AES Price Outlook: The Shares Face Bearish Pressure

Even though capital flows and analyst signals are conflicting, AES (AES) is currently showing a bearish technical configuration in a volatile market environment. Navigating possible negative risks and determining entry points requires an awareness of the complex market indicators and technical patterns surrounding AES for investors who prioritize data-driven decision-making.

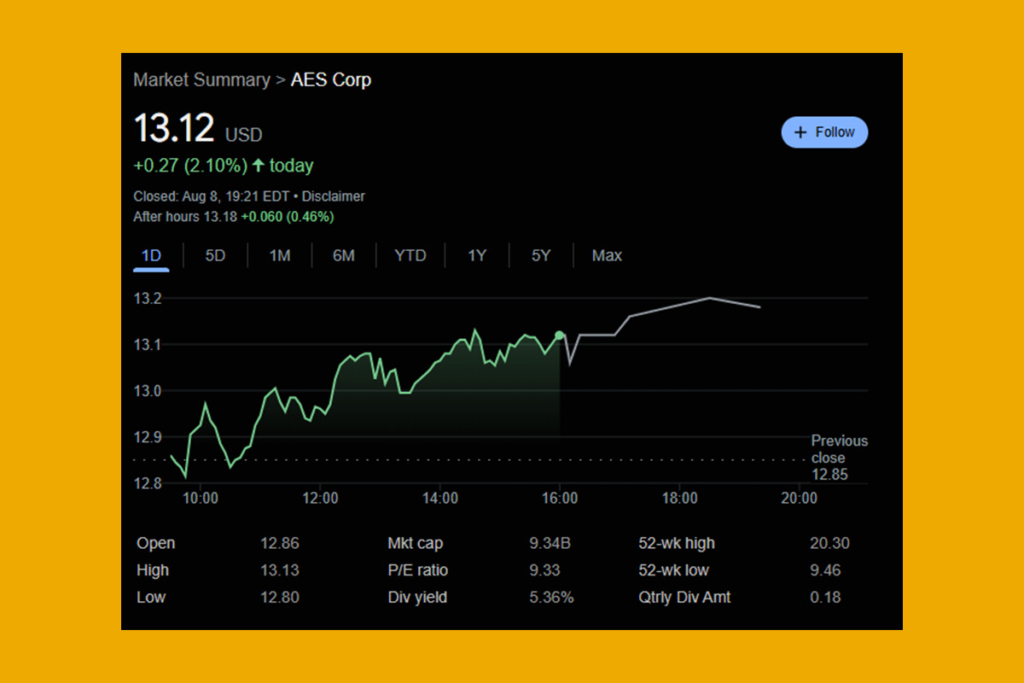

Death Cross and Weak RSI Point to Prolonged Downtrend

There are a number of unavoidable bearish signs on the AES chart. Most significantly, a traditional death cross, which frequently signals prolonged negative momentum, has been formed when the 50-day moving average crossed below the 200-day moving average.

The Relative Strength Index (RSI), which measures momentum, is currently at 38, which suggests that bears are currently controlling market mood and show little purchasing activity. A drop in trading activity, as indicated by volume analysis, is frequently an indication of waning investor confidence. The bearish technical outlook is expected to continue unless AES is able to recover important support zones and break above crucial moving averages.

Analysts Divided Despite Bearish Technicals

Despite the technical charts’ pessimistic outlook, analyst sentiment about AES is still divided. Some analysts point to the project’s solid foundation and long-term prospects, highlighting new collaborations and advancements. Conversely, some warn that sector-wide sell-offs and macroeconomic challenges may still have an impact on the performance of the AES price.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.