Bitcoin ETFs Drive Billions in Daily Volume—A New Era for Institutional Crypto?

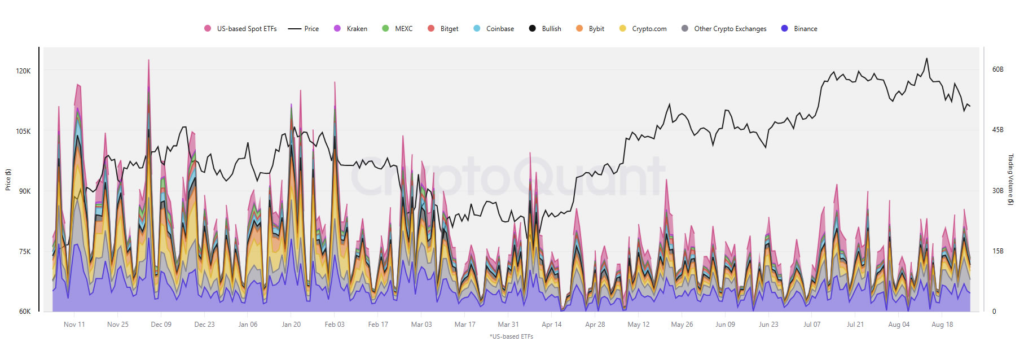

Bitcoin ETFs – United States-based spot Bitcoin exchange-traded funds (ETFs) are emerging as a powerful force in the crypto market, accounting for a significant share of daily trading volumes. According to Julio Moreno, head of research at CryptoQuant, Bitcoin spot trading through these ETFs has become “a significant source of investor exposure to Bitcoin.”

On active days, US Bitcoin ETFs generate between $5 billion and $10 billion in daily volume, sometimes even surpassing top crypto exchanges. This surge highlights the growing wave of institutional demand flowing into Bitcoin.

Binance Still Dominates Spot Trading

Despite the rise of ETFs, Binance remains the global leader in spot trading. Data from CoinGlass shows that the 11 US spot Bitcoin funds collectively record $2.77 billion in daily volume, roughly 67% of Binance’s $4.1 billion daily spot BTC volume. Binance’s total daily trading across all pairs sits at an impressive $22 billion, confirming its dominance.

Meanwhile, Bitcoin trading volumes have peaked at $18 billion, while Ether (ETH) reached highs of $11 billion on certain days. However, ETH spot trading is still largely concentrated on centralized exchanges, with ETFs holding just a 4% market share—a sign of slower institutional adoption for Ethereum compared to Bitcoin.

Ethereum ETFs Outperform Bitcoin in Inflows

While Bitcoin ETFs dominate in trading activity, Ethereum ETFs are stealing the spotlight in inflows. Over the past four trading days, BTC ETFs attracted $571.6 million, while ETH ETFs pulled in $1.24 billion—more than double.

The BlackRock iShares Bitcoin Trust (IBIT) led BTC inflows, securing $223.3 million, nearly 40% of the total. Still, sentiment around Bitcoin has cooled, with prices slipping about 2.5% since Monday to around $111,600.

ETH ETFs, by contrast, have enjoyed over $4 billion in inflows this month alone, accounting for 30% of total inflows since their launch 13 months ago. Analysts argue that ETFs are no longer just supplementary but are actively reshaping market liquidity and reinforcing their role as a gateway for institutional adoption.

Comments are closed.