SpaceX Bitcoin Holdings Near $1B After BTC Hits New High

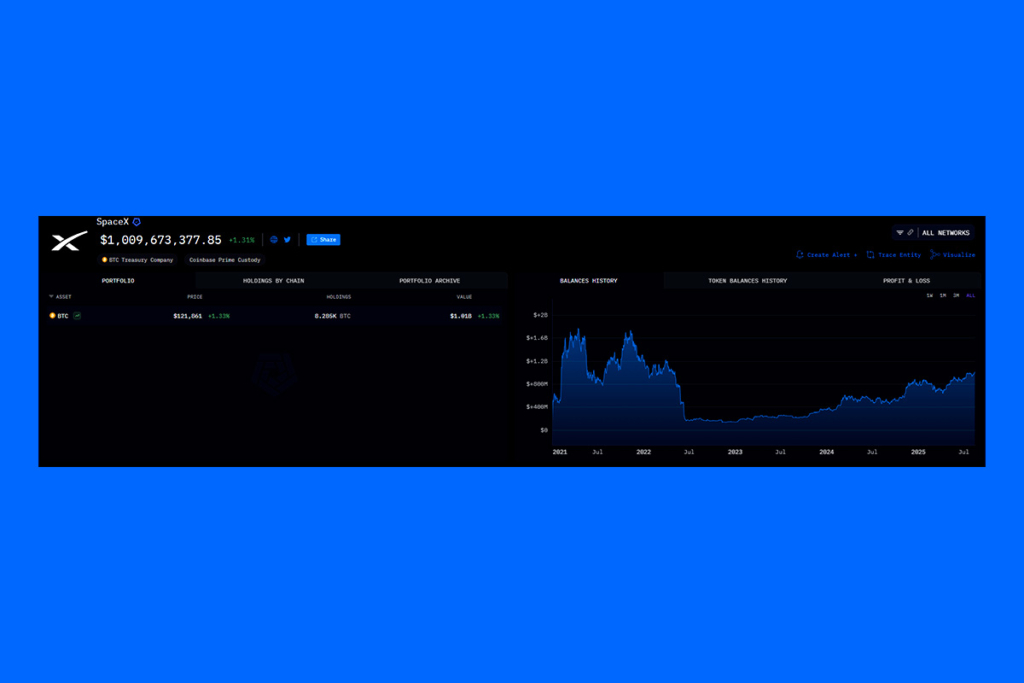

Since the price of Bitcoin hit a new high on Wednesday, SpaceX’s holdings have increased to almost $1 billion. Arkham Intelligence research indicates that Elon Musk’s aerospace company presently has 8,285 Bitcoin, which is worth approximately $1.02 billion. But this is not the first time SpaceX has owned over $1 billion worth of Bitcoin.

SpaceX Bitcoin Holdings Drop Sharply Following 2022 Crypto Chaos

SpaceX’s holdings, which date back to the start of 2021, increased to a total valuation of $1.8 billion in April of that year, according to Arkham data. Around 28,000 Bitcoin was owned by the corporation at this time. To reach its current size, SpaceX reportedly cut its holdings by about 70% in the middle of 2022.

The meltdown of Terra-Luna in May, the collapse of FTX in November, and the ensuing domino effect may have generated a market-wide shock that provoked this. The data indicates that the business hasn’t bought any more bitcoin since. Along with selling off the majority of its bitcoin holdings during that time, Tesla also now has 11,509 BTC, valued at $1.42 billion.

Bitcoin Climbs on Inflation Data and Rate Cut Hopes

On Wednesday, there was a notable spike in the price of Bitcoin that caused it to surpass the previous record established in July. After hitting an all-time high of over $124,457 yesterday, it is now trading at $120,912. The largest cryptocurrency in the world has surpassed Google’s $2.448 trillion market capitalization to become the fifth largest asset with a $2.452 trillion market capitalization. Following lower-than-expected economic statistics, optimism over a September interest rate cut in the US contributed to the spike in the price of Bitcoin.

Markets had anticipated July’s CPI to tick up slightly to 2.8% from June’s 2.7%. Instead, the figure held steady despite inflationary pressure from tariffs. This outcome is bullish for BTC and ETH, as it increases the likelihood of a potential U.S. rate adjustment.

Paul Howard, senior director at crypto market maker Wincent

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.