Rising Altcoin Outflows Signal Growing Sell Pressure

The recent decline in altcoin markets is driven not only by short-term volatility but also by increasing sell pressure and weakening investor demand. One of the key indicators is the sharp rise in the number of altcoins being transferred to exchanges, reaching this year’s highest levels.

Data from CryptoQuant reveals that the seven-day average of altcoin inflow transactions has exceeded 70,000. Similar surges earlier in 2025 were accompanied by significant price drops in both Bitcoin and altcoins. As Coin Bureau highlighted, “Transactions sending alts to exchanges just hit a new YTD high, signaling rising sell pressure — or traders gearing up for the next big rotation.”

Stablecoin Flows Suggest Weakening Buying Power

While altcoin supply to exchanges increases, stablecoin inflows are declining, painting a fuller picture of market sentiment. CryptoQuant’s Stablecoin CEX Flow data shows net inflows remain positive but have sharply decreased since mid-September, nearing zero in October.

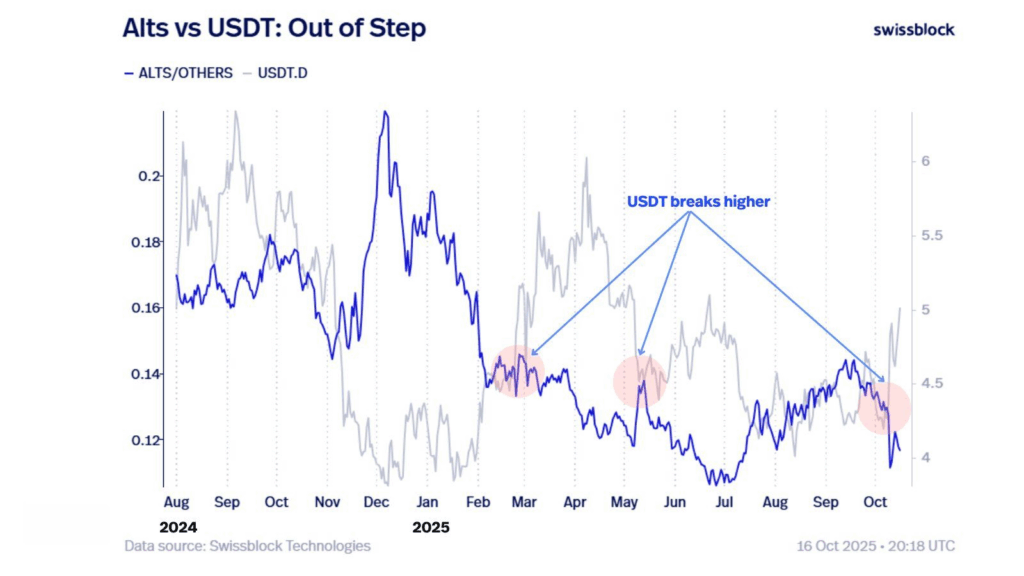

This drop in stablecoin movement to exchanges implies reduced buying capacity. The USDT.D index, measuring Tether’s dominance in market capitalization, has risen above 5%, indicating stablecoins are not fueling altcoin price increases.

Altcoin Vector notes that increased USDT dominance following recent liquidations typically aligns with steep altcoin price declines.

Signs of a Potential Market Bottom Amid Weakness

Despite these challenges, some technical analysts see signs that altcoins may be nearing a cycle bottom. Analyst Merlijn points to a rare MACD crossover signal that has appeared only three times in the past eight years, historically marking the start of an altcoin supercycle.

Such signals often precede strong rallies, yet caution remains essential. As Coin Bureau suggests, “Positive technical signals can emerge in the darkest phases of the market, but the current bearish indicators cannot be ignored.”

October’s volatility and historic market turning points mean investors should remain vigilant as the month progresses.

Comments are closed.