Featured News Headlines

Bitcoin Bulls Watch Fed’s Rate Hold and Tariff News for Next Rally

Bitcoin – As markets brace for a key Federal Reserve decision, a surprising relief on tariffs has added fuel to Bitcoin’s bullish setup. The crypto giant now faces a crucial test: will it break out cleanly, or fall back to the $112K–$115K demand zone to retest buyer strength?

Fed Chair Powell and Inflation Concerns

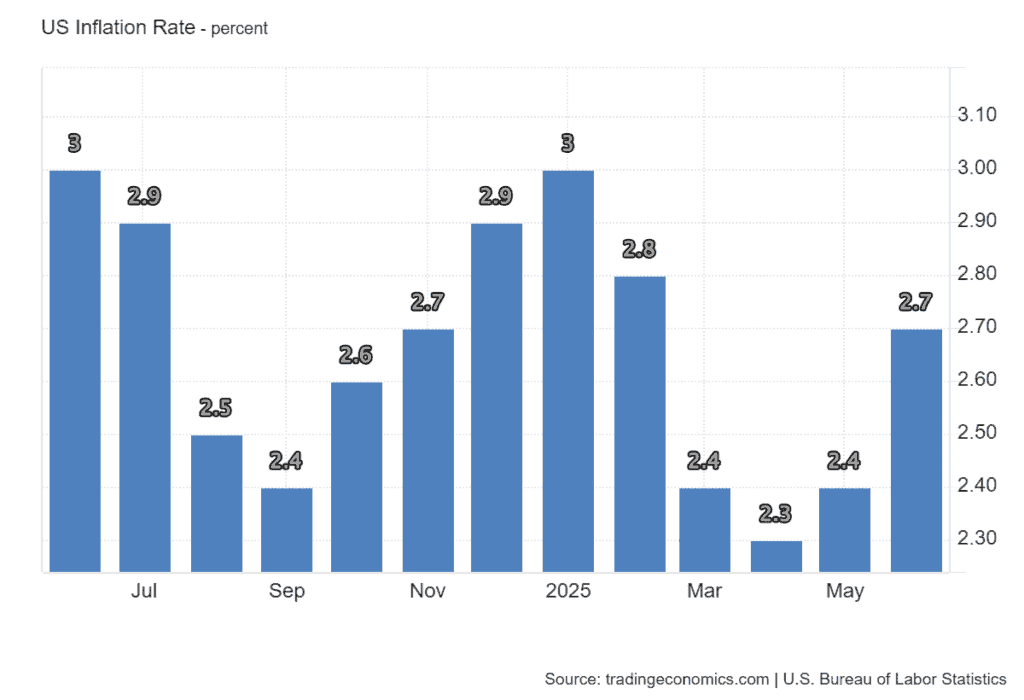

July’s macro scene heats up with Fed Chair Jerome Powell preparing to steer the Federal Open Market Committee (FOMC) meeting. Inflation remains a hot topic after June’s Consumer Price Index (CPI) surged to 2.7% year-over-year, marking a four-month high and shaking the disinflation narrative.

This unexpected inflation spike has investors doubting how dovish the Fed can be, with the CME FedWatch Tool showing a 97.4% probability the Fed will hold interest rates steady between 4.25% and 4.5% at the July 30 meeting. A rate cut is seen as highly unlikely for now, with only a 2.6% chance priced in.

Tariff Rollbacks Fuel Bitcoin Momentum

While the Fed remains hawkish, fiscal relief has come unexpectedly through tariff rollbacks. In June, the US reversed some China import duties, injecting stealth easing into the market right as BTC’s Coinbase Premium Index surged into positive territory.

BTC responded by closing three consecutive green months, defending the $100K level in June and surging past $123K by mid-July — an impressive 11.31% gain for the month.

What’s Next for Bitcoin?

Structurally, Bitcoin’s setup looks primed for a short squeeze, with around $9.5 billion in shorts positioned near $123K. The sticky inflation keeps rates elevated, supporting a cautious market, but tariff relief injects fresh buying power.

Bitcoin now faces a critical moment: will it break past resistance decisively, or retreat to test demand zones? With liquidity tightening and macro risks swirling, all eyes are on how BTC navigates this volatile landscape in the days ahead.

Comments are closed.