Featured News Headlines

Aster Price Analysis: Could $1.50 Be Next?

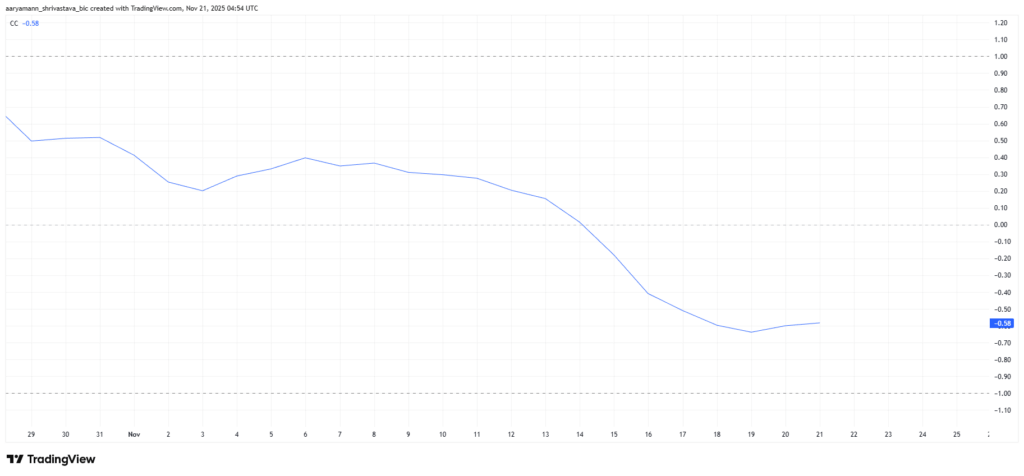

Despite the overall bearish pressure in the crypto market, Aster is showing resilience against deeper drops by leveraging unique structural advantages. Its negative correlation with Bitcoin is strengthening, enhancing Aster’s potential for upward movement. At the time of writing, the correlation coefficient stands at -0.58, indicating the two assets move in opposite directions.

Aster Rises as Bitcoin Falls

As Bitcoin continues to decline on the daily chart, this negative correlation provides Aster room to rise even when the market weakens. This dynamic has become one of Aster’s key advantages. While Bitcoin retraces, Aster’s price structure benefits from this divergence.

Buyers can take positions without the usual pressure tied to Bitcoin’s volatility. This makes Aster an alternative investment vehicle in the crypto space. Macro momentum indicators also point to strengthening inflows.

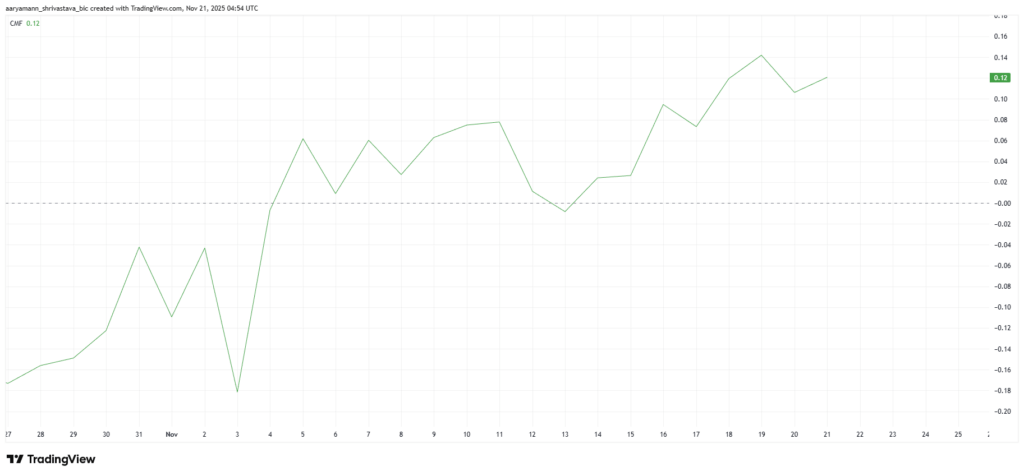

The Chaikin Money Flow (CMF) indicator shows a sharp rise, signaling increasing capital inflows into the asset. Sustained positive CMF readings generally indicate renewed investor confidence and provide fundamental support for continued rallies.

Investor Support Drives Momentum

Investor backing plays a critical role in sustaining price momentum, and Aster benefits from consistent accumulation. If these inflows continue, the altcoin could gain strength toward the $1.50 mark.

Increasing capital flows reflect not only short-term price movements but also long-term confidence. Investor interest in Aster shows trust in the project’s fundamentals and market positioning.

Positive CMF values indicate that buying pressure exceeds selling pressure, suggesting that price gains are built on solid foundations. Such indicators are considered reliable signals in technical analysis.

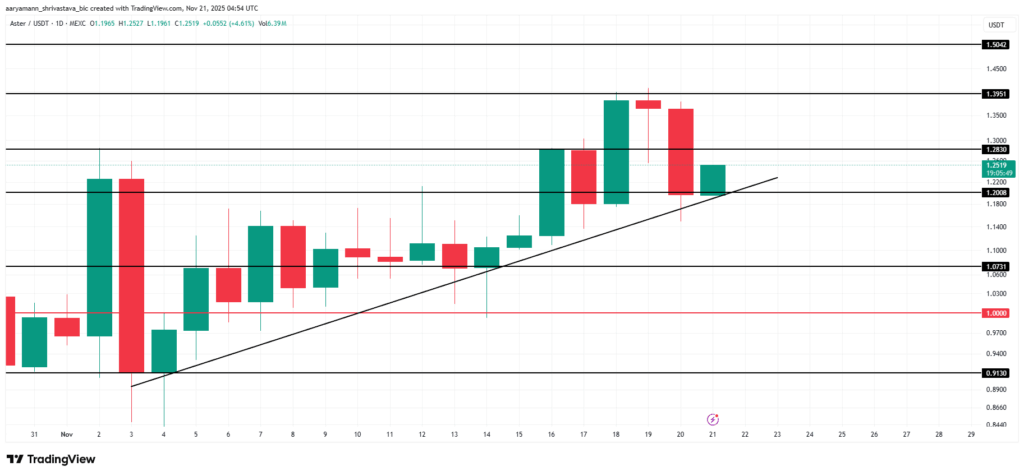

Critical Position at $1.25

Aster is currently trading around $1.25, maintaining above the key $1.20 support level. It is positioned just below the $1.28 resistance. This setup suggests that as long as the broad momentum and negative correlation with Bitcoin persist, the altcoin can continue its upward trajectory.

Based on current indicators, Aster’s roughly three-week uptrend is likely to extend further. Despite the recent 8% drop, bullish conditions could push the price toward $1.39. A breakout above this level would open the path to $1.50, reinforcing the strength of the ongoing rally.

However, if investors decide to lock in profits, Aster could lose its $1.20 support. A break below this threshold may push the price down to $1.07, invalidating the bullish thesis and signaling a shift in market sentiment.

Maintaining support levels is critical for the continuation of the uptrend. The $1.20 level emerges as a key line where buyers must defend.

Aster’s performance in the coming days will depend on Bitcoin’s movements, overall market liquidity, and investor sentiment. If the negative correlation persists, Bitcoin weakness could continue to provide an opportunity window for Aster.

[…] price reached a lower high between November 19 and November 24, whereas the Chaikin Money Flow (CMF) reached a higher high. CMF tracks the addition or removal of large wallets. This is a positive […]