Featured News Headlines

Bitcoin ETF Outflows Signal Market Shift, But No Panic Yet

On September 24th, Binance experienced its first major stablecoin outflow in three months, with $913 million leaving the platform in a single day. Analyst Amr Taha noted this shift on CryptoQuant Insights, signaling a potential change in market dynamics. This came after a generally positive trend of stablecoin inflows in recent weeks.

Impact on Bitcoin and Market Liquidity

Following this, Bitcoin spot ETFs recorded a $253 million outflow on September 25th, further reducing spot-buying liquidity on Binance and hinting at weakening buying power. Meanwhile, Binance’s net taker volume increased by $364 million, indicating a rise in retail trader activity. However, Open Interest (OI) on the exchange dropped by nearly $500 million, contributing to a $3.35 billion decline in OI across all exchanges on September 26th, according to CoinGlass data.

Are Bitcoin Holders Panicking?

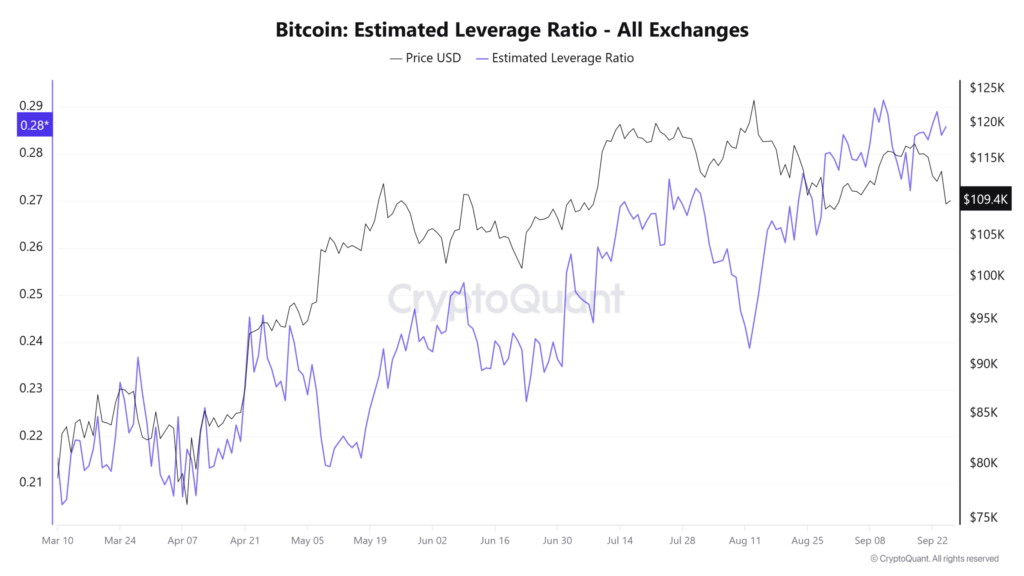

Interestingly, the estimated leverage ratio for Bitcoin remained stable, suggesting that the OI decline resulted mainly from liquidations rather than a widespread market sell-off. This is an early sign that Bitcoin holders are not capitulating.

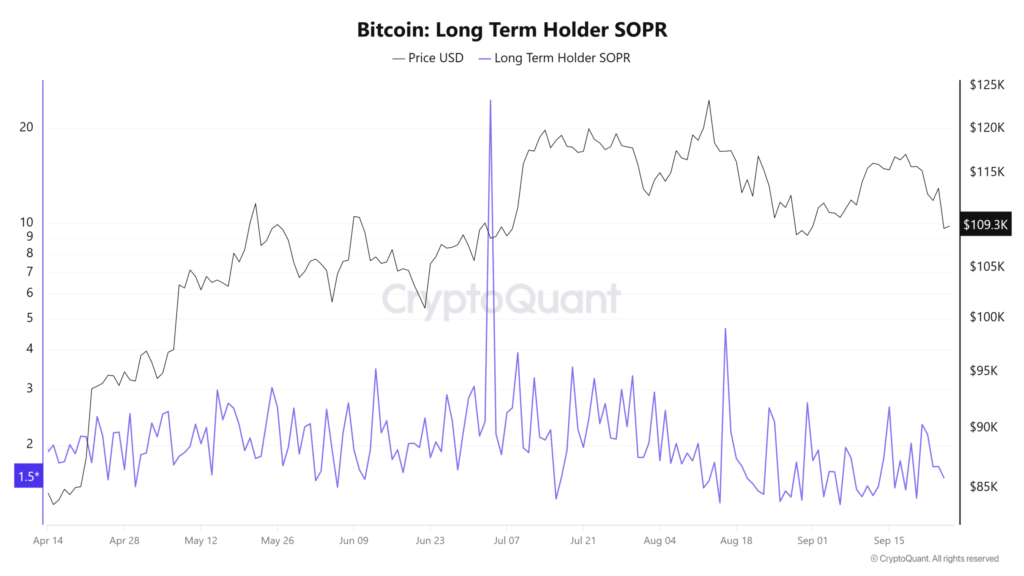

The long-term holder Spent Output Profit Ratio (SOPR) has been slowly declining since early July but remains above 1 at 1.57, meaning holders are still mostly in profit despite recent selling pressure.

Market Sentiment and Outlook

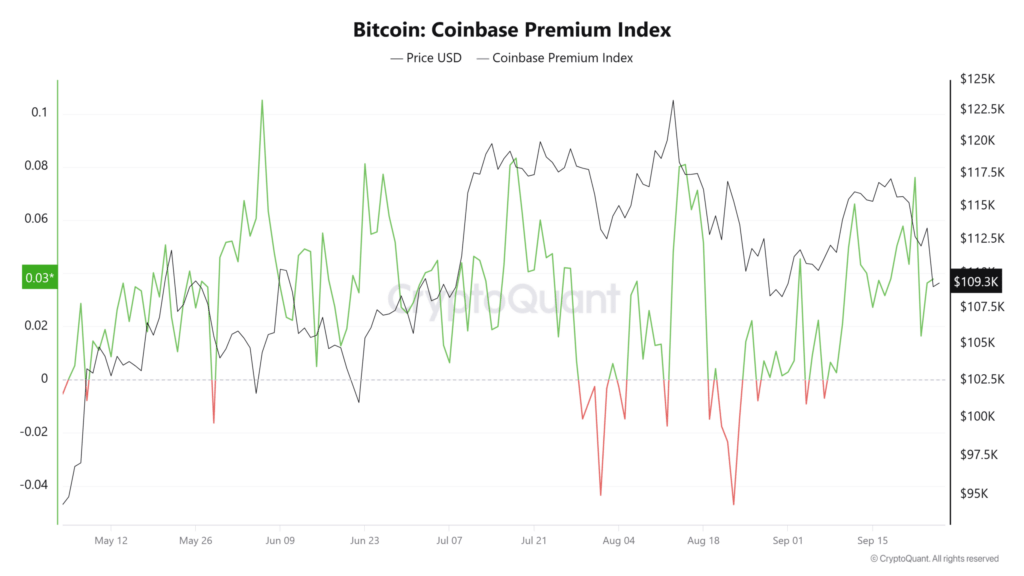

The Coinbase Premium, which tracks U.S. investor demand, remained positive despite recent dips, showing that sell-offs from U.S. investors are not severe. Since September 22nd, Bitcoin has dropped 5.16%, continuing a downtrend, with further correction toward the $105,000–$107,000 range possible.

This drop in OI reflects a cautious stance from speculators, aligning with the current bearish sentiment. However, these corrections are typical in healthy markets and don’t negate the broader bullish trend.

As one analyst put it, “Traders and investors must not lose sight of the forest for the trees,” emphasizing the importance of focusing on long-term trends over short-term fluctuations.

Comments are closed.