Featured News Headlines

Bitcoin at $125K, Gold at $3,920: Is the U.S. Debt Crisis the New Catalyst?

Bitcoin and Gold – As the U.S. national debt races toward a historic $38 trillion, investors are flocking to safe-haven assets like Bitcoin and gold, signaling growing concern over the stability of the dollar and the broader global economy.

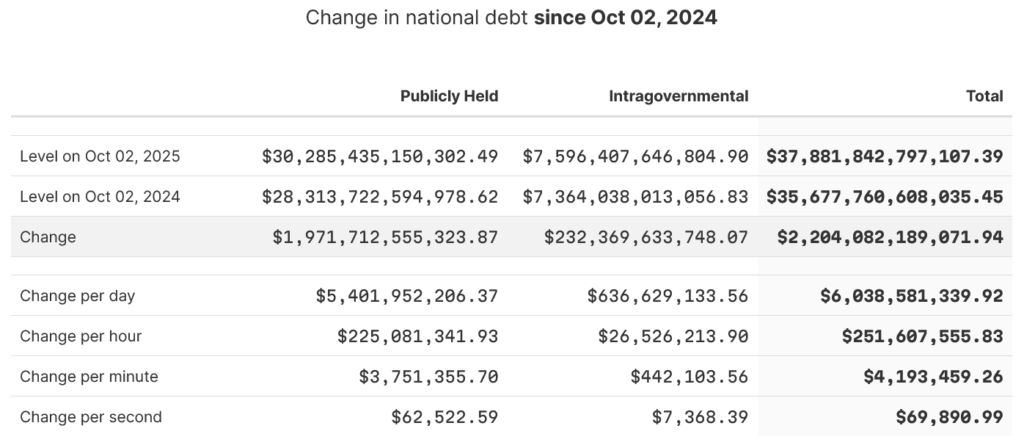

U.S. Debt Rising by $6 Billion Per Day

The debt clock is ticking at an unprecedented pace. According to the U.S. Congress Joint Economic Committee, America’s national debt has reached $37.9 trillion, growing by $69,890 per second — or roughly $4.2 million every minute. That amounts to $6 billion per day, a figure that surpasses the GDP of more than 30 nations, based on Worldometer data.

Representative Keith Self warned that without urgent fiscal reforms, the debt could exceed $50 trillion within a decade. “Congress must act now — demand fiscal responsibility from your leaders before the gradual slide becomes a sudden collapse,” he said on Friday. At the current rate, the U.S. is projected to hit the $38 trillion mark in just 20 days.

Bitcoin and Gold: The “Debasement Trade”

The accelerating debt crisis is pushing investors toward what JPMorgan recently dubbed the “debasement trade” — assets that may outperform as fiat currencies lose value. Leading the charge are Bitcoin and gold, both of which set new all-time highs over the weekend.

On Saturday, Bitcoin surged to $125,506, while gold reached $3,920 on Sunday, driven by fears of further dollar weakening and monetary instability.

Bitcoin’s fixed supply and decentralized design have attracted increasing attention from major institutional players. BlackRock CEO Larry Fink, once a vocal critic of Bitcoin, shifted his stance in January, stating that Bitcoin could reach $700,000 due to currency debasement concerns.

Ray Dalio: Hard Assets are the New Hedge

Bridgewater Associates founder Ray Dalio echoed similar sentiments, recommending in July that investors allocate 15% of their portfolios to hard assets like Bitcoin and gold to optimize for the “best return-to-risk ratio.”

Dalio emphasized that the problem isn’t exclusive to the U.S. He warned that other Western economies — including the UK — are caught in a similar “debt doom loop”, with their currencies likely to underperform against Bitcoin and gold, which he called “effective diversifiers.”

Global Debt Hits $337.7 Trillion

It’s not just America feeling the weight. According to Reuters and data from the Institute of International Finance, global debt surged to a record $337.7 trillion by the end of Q2 2025. The trend is largely driven by continued quantitative easing and a weaker U.S. dollar, increasing the appeal of inflation-resistant assets.

Trump, Musk, and the Cost of Cutting Costs

The Trump administration previously attempted to rein in federal spending, even enlisting Tesla CEO Elon Musk to help streamline operations. Musk’s involvement with the Department of Government Efficiency reportedly saved $214 billion, though he departed after 130 days.

In July, Trump signed the “Big Beautiful Bill Act,” aimed at cutting $1.6 trillion in future federal expenses. Ironically, while the bill promised savings, its implementation has added to the national debt, which now stands poised to hit another major milestone.

Comments are closed.