Featured News Headlines

ASTER Price Drops 27%: Bearish Signals in Futures and Spot Markets

Since reaching its all-time high of $2.43 on 24 September, ASTER [ASTER] has come under intense selling pressure. At the time of writing, the altcoin was trading at $1.74, reflecting a daily drop of 10.34% and a 27.75% decline from its peak. This correction has also wiped nearly $1 billion off its market cap, which fell from $3.89 billion to $2.9 billion.

Futures Market Shows Bearish Shift

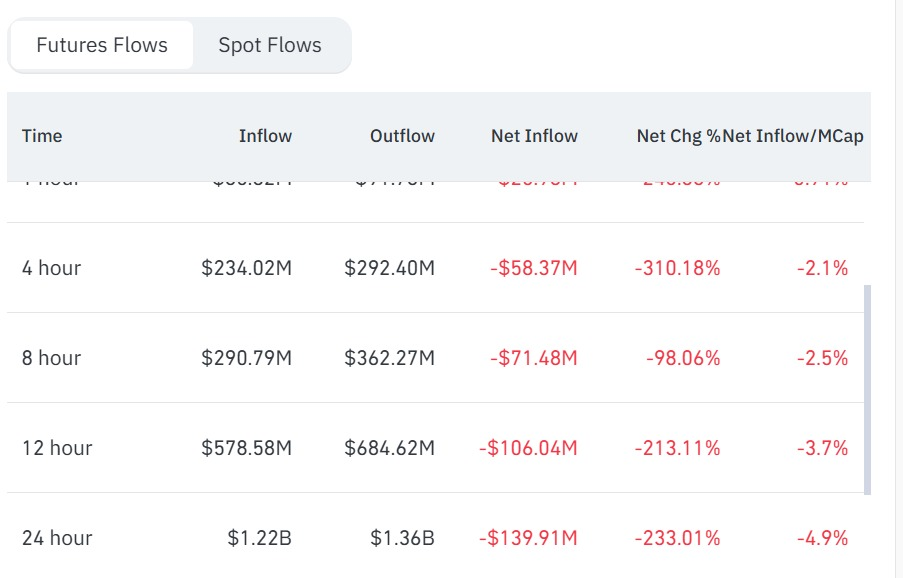

ASTER’s derivatives market is witnessing a notable pullback. According to CoinGlass, Futures inflows have declined to $1.22 billion, while outflows increased to $1.36 billion, resulting in net negative flows of -$139.9 million over the past 24 hours — a 133% decrease. This suggests reduced speculative interest and increased trader caution.

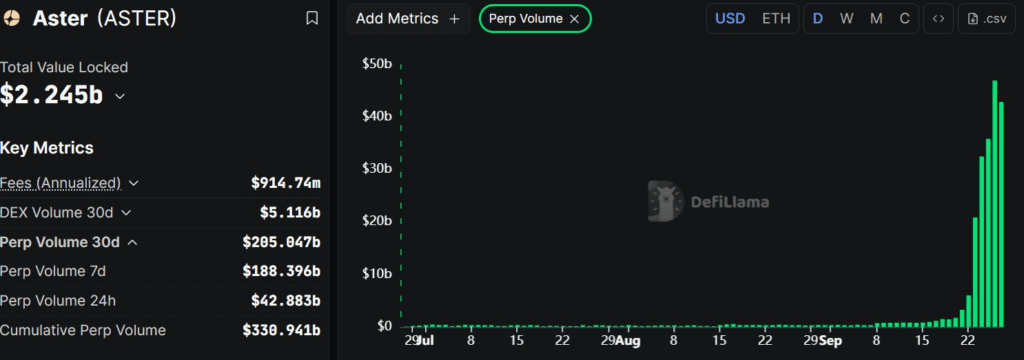

Perpetual volume has also declined significantly, falling from $46.98 billion to $42.88 billion in just 24 hours. Weekly volume is down from $188.3 billion, highlighting a sharp contraction in open positions and a likely phase of de-risking.

Spot Market Turns Bearish

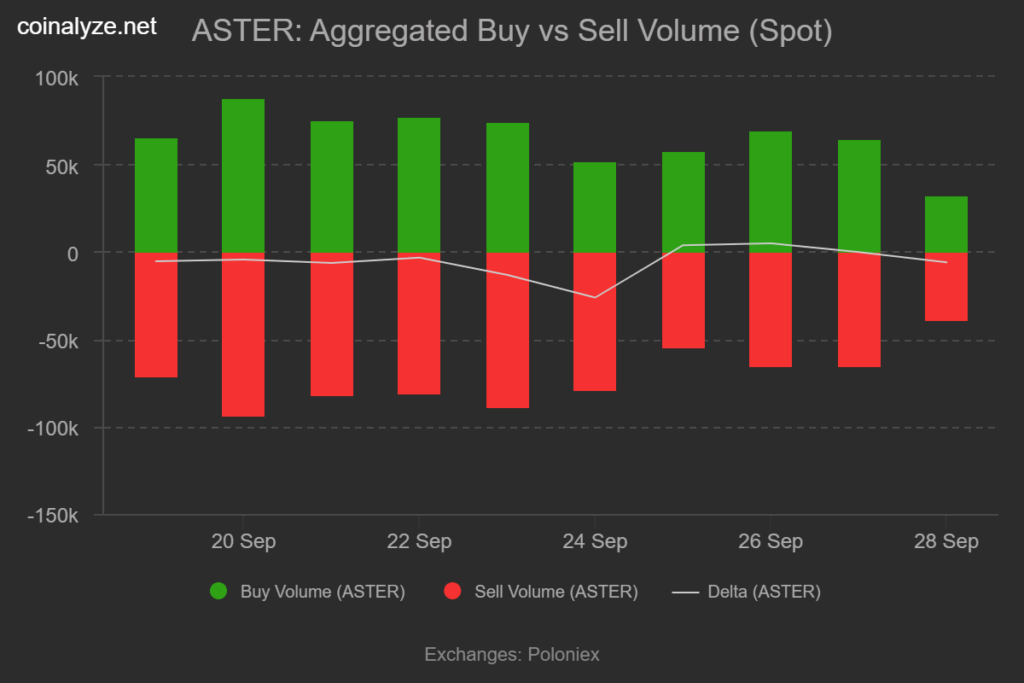

In the Spot market, seller momentum appears to be gaining ground. According to Coinalyze, ASTER saw a -6k delta on 28 September, with 38.8k Sell Volume compared to 32k Buy Volume — a clear indication of growing sell-side pressure.

Whale Activity Declines

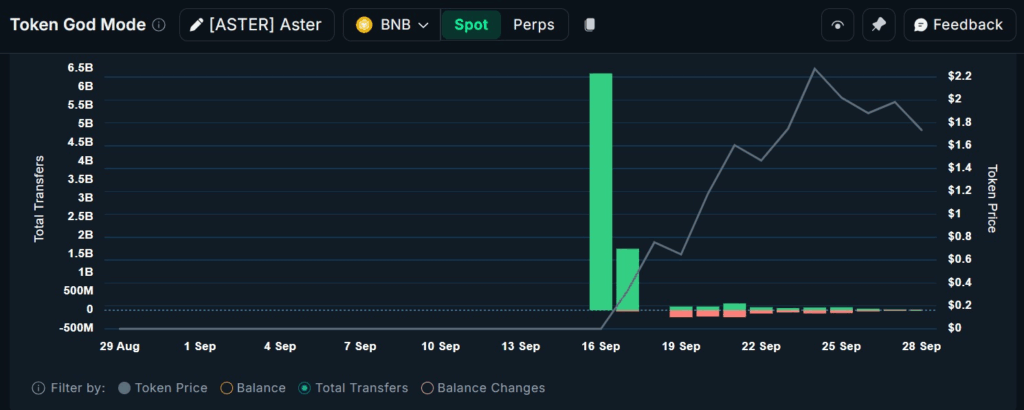

On-chain data also shows that whale participation has dropped. While whales were buying over 1.6 billion tokens daily leading up to the ATH, recent figures show just 21 million in buys and 15 million in sells, signaling a cooling speculative appetite.

Comments are closed.