Featured News Headlines

Amazon Lags Behind in 2025: Is Now the Time to Buy?

While the broader stock market continues its bullish momentum—with the S&P 500 climbing 14% year-to-date—Amazon (NASDAQ: AMZN) has barely moved. Up less than 4% so far this year, the tech giant is underperforming not just the index, but also its high-growth tech peers. The slowdown has surprised many, particularly given Amazon’s heavy investment in artificial intelligence (AI), a theme driving much of the market’s enthusiasm in 2025.

So what’s behind this underwhelming performance? Has Amazon lost its edge, or is the market simply overlooking its long-term potential?

Steady Growth, but Rising Expectations

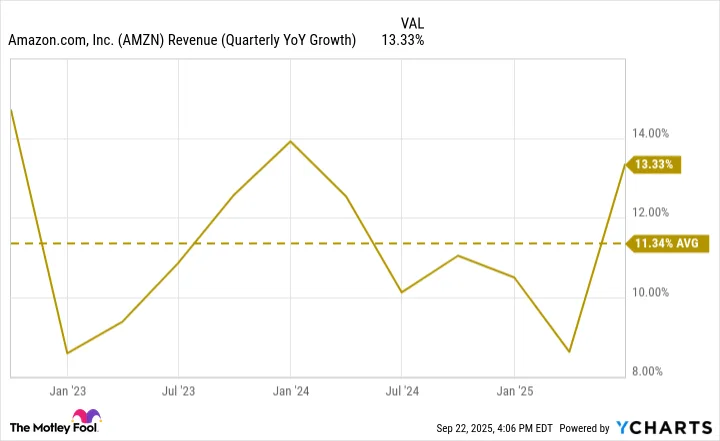

Amazon isn’t exactly slowing down. Over the past three years, the company has posted consistent top-line growth, averaging around 11%. In the most recent quarter ending June 30, Amazon reported a 13% year-over-year increase in revenue, totaling $167.7 billion—a solid result by any traditional metric.

But today’s tech market is far from traditional. Growth is no longer just about consistent gains; it’s about acceleration, particularly in AI. Amazon’s multibillion-dollar bet on AI—reportedly up to $100 billion in spending this year—has yet to yield the kind of explosive results that excite investors.

The company projected operating income between $15.5 billion and $20.5 billion for the current quarter. While that’s a strong figure, the midpoint falls just under Wall Street’s $19.5 billion estimate. In a market where AI narratives dominate, even a slight miss on guidance can weigh heavily on sentiment.

In a Competitive AI Race, Others Are Moving Faster

Part of the pressure on Amazon comes from the sharp rise of other AI-linked stocks. Palantir Technologies, for instance, has surged over 135% this year despite being far less profitable than Amazon. The reason? A strong narrative around AI adoption and data analytics.

Meanwhile, Seagate Technology—traditionally viewed as a data storage company—has rallied 166% year-to-date, benefiting from increased demand for storage infrastructure tied to AI and machine learning models. While Seagate is not a core AI player, its indirect role in the ecosystem has made it one of the top-performing stocks on the S&P 500 in 2025.

In comparison, Amazon’s AI efforts appear slower to materialize in tangible revenue or user-facing applications. While the company is integrating AI into its retail and cloud businesses, including warehouse robotics and shopping personalization, these developments may be harder to quantify in the short term.

Valuation Reflects Skepticism, Not Collapse

Amazon now trades at a price-to-earnings (P/E) ratio of around 35—lower than its historical average, which often ranged above 50 or even 60. This re-rating could suggest that investors are resetting expectations. But it could also indicate a more rational pricing for a company in transition.

Importantly, Amazon still boasts a highly diversified business model—spanning e-commerce, cloud computing (AWS), digital advertising, and now AI infrastructure. Even if it’s not the hottest AI stock today, its long-term positioning remains significant.

AI Investments May Take Time to Pay Off

Despite the muted short-term reaction, Amazon is one of the companies best positioned to benefit from AI in the long run. Its ability to enhance logistics, improve cloud services, and personalize consumer experiences gives it multiple practical applications for machine learning.

As with many transformative technologies, the payoff for AI spending may not be immediate. Investors looking for rapid returns might turn to more niche AI plays, but companies like Amazon often see compounding benefits over a longer time horizon.

And while Palantir and Seagate are making headlines now, they don’t carry the same breadth or infrastructure reach as Amazon does through AWS or global retail operations.

Market Sentiment vs. Business Fundamentals

At the heart of the current market hesitation may be a simple misalignment between narrative and numbers. The AI story is there—but without the blockbuster guidance or revenue spikes seen in smaller, more focused companies, Amazon’s progress isn’t translating into share price momentum.

That said, the fundamentals of Amazon remain strong. Its growth is consistent, margins are expanding, and it’s investing in future technologies—without abandoning its core strengths.

For many seasoned analysts, these are the signs of a company building long-term value rather than chasing short-term hype.

Comments are closed.