Is the Bitcoin 4-Year Cycle Officially Dead?

The Bitcoin halving appears to be in the center of the four-year bull and bear cycles that have historically characterized cryptocurrency markets. However, specialists and researchers in the field believe that this pattern may be coming to an end. Jason Williams, an investor and author, for instance, thinks the cycle is over.

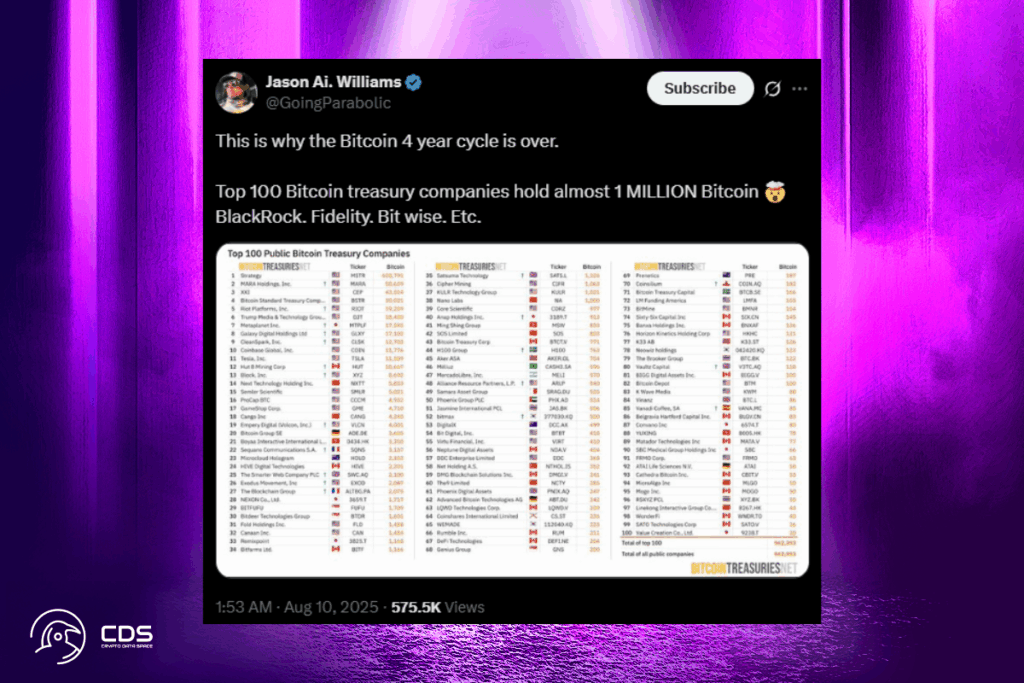

Top 100 Bitcoin treasury companies hold almost 1 MILLION Bitcoin. This is why the Bitcoin 4 year cycle is over.

Williams

Bitwise Asset Management’s chief investment officer, Matthew Hougan, expressed similar views. It won’t be formally over until 2026, when positive returns are anticipated, Hougan said. Reiterating his remarks from July, he summed up his ideas as follows: The four-year cycle is over.

Experts Reveal What Really Moves Bitcoin Now

The conventional four-year halving cycle of Bitcoin may be losing its dominance as a market mover, according to several prominent figures in the cryptocurrency space. Since 95% of Bitcoin has already been mined, Pierre Rochard, CEO of The Bitcoin Bond Company, contends that halvings are now immaterial to market dynamics.

Similarly, macroeconomic factors, institutional capital flows, regulatory developments, and the adoption of exchange-traded funds (ETFs) have become just as, if not more, significant in determining the course of Bitcoin’s price, according to Martin Burgherr, Chief Clients Officer at Sygnum Bank. The halving event is now only one of many inputs in a sophisticated market model, rather than the primary impetus as the market develops.

From Halvings to Macroeconomics: Bitcoin’s Market Drivers Are Changing

According to technical and market structure analysis, this argument supports Bitcoin’s lessened supply shock effect. In previous cycles, supply squeezes were caused by halving events, which drastically reduced the rate at which new Bitcoin entered the market. Today, however, price movement reacts more to demand-side shocks and macro liquidity conditions than to mining rewards alone because a significant amount of supply is already held by long-term holders and is deeply integrated into institutional investment products.

Major factors for traders today include global interest rate developments, ETF inflows, and risk-on mood in stocks. The increasing impact of institutional capital and traditional finance linkages raises the possibility that Bitcoin’s future market rhythm may deviate from the four-year pattern, even if some analysts continue to believe that the halving cycle is still relevant, particularly given its planned scarcity.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.