Featured News Headlines

Avalanche Stablecoin FRNT Marks Rising GovTech Adoption

Avalanche is steadily emerging as a blockchain of choice for governments and institutional players, even as its native token AVAX remains far from its historical peak. The network’s appeal lies in its scalability, fast transaction speeds, and robust infrastructure that supports both traditional finance (TradFi) and decentralized finance (DeFi) solutions.

In a notable development, Wyoming’s Stable Token Commission issued the first government-backed stablecoin, the Frontier Stable Token (FRNT), on Avalanche and six other public blockchains. According to Cointelegraph, FRNT is fully collateralized with U.S. dollars and short-duration U.S. Treasury bills, maintaining a mandated 102% reserve. This launch signals a significant step toward government adoption of blockchain technology, illustrating that public institutions are increasingly exploring distributed ledgers for secure and transparent financial systems.

Institutional Interest Drives Blockchain Adoption

Beyond government initiatives, Avalanche has drawn attention from major financial institutions. SkyBridge Capital, led by Anthony Scaramucci, committed to tokenizing $300 million worth of hedge fund capital on the network. This move represents a broader trend of traditional finance engaging with blockchain technology, which Nansen, a crypto analytics firm, described as “quietly turning TradFi and gov tech into onchain reality,” further noting, “DeFi just got institutional.”

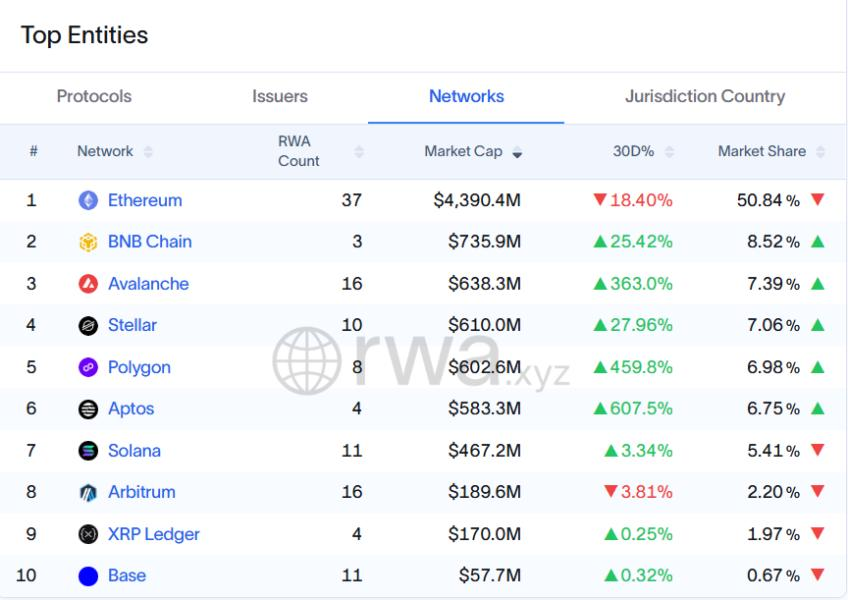

By the end of the third quarter, Avalanche had become the third-largest blockchain by the value of tokenized U.S. Treasurys onchain, with $638 million, trailing only BNB Chain and Ethereum, according to RWA.xyz. Tokenized Treasurys are minted on the blockchain to enhance accessibility for investors and expand trading opportunities. This reflects the growing real-world asset (RWA) tokenization sector, which bridges traditional financial instruments with decentralized infrastructure.

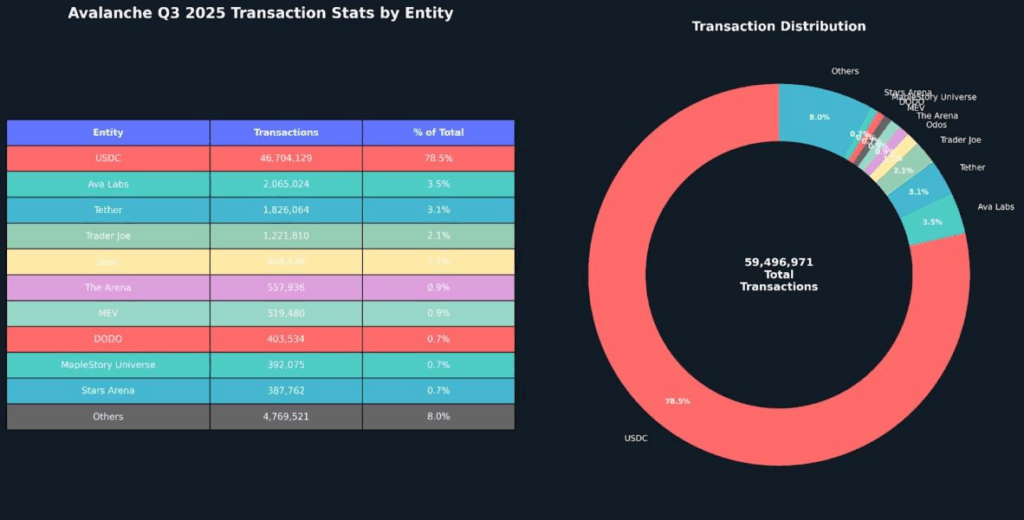

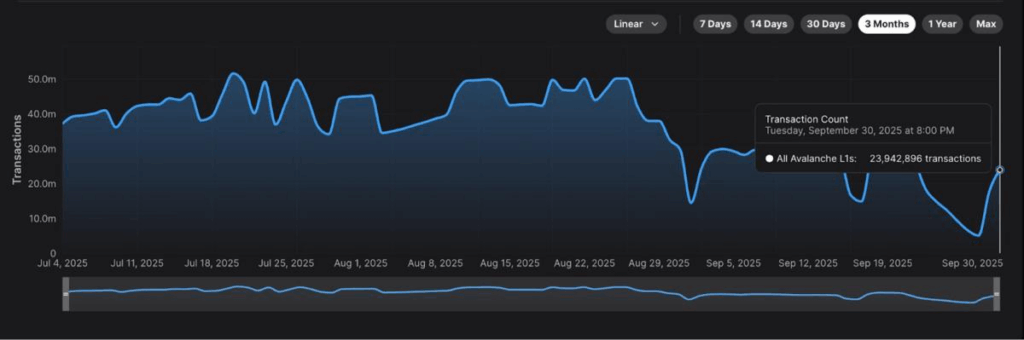

Network Usage and Transaction Volume

Avalanche’s onchain activity demonstrates substantial engagement from users. Nansen reports that the network averages over 1 million daily transactions, peaking at 51.6 million transactions in a single day during the past quarter. Such volume highlights Avalanche’s capacity to handle large-scale operations efficiently, a key reason institutional players and governments are showing interest.

Despite these adoption milestones, the network’s native token, AVAX, has struggled to capture the same upside. AVAX is currently down 86% from its all-time high of $146, achieved on November 21, 2021. At the time of publication, Avalanche was trading at $19.66, reflecting a 33% decline over the past month. Broader market conditions have also weighed on the token; in early October, the cryptocurrency sector experienced a record $19 billion liquidation event, following geopolitical tensions and trade policy announcements by U.S. leadership.

Bridging TradFi and DeFi

Avalanche’s increasing role in tokenized U.S. Treasurys illustrates its unique positioning at the intersection of traditional and decentralized finance. Tokenization on the network enables enhanced liquidity and transparency, allowing investors to access government-backed assets without the constraints of conventional markets. Nansen describes this trend as a quiet transformation, noting that institutional-grade financial products are increasingly becoming “onchain realities.”

The integration of stablecoins such as FRNT further strengthens Avalanche’s position as a reliable infrastructure for institutional applications. These stablecoins, fully collateralized and governed by regulatory mandates, offer a safer entry point for traditional investors into the blockchain space. By providing a bridge between fiat-backed assets and the decentralized ecosystem, Avalanche is shaping the future of tokenized finance.

Challenges for the Native Token

Despite institutional and governmental adoption, AVAX’s price trajectory remains under pressure. The disconnect between network activity and token performance highlights a broader trend in blockchain markets: adoption and utility do not always immediately translate into short-term price gains. Market volatility, macroeconomic factors, and broader crypto sentiment play crucial roles in token valuation.

Recent declines in AVAX coincided with geopolitical and economic uncertainties, including U.S.-China trade tensions. Early October saw a substantial liquidation in the crypto market, contributing to AVAX’s recent drop. Even with growing network use and institutional engagement, the native token continues to face challenges in reclaiming its prior highs.

Avalanche is steadily emerging as a key player in government-backed stablecoins and institutional finance. Its robust network supports high transaction volumes, tokenized assets, and stablecoins like FRNT, marking significant adoption milestones. As Nansen notes, “DeFi just got institutional,” with Avalanche bridging the gap between traditional finance and decentralized technology.

While AVAX has not mirrored this growth in token price, the network’s adoption trends indicate a strong foundational infrastructure capable of supporting both governments and institutional investors. Avalanche’s continued focus on tokenized Treasurys, real-world asset integration, and fast, scalable blockchain operations positions it as a pivotal player in the evolving landscape of decentralized finance and institutional-grade blockchain solutions.

Comments are closed.