Featured News Headlines

Bitcoin Falls Below $86K as U.S. Selling Dominates and Asia Steps In

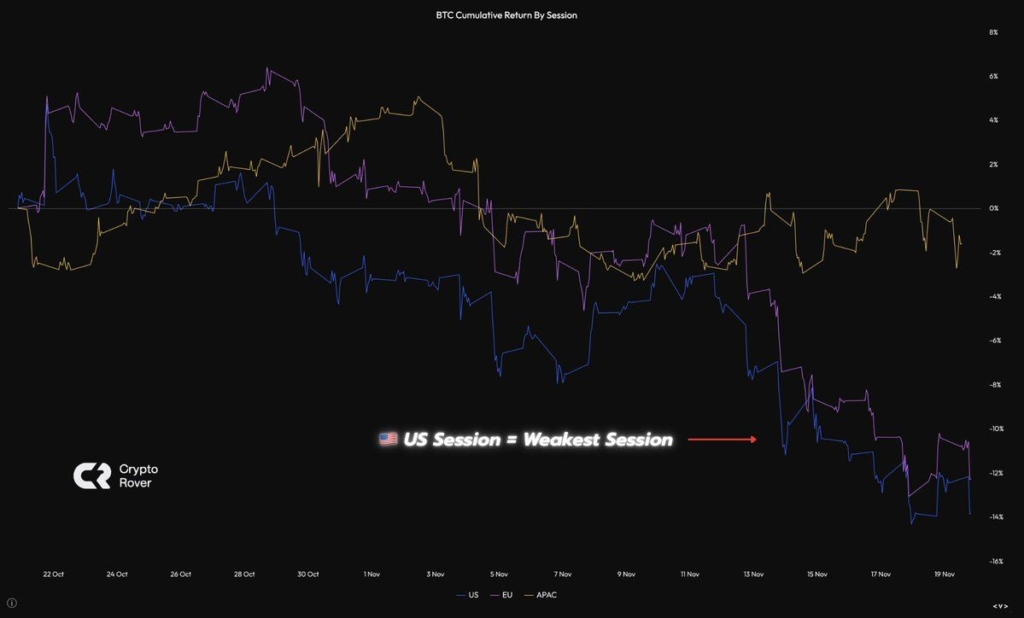

Bitcoin’s latest downturn is exposing a striking divide in global trading behavior, with U.S. sessions consistently driving sell-offs while Asian traders buy the dip and stabilize the market. The contrast has intensified debates about whether Bitcoin is undergoing a routine correction—or facing deeper structural pressure.

U.S. Sessions Lead the Sell-Off, Asia Absorbs the Pressure

This week’s price action shows a clear pattern: U.S. trading hours deliver the steepest declines, European sessions see modest drawdowns, and Asia-Pacific markets repeatedly step in to recover price losses. According to aggregated intraday data, the American trading window has been the primary driver behind Bitcoin’s recent weakness.

One trader summarized the trend on X: “Every single America session consists of relentless selling for hours. Then the Asians wake up and buy it all back until the Americans wake up. Like literal clockwork.”

The divergence reflects regional differences in risk appetite. U.S. traders appear cautious amid shifting macro signals, liquidity concerns, and policy uncertainty. Meanwhile, many Asian investors approach dips as accumulation opportunities, supported by different investment frameworks and long-term optimism surrounding Bitcoin.

Adding to the dynamic, the Coinbase Premium Index—a gauge of U.S. institutional sentiment—has stayed negative throughout most of November, signaling persistent bearishness from American institutions even as whales remain bullish.

Institutional Accumulation Reshapes Bitcoin’s Market Cycle

On-chain analyst Ki Young Ju argues that traditional Bitcoin cycle patterns have shifted. He says Bitcoin’s bull cycle technically peaked earlier in 2024 at $100,000, and classical models would typically imply a drop toward $56,000.

However, institutional accumulation is now acting as a “virtual price floor.” Corporate treasuries and long-term holders rarely sell during downturns, fundamentally altering how Bitcoin reacts to corrections. Still, analysts caution that concentrated ownership creates new risks: if institutions face financial stress, large liquidations could destabilize the market.

Analysts View the Pullback as a Healthy Bull-Market Reset

According to Chris Kuiper of Fidelity Digital Assets, the current correction is a natural reset within an ongoing bull market. On-chain indicators, including the MVRV ratio for short-term holders, show that recent buyers are facing temporary unrealized losses—similar to past corrections that preceded renewed rallies.

Importantly, no major regulatory shocks, exchange failures, or macro crises triggered this pullback. Instead, analysts point to profit-taking and leverage unwinds following Bitcoin’s run toward $100,000.

As traders look ahead, the market faces two potential paths: U.S. pessimism may ease and align with Asia’s optimism, or the regional divide may deepen as global macro conditions evolve. The next phase of Bitcoin’s trajectory will likely hinge on liquidity policies, institutional behavior, and regulatory developments worldwide.

Comments are closed.