ASTER Price Rockets Despite Monthly Decline After CZ Purchase

After Changpeng Zhao, a co-founder of Binance, revealed that he had bought 2.09 million ASTER tokens, the price of the token skyrocketed. On November 2, the tokens, which were valued at about $2 million, were purchased for about $0.91 each. Before a minor dip, the token saw a quick 35% spike, reaching a peak of $1.26. Aster was trading at $1.05 at the time of writing, up 7.14% from the day before. The token is still down 50.74% over the last month and 8.38% over the last seven days. As a result of the action, Aster’s daily trading volume increased by 862% to $2.29 billion, and its market capitalization topped $2.5 billion. This suggests a sharp increase in market activity. Derivatives data from Coinglass shows that open interest increased 42.9% to $640.5 million. This indicates a rise in leveraged holdings.

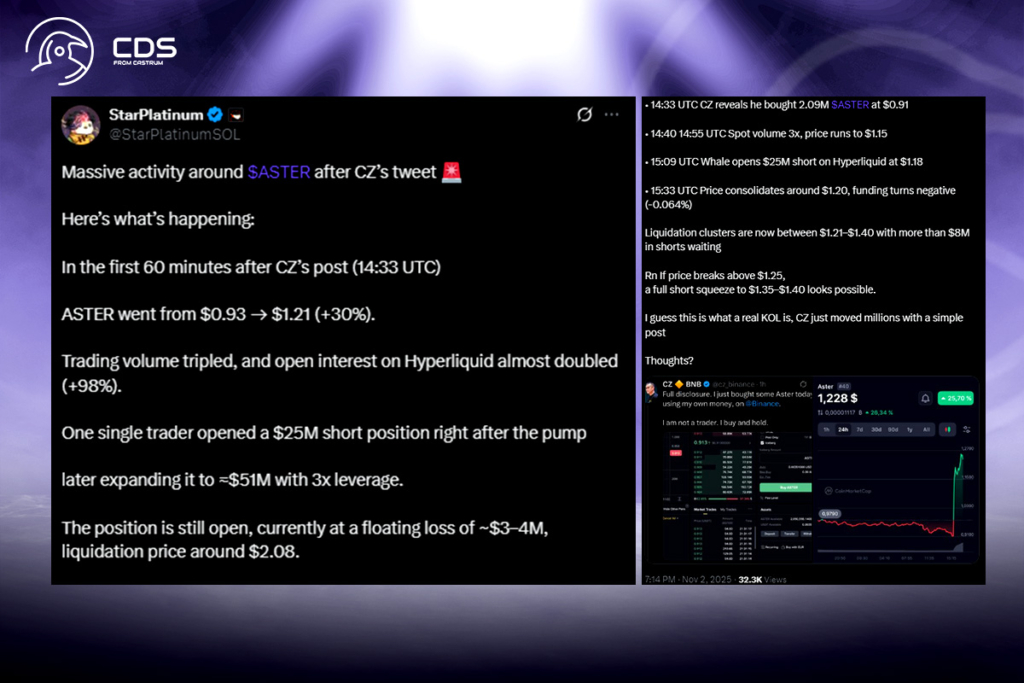

Retail Dominance Clashes with Whale Bets on ASTER

Retail traders were encouraged by CZ’s description of his investment as a personal “buy and hold” decision. Retail dominance was demonstrated by Binance’s overall long-to-short ratio of 1.9. However, in reaction, several prominent traders bet on a price reversal by taking massive short positions on Hyperliquid (HYPE). Using three times leverage, one wallet’s $25 million short position at $1.18 grew to almost $51 million. In the meantime, $18 million in shorts was added to another wallet. After the sharp pump, these whale bets imply doubt about Aster’s viability.

MACD Signals Weak Buy as ASTER Momentum Slows

Following the post-announcement spike, Aster‘s one-hour chart indicates that the bullish momentum is fading. The price’s consolidation below the middle Bollinger Band, which is at roughly $1.11, suggests a temporary correction phase. The bottom band, close to $0.88, indicates short-term support, while the higher band, at $1.34, indicates imminent resistance. Overbought circumstances have cooled, as evidenced by the relative strength indicator dropping from 80 to 46 earlier in the day. The MACD line is still marginally above the signal line, giving a weak buy signal, even though the histogram is narrowing, signaling diminishing bullish pressure.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.