Featured News Headlines

AVAX Shows Strong Fundamentals Despite Price Lag

Although AVAX crypto has lagged behind some of the market’s top performers, its on-chain activity continues to stand out. Analysts and participants point to these fundamentals as a signal of the network’s growing momentum, which could potentially influence price movements in the near term.

RebornAli3N’s October recap highlighted that AVAX recorded over 61.4 million transactions, the second-highest on record, alongside 69.8K AVAX burned—the most since December 2023. The network also saw $13.1 billion in decentralized exchange (DEX) volume and over 60 million ERC20 transfers. Such metrics indicate sustained on-chain demand and a vibrant ecosystem, suggesting that the project maintains significant operational strength even as its price remains subdued.

Network Health Signals Growing Momentum

On-chain data shows that AVAX remains one of the healthiest networks in the crypto space. High transaction counts, significant token burns, and active DEX participation all reflect consistent usage and engagement. Analysts note that these metrics often precede shifts in market sentiment, highlighting that while price may currently trail, fundamental activity is a key factor to monitor.

“This level of network activity demonstrates the growing ecosystem momentum,” the recap notes. These insights underscore the distinction between short-term price performance and underlying network strength—a metric increasingly watched by participants tracking AVAX’s long-term trajectory.

RSI and Momentum Indicators Point to Possible Reversal

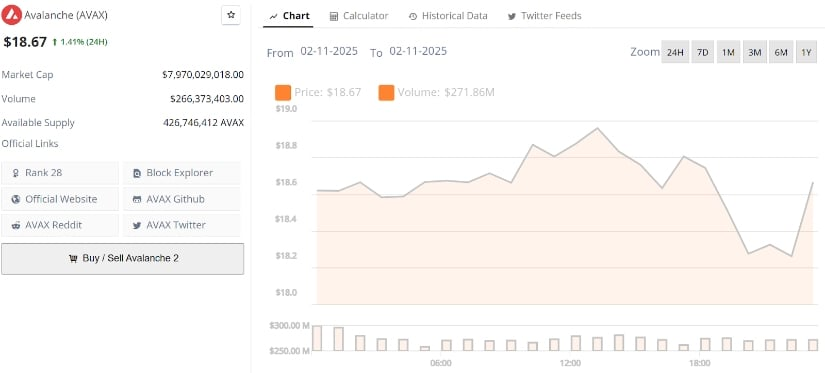

Technical indicators suggest AVAX may be approaching a shift in momentum. Observations from aihansu’s chart reveal that the price is hovering between $18 and $19, approaching a potential breakout from the descending trendline.

The Relative Strength Index (RSI) has rebounded from oversold conditions and shows an upward curve, often interpreted as an early signal of improving momentum. Analysts have observed that if this trajectory continues, a move above the $20.50 to $21.00 range could mark renewed technical strength. Immediate resistance lies near $26.99, corresponding with previous local highs.

Handle emphasizes that maintaining price structure above $16 is crucial to keeping the bullish divergence intact, potentially setting the stage for a recovery toward higher targets in the coming week.

Symmetrical Triangle Pattern Signals Key Levels

Coinbro’s macro chart highlights AVAX forming a large symmetrical triangle following months of consolidation. This price compression suggests that higher lows are aligning beneath consistent resistance, creating conditions for a possible breakout.

“Price compression has tightened, and with higher lows under consistent resistance, a breakout could trigger accelerated movement,” Coinbro notes. The pattern indicates that if AVAX achieves a decisive breakout with volume confirmation, medium-term targets around $45 and $60 may be observed. In a fully resolved scenario, the chart suggests that long-term projections could even extend beyond $100.

The $22 to $24 range has been identified as a potential breakout trigger zone, drawing the attention of participants monitoring structural shifts in the market.

Horizontal Resistance Remains Key

Despite the network’s strong fundamentals, AVAX continues to face horizontal resistance near $19.80 to $20.20. This range has capped recovery attempts for several weeks, leaving the price structure neutral-to-bearish until the resistance is decisively overcome.

Handle adds, “Once AVAX reclaims this level and sustains it, the technical bias could swiftly flip bullish.” A confirmed breakout above this zone could open room for a retest of $23 to $25, potentially supporting a broader structural recovery.

Balancing Fundamentals and Technical Signals

Overall, AVAX demonstrates a clear divergence between price and network strength. On-chain metrics, including transaction volumes, token burns, and DEX activity, reflect a resilient ecosystem, while technical indicators hint at a possible trend shift if resistance levels are overcome. Participants are closely observing the interplay between these fundamental and technical signals, which together paint a nuanced picture of AVAX’s current market behavior.

This case illustrates how crypto projects may exhibit robust operational health even when price performance temporarily lags, emphasizing the importance of analyzing both on-chain fundamentals and market structure to understand the full dynamics of a digital asset.

Comments are closed.