Featured News Headlines

APT Token Unlock: Market Ignores $50M Release

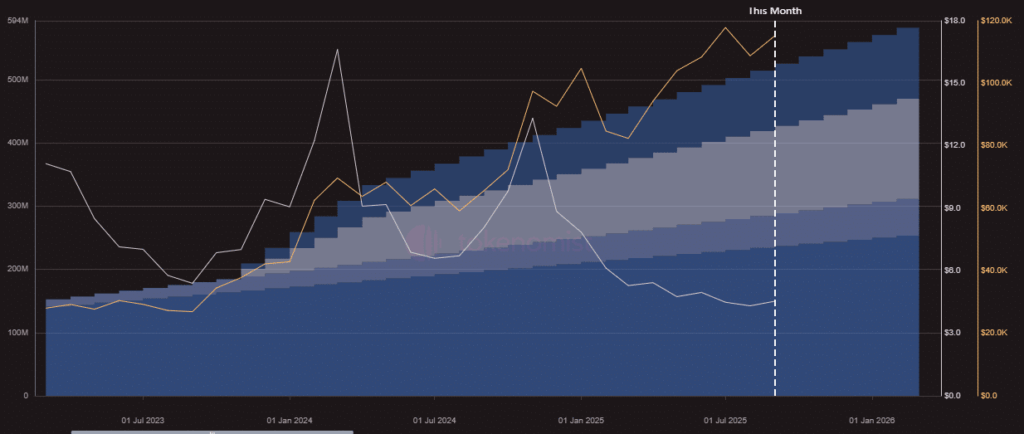

Aptos [APT] executed a $50 million token unlock on September 11th, releasing 11.31 million APT at 10:00 AM UTC. Despite the sizable emission, the price reaction was muted, with the token recording only a 0.94% uptick, signaling weak market momentum.

No Strong Correlation Between Unlocks and Price

This unlock was part of the network’s scheduled monthly token emissions aimed at supporting ecosystem development and early investors. Historical trends suggest that such events have not shown a direct correlation with price movements. For instance, “during the last month’s unlock, APT bounced 6%,” a spot check revealed.

Community Sentiment and Staking Absorption

Some community members suggest that rising staking demand is helping absorb the unlocked tokens, thereby dampening any potential sell-off pressure. However, broader market sentiment remains cautious, limiting speculative inflows.

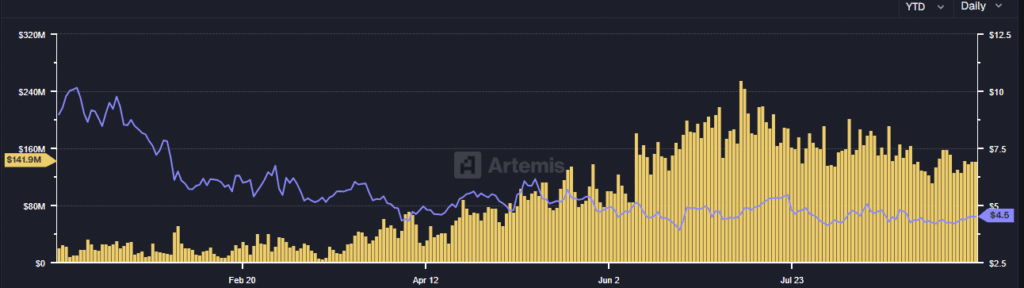

According to data from Santiment, APT’s weighted sentiment has been negative since late August. Additionally, “speculative interest (Open Interest) has declined since late July,” pointing to reduced activity from leveraged traders and futures markets.

The contrast is notable: “A sharp spike in speculative interest in early July sent APT flying from $4.3 to over $5.5,”highlighting the importance of derivatives demand in driving price rallies.

DEX Volume and Network Activity Decline

On-chain metrics show further weakness. Aptos-based DEX volumes have declined sharply from over $255 million to under $150 million, suggesting a drop in network activity and demand for APT as a gas token.

Until speculative demand returns and ecosystem activity picks up, APT could remain range-bound below the $4.8 mark. A breakout above the overhead resistance trendline could, however, improve the outlook for bulls.

Comments are closed.