Featured News Headlines

Ethereum Dominance Drops, Altcoin Outlook Weakens

With just one week into Q4, the crypto market has retraced nearly all its September gains. The Fear & Greed Index has slipped back into the “fear” zone, and Bitcoin (BTC) is now trading only 3% above its monthly open of $108,000. Similarly, the total crypto market cap (TOTAL) is hovering about 3% above its $3.70 trillion base.

Altcoins Underperform as Market Momentum Fades

While BTC has managed to hold relatively steady, altcoins have been hit harder. The TOTAL2 index—which tracks the market cap of all cryptocurrencies excluding Bitcoin—is down 4.43%, nearly double BTC’s losses. This drop came after TOTAL2 was rejected at a major resistance level, indicating weakness in the broader altcoin sector.

Adding to the concern is the behavior of Ethereum dominance (ETH.D), which continues to trend downward. Since peaking at 15% in mid-August, ETH.D has steadily declined. This divergence from past patterns—where rising ETH.D often signaled strong altcoin rallies—suggests that capital is no longer flowing into alts as it once did.

Brief Altcoin Spike Proves Short-Lived

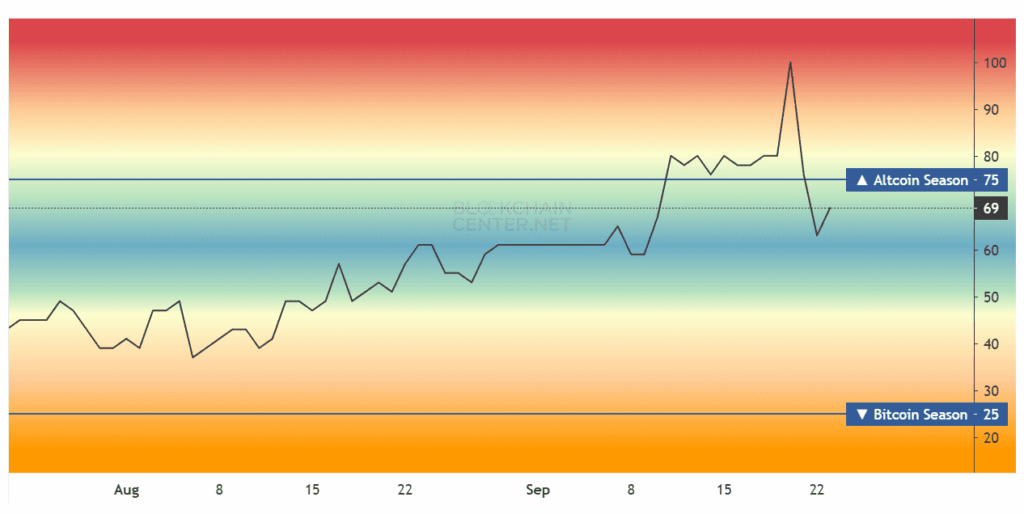

On September 19, the Altcoin Season Index briefly surged to 100, its highest level in seven years, following the launch of Astar (ASTER). However, the rally quickly reversed, and the index has since dropped back to 69, only slightly above its September start.

Bitcoin Regains Dominance

Meanwhile, Bitcoin dominance (BTC.D) has risen by 1.01% this week, making it the only major metric still holding above September levels. In contrast, ETH.D has dropped by 2.86%, highlighting a clear rotation of capital back into Bitcoin.

Comments are closed.