On-Chain Data Warns: Bitcoin Selling Pressure Hits Multi-Year High

Joao Wedson, a well-known on-chain analyst, claims that Bitcoin is currently experiencing the strongest period of selling pressure in the previous three years. In a post on X, Wedson really displayed the declining buy/sell pressure delta. Since market sell orders far outnumbered market buy orders, the metric’s declining values highlighted aggressive selling activity. As is commonly known, prices are driven by market orders rather than limit orders.

Bitcoin Retention Rate Climbs Despite Market Stress

Wedson felt optimistic about the outcome. Even though there has been a lot of pressure to sell, this level of selling is not expected to continue for very long. It does not have to mark the precise bottom. Nonetheless, it typically indicates a market bottom and may be followed by a period of consolidation.

The holder retention rate has been climbing in recent months, despite the evidence showing an increase in sell pressure. The percentage of addresses that keep a Bitcoin balance during a 30-day period is tracked by the statistic. The increasing retention rate raises the possibility that holder confidence is getting better. Despite worries that the bull market may be coming to an end, it also indicates a rising long-term commitment.

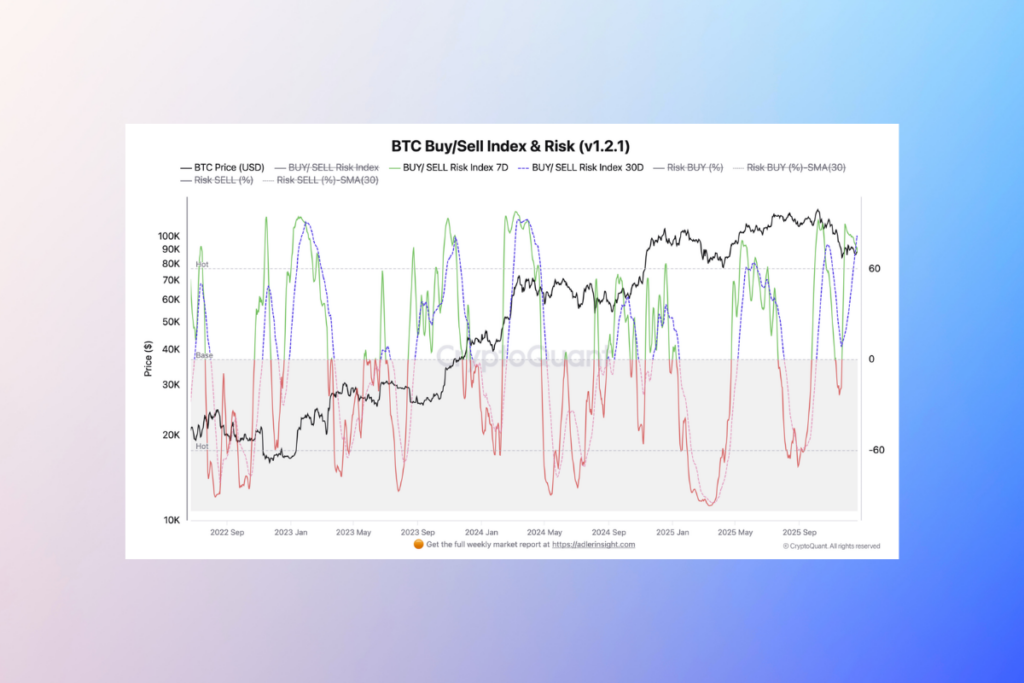

Bitcoin Rallies Face Resistance as Buy/Sell Index Overheats

Despite the encouraging results of the retention metric, traders and investors must continue to monitor the current state of the market. Axel Adler Jr., a cryptocurrency analyst, noted that the buy/sell index values across the 1-, 7-, and 30-day timeframes show high risk. These findings indicate that the market is still dangerous for purchasers. The 1D value was just 43 after the price drop to $84.4k last week, but the 7D and 30D levels indicated overheating. Long bets typically unwind during price increases, and the structure is still risky for purchasers overall. Rallies are difficult to maintain as a result.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.