Featured News Headlines

Bitcoin Price Dips: Are Options Traders Betting on a Rally?

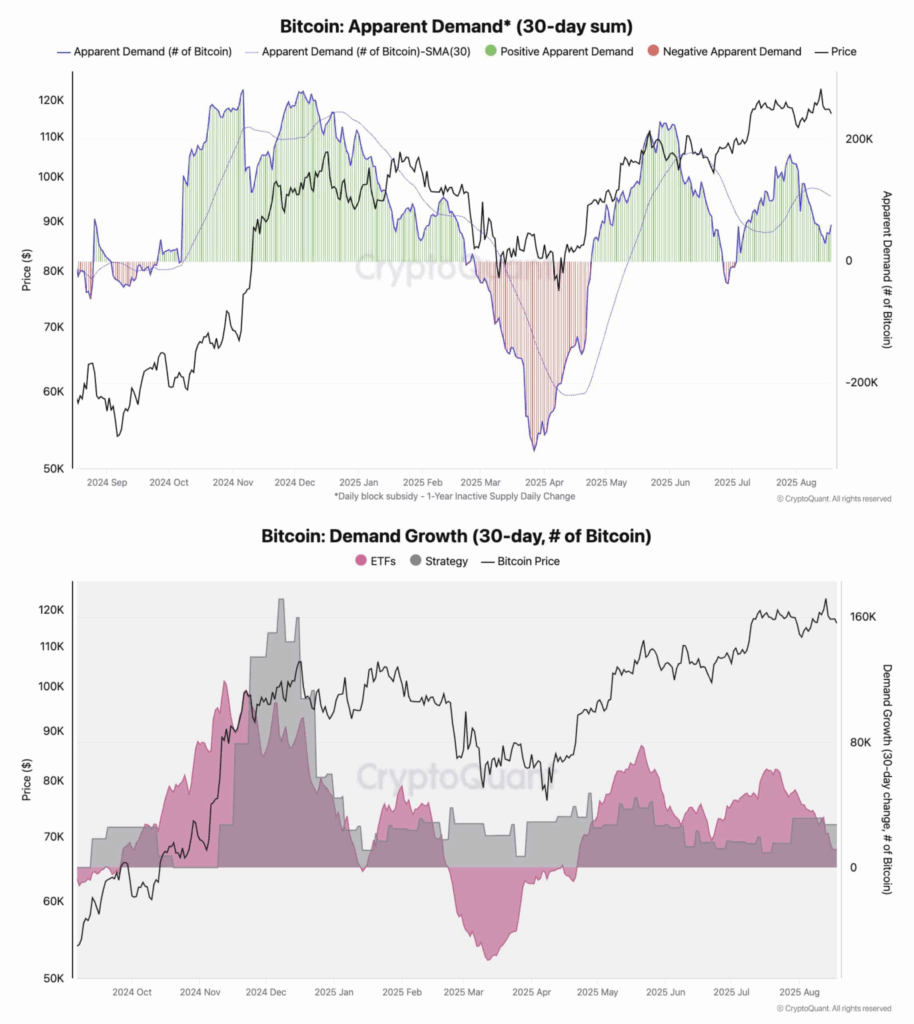

Bitcoin (BTC) has seen a notable decline in demand from ETFs and treasury firms, which has contributed to the recent price drop from around $124,000 to $112,500. According to Julio Moreno, Head of Research at CryptoQuant, this slowdown in demand is a key factor behind the retracement.

Demand Falls Sharply, Raising Concerns

In early August, demand for Bitcoin stood above 170,000 BTC, but it has since fallen by more than two-thirds to around 50,000 BTC. This drop in appetite highlights growing caution among large institutional investors. Alongside this, analysts have pointed to broader macroeconomic challenges that could put further pressure on Bitcoin prices in the near term.

Federal Reserve and Liquidity Issues in Focus

Market watchers are closely following Federal Reserve Chair Jerome Powell’s upcoming speech at the Jackson Hole Symposium on August 22. Expectations for a possible rate cut in September are being reassessed in light of Powell’s remarks.

Wall Street analyst Tom Lee predicts that Powell may maintain a hawkish stance during the speech, but markets could rally afterward. Meanwhile, Coinbase’s Head of Research, David Duong, warns that tightening dollar liquidity could weigh on Bitcoin in the coming weeks.

Duong explains that the U.S. Treasury is expected to borrow roughly $400 billion from the markets soon, which could dampen investor sentiment toward cryptocurrencies in the short run. Delphi Digital has shared similar cautious views. Despite these headwinds, Duong believes September might bring more clarity to Bitcoin’s path forward.

Is the $110,000 Support Level at Risk?

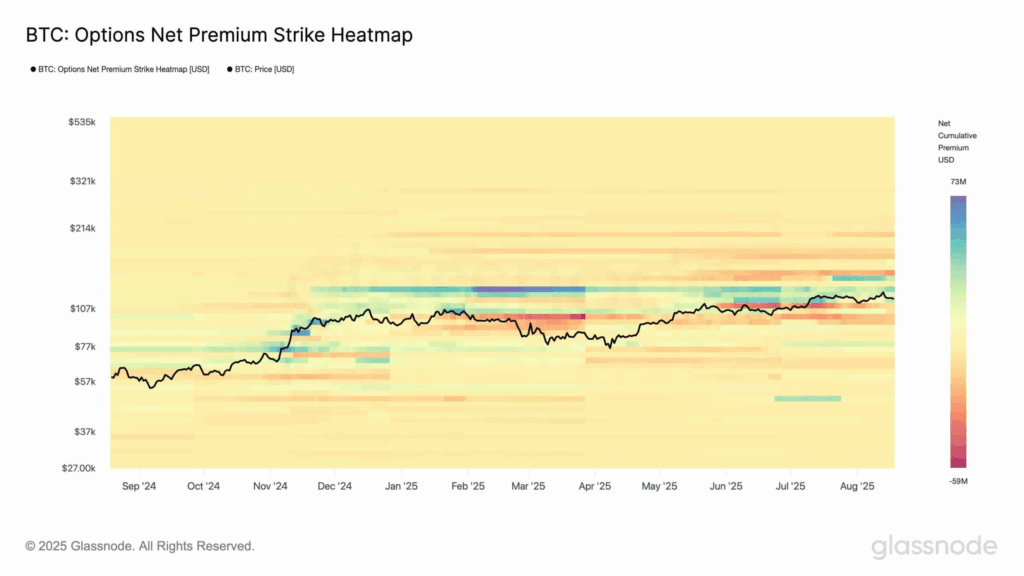

Given these pressures, a critical question is whether Bitcoin’s $110,000 support level will hold. According to Glassnode, options traders are taking a contrarian approach, with market positioning hitting record levels.

Speculators have been buying more call options, betting on a price rise toward the $120,000–$130,000 range. This target zone is seen as a key upside point. However, if Bitcoin’s price falls below the Short-Term Holder (STH) Cost Basis of $108,000—a level that has historically acted as support and resistance—the downside risk could accelerate.

If the $110,000 support breaks, the $108,000 level will be critical to watch as a potential rebound point amid ongoing macroeconomic challenges.

Options Traders See the Dip as a Buying Opportunity

Despite the recent pullback, many bullish options traders view this period as a chance to buy Bitcoin at a discounted price before a possible rally to new highs. This cautious optimism among investors suggests confidence in Bitcoin’s long-term potential despite short-term uncertainties.