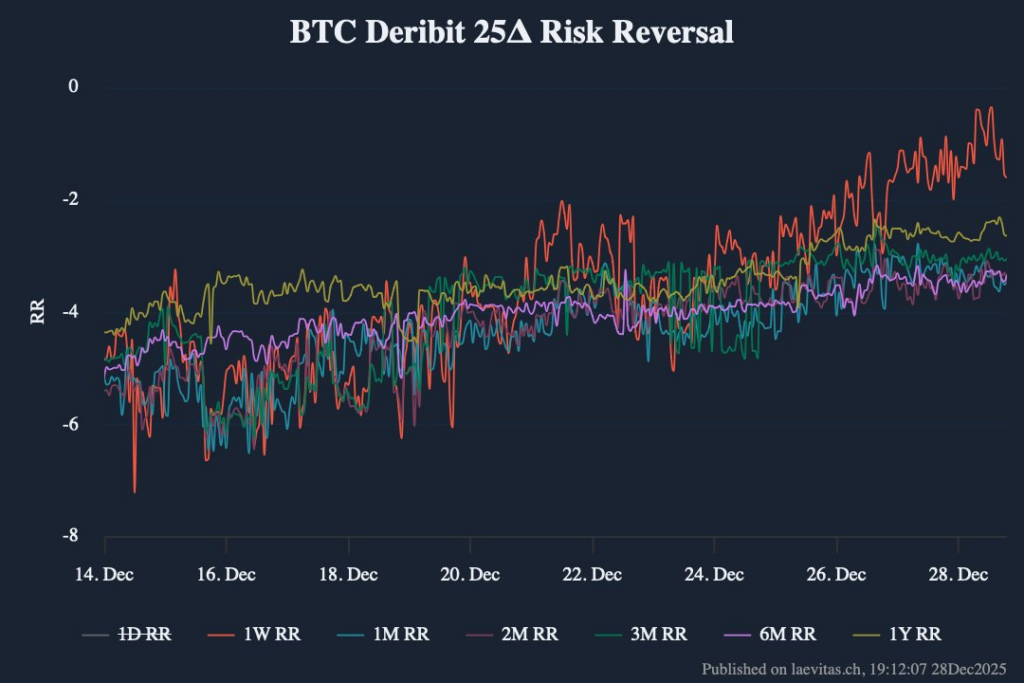

Short-term market sentiment remains defensive, according to data from options analytics platform Leavitas. Positioning suggests choppy price action, with sophisticated traders favoring downside protection rather than upside exposure.

This shift is reflected in the decline of the one-week 25-Delta Risk Reversal, indicating increased demand for put options and bearish hedging strategies. Notably, risk reversals across all maturities — from one week to one year — remain negative, signaling that institutions are prioritizing protection over breakout bets.

For sentiment to improve meaningfully, analysts note that the 25-Delta Risk Reversal would need to return toward neutral or positive territory.

Singapore-based trading desk QCP Capital also highlighted the lack of conviction following the latest derivatives expiry:

“With open interest down roughly 50% post-expiry (Dec 26), conviction remains limited. Capital is sidelined, and direction likely waits for liquidity to return.”

Institutional Demand Shows Signs of Cooling

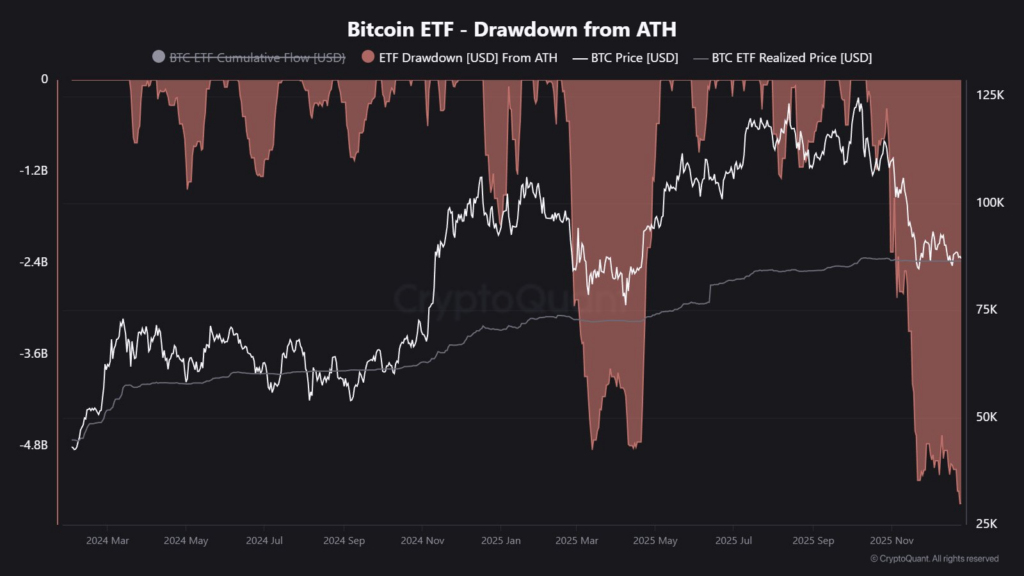

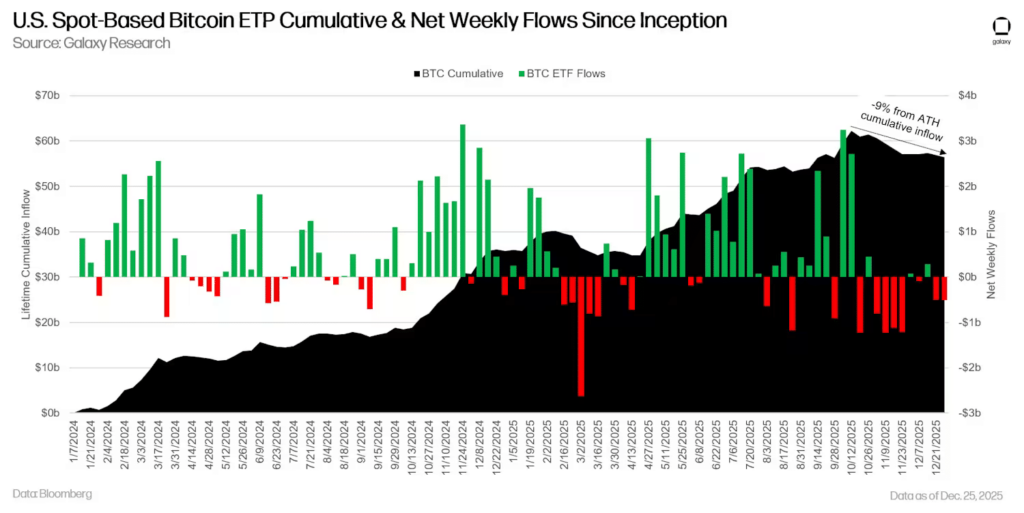

Cautious derivatives positioning aligns with recent developments in institutional flows. In late 2025, U.S. spot Bitcoin ETFs recorded cumulative outflows of $5.5 billion — the largest since their launch in 2024. These outflows were largely attributed to hedge funds exiting basis trades as yields compressed from around 10% to 5%.

Despite this, total ETF inflows remain only 9% below their October peak of $62 billion, suggesting longer-term holders have largely maintained their positions.

Several factors contributed to the fourth-quarter market pullback, including the October 10 sell-off and uncertainty surrounding the MSCI index review of Bitcoin treasury firms. With the risk of MSCI delisting Strategy remaining elevated into mid-January, Bitcoin may continue trading sideways.

Since mid-December, BTC has struggled to break above $90,000, with $94,000 acting as a key resistance level — a range that could persist into early 2026.

Comments are closed.