Featured News Headlines

Avantis AVNT Token’s Strong Price Performance

Virtual currencies showed mixed reactions following Monday’s rallies, with Bitcoin slipping below $110,000 after briefly touching $111,600. Meanwhile, the altcoin market remained relatively subdued — except for Avantis (AVNT), which surged nearly 62% within 24 hours.

Avantis Hits New Highs on TVL Milestone

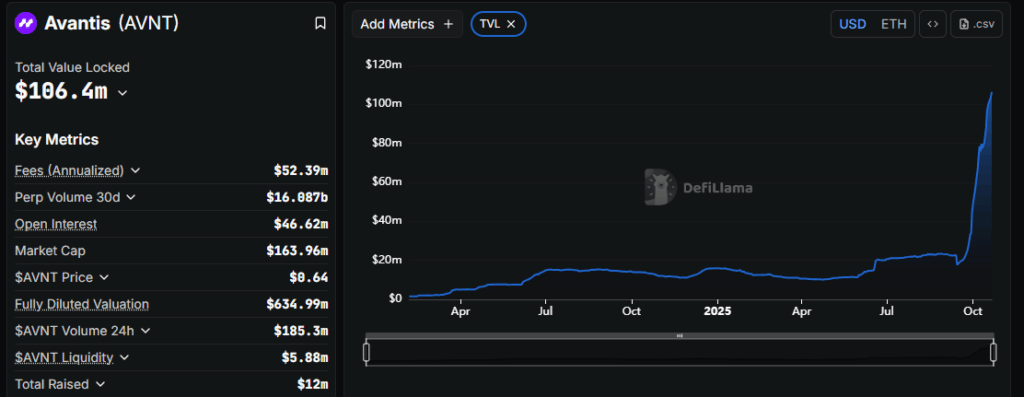

AVNT jumped from $0.4703 to an intraday peak of $0.7611, fueled by the decentralized exchange’s announcement of surpassing $100 million in total value locked (TVL). This milestone has sparked excitement within the crypto community, signaling rising confidence in decentralized finance (DeFi) projects.

The DEX team celebrated on social media platform X, emphasizing Avantis’ position as a key player in the growing perpetual decentralized exchange space. Since mid-last month, Avantis has seen robust TVL growth, confirming a wider trend of increasing adoption in this sector.

Simplifying Passive Income with Avantis USDC

One of the project’s innovations is the recent launch of Avantis USDC (avUSDC), a single stablecoin vault designed to boost liquidity and help users generate yields without complex trading strategies.

According to the team, “Avantis USDC (avUSDC) simplifies access to perpetual yields, enabling anyone to become a passive market maker.” This approach appeals to both new and experienced DeFi participants, driving the token’s recent price momentum.

Looking Ahead: Avantis’ Growth Ambitions

Currently holding a TVL of $106 million, Avantis aims to reach $500 million, as highlighted by DeFiLlama data and the project’s roadmap. The team cites innovative yield strategies and composable yield integrations as key drivers for future expansion, enhancing compatibility with other decentralized applications (dApps).

AVNT Price and Market Sentiment

After reaching an intraday high, AVNT currently trades around $0.72, with daily trading volume increasing by over 580%, reflecting heightened market interest.

Maintaining momentum could push AVNT toward resistance levels at $0.8739 and the psychological $1 mark, with potential upside extending to $1.1849 — about a 65% increase from current levels.

However, as noted, holding support between $0.55 and $0.60 is essential to sustain bullish momentum before moving into higher resistance zones.

Comments are closed.