Featured News Headlines

$16 Billion in Bitcoin and Ethereum Options Set to Expire in Major Derivatives Event

Bitcoin and Ethereum – More than $16 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are scheduled to expire on October 31, 2025, at 8:00 UTC, marking one of the largest monthly expiries of the year on Deribit. This expiration surpasses last week’s $6 billion event due to the monthly rollover of October contracts, making today’s expiry a crucial moment for traders watching max pain levels, market positioning, and potential short-term volatility.

Bitcoin Options: Bullish Positioning Dominates Ahead of Expiry

This month’s options expiry towers over last week’s $4 billion event, reflecting elevated trading activity around BTC. As of now, Bitcoin is trading at $91,389, with the max pain point at $100,000, suggesting significantly bullish positioning despite recent market turbulence.

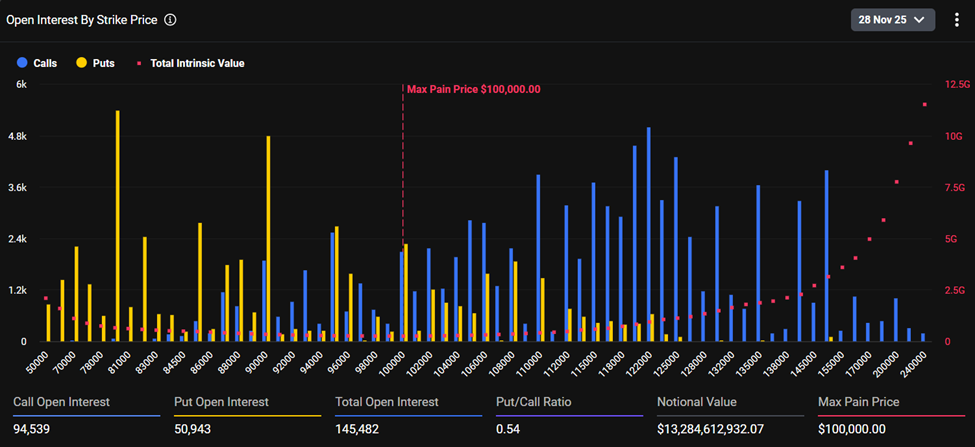

In total, 145,482 BTC options contracts—valued at $13.28 billion—will expire today. The put-to-call ratio of 0.54 signals that more traders are betting on upward movement than decline. Deribit data shows 94,539 call contracts open versus 50,943 puts, reinforcing the upside skew.

Deribit analysts highlighted that recent market pullbacks influenced trader behavior. Many put holders took profit when BTC fell to the $81,000–$82,000 region, while others maintained cautious downside protection. At the same time, a massive end-of-year call condor—a bullish options structure targeting $100K–$118K—has become the dominant trade of the week, costing around $6.5 million in premiums and signaling expectations for a potential “Santa rally.”

However, some participants have capped upside potential through call overwriting, especially around December 100K and January 100K–105K strikes, dampening implied volatility even as realized volatility remains steady.

Ethereum Options Expiry Reaches $1.7 Billion

Ethereum, trading at $3,014, faces a $1.73 billion options expiry with a max pain level of $3,400. Open interest includes 387,010 call contracts versus 187,198 puts, totaling 574,208 contracts with a put-call ratio of 0.48.

Compared to Bitcoin, ETH’s positioning is more balanced, with lighter downside skew and open interest distributed more evenly across key strike prices. Market watchers expect ETH’s next move to depend heavily on whether BTC volatility spills over into altcoins.

A Critical Expiry Window for Both BTC and ETH

With billions in open interest unwinding simultaneously, liquidity conditions across BTC and ETH could shift rapidly. If prices gravitate toward max pain zones, market makers may dampen volatility; if volatility spikes instead, the expiry could accelerate sharp price swings.

As traders remain split between defensive hedges and bold year-end bullish bets, today’s expiration marks a pivotal moment for crypto markets heading into the final stretch of the year.