DOGE Price Under Pressure: Heavy Selloff Smashes Bullish Momentum

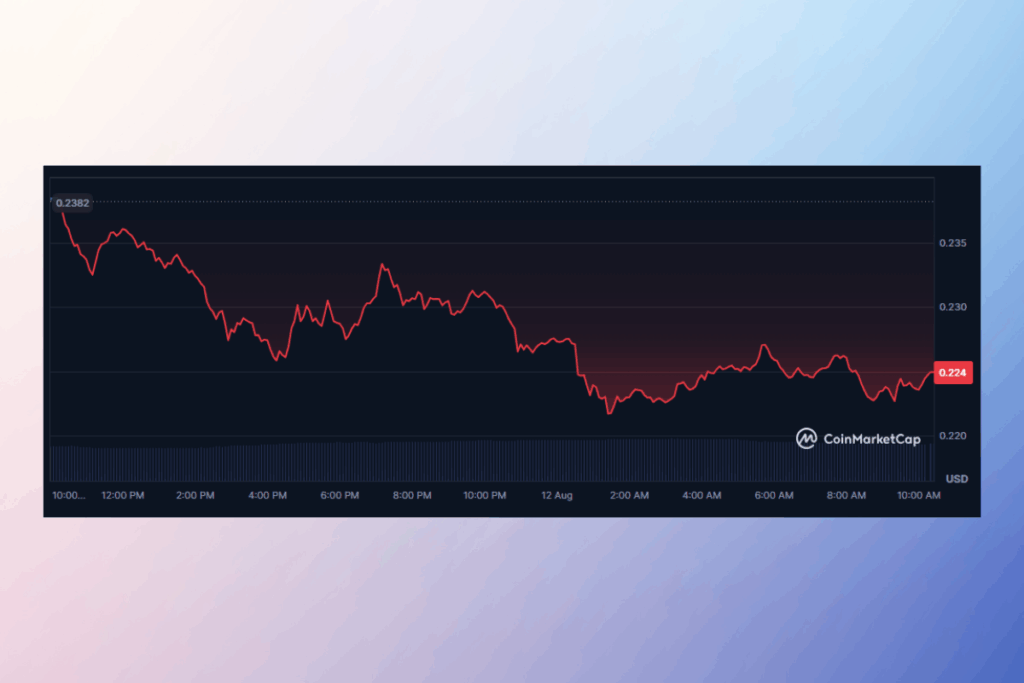

As strong selling pressure overcame bid-side liquidity, Dogecoin (DOGE) fell from $0.24 to $0.22, an almost 4% decline in the last day. On August 11, DOGE experienced the steepest drop, plunging from $0.238 to $0.233 on a trading volume of 485.69M, 31% higher than its daily average. With this resounding denial, $0.238 is solidly established as a significant short-term resistance level.

DOGE Price Stuck in Tight Range: Signs of Seller Exhaustion Emerge

As global trade tensions and regulatory uncertainties exacerbate risk-off sentiment across digital assets, the decline has been exacerbated by broader market weakness. DOGE and other cryptocurrencies are being further burdened by institutional de-risking brought on by central banks’ indications of potential policy changes and tariff conflicts between major nations.

793.38M in buy-side volume was generated by buyers’ attempts to keep the price steady at $0.226, but several attempts at recovery were unsuccessful in breaking through the $0.231 secondary resistance. DOGE consolidated closely between $0.2247 and $0.2253 by the last hour of trading as volume decreased, which may indicate selling weariness.

Will $0.22 Support Hold or Collapse?

Whether $0.22 remains a solid support or if broader market factors will cause a breakdown is being actively watched by market participants. The first indication of rebound momentum may be a clean breakout over $0.231, but additional whale buildup and a reduction in macroeconomic worries are probably needed for longer-term gains. Given how much the general risk appetite influences meme coin sentiment, DOGE’s next significant move will depend on both technical levels and headline-driven volatility in the cryptocurrency space.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.