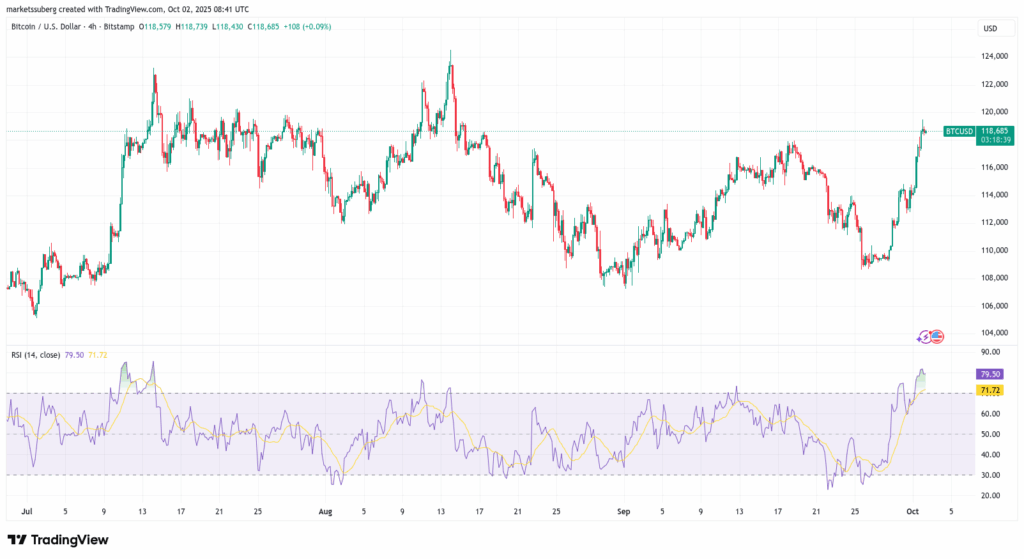

RSI Nears Extreme Levels as BTC Hits $119K

Bitcoin (BTC) surged to a six-week high, touching $119,500 on Bitstamp, posting a near 10% gain in the past week. The rally echoes similar strength in traditional safe havens like gold, but analysts caution a short-term correction may follow.

Market data from TradingView and Cointelegraph Markets Pro show BTC/USD approaching technically overheated conditions. Popular trader Roman commented on X, stating:

“Everything is overbought but no signs of initial weakness. Simple breakout & retest.”

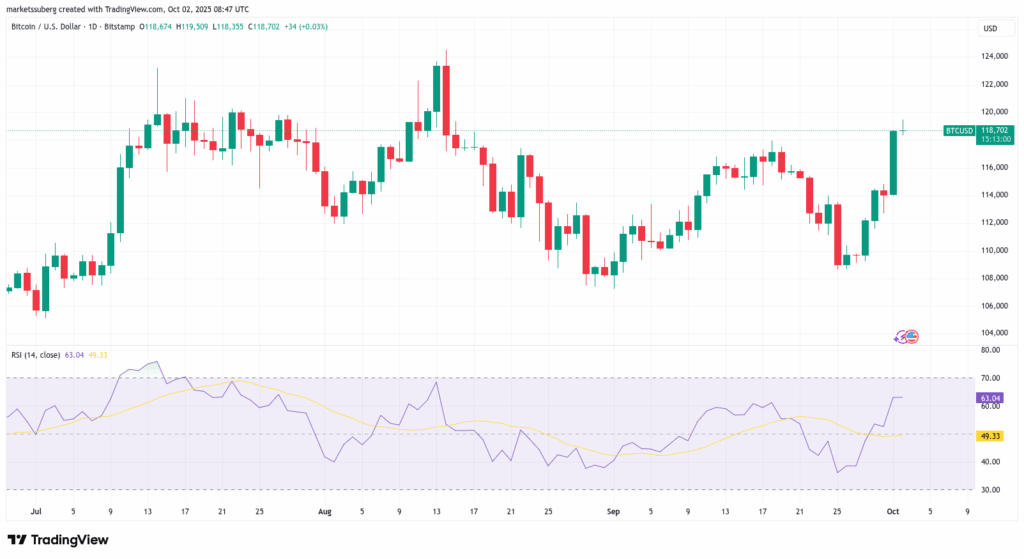

The Relative Strength Index (RSI), a leading momentum indicator, currently sits near 90/100 on the 4-hour chart—its highest level since July. Such high readings typically precede price consolidations or pullbacks, especially on lower time frames.

Despite short-term cooling risks, some analysts remain optimistic about further gains. Roman added that volume, RSI, and MACD still support a potential move toward $124,000 in the coming days, provided price stabilizes after a healthy retest.

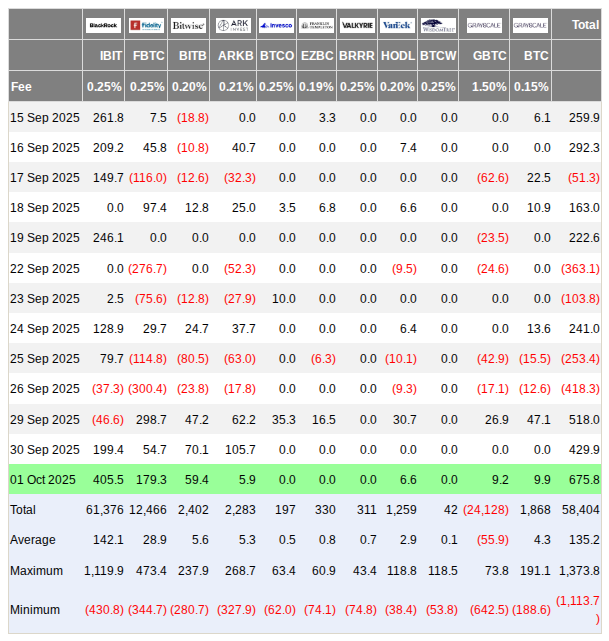

Bitcoin ETFs Drive Institutional Confidence

Institutional interest also underpins Bitcoin’s recent strength. U.K.-based Farside Investors reported that U.S. spot Bitcoin ETFs saw $1.6 billion in net inflows this week alone. Notably, BlackRock’s iShares Bitcoin Trust (IBIT) led with $600 million.

ETF analyst Eric Balchunas highlighted that IBIT has now entered the top 20 largest ETFs by assets:

“It took in $40B over the past 12 months and grew 85%. At that pace, Top 10 by Christmas 2026 isn’t out of the question.”

As ETF inflows grow and retail momentum builds, Bitcoin may be primed for higher levels—though short-term volatility remains a key risk to monitor.

Comments are closed.