Featured News Headlines

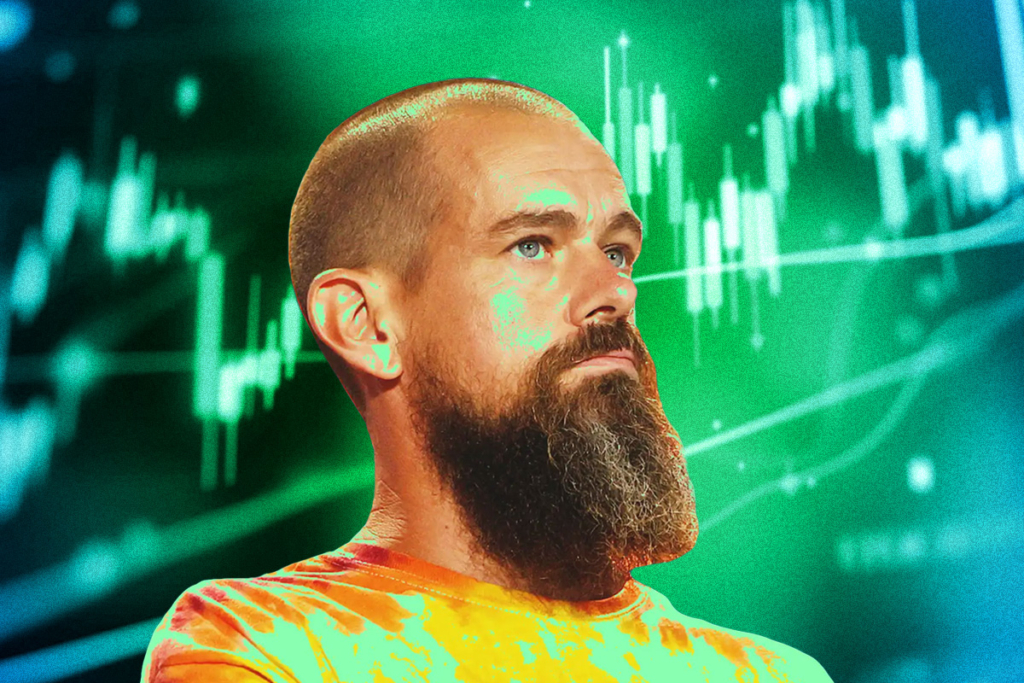

Jack Dorsey’s Block Reports: Revenue Up 1.5%, Bitcoin Holdings Continue to Grow

Jack Dorsey’s Block Inc. continues to make headlines with its steady Bitcoin accumulation strategy. In the second quarter, the company added 108 BTC, bringing its total corporate treasury holdings to 8,692 BTC. This ongoing purchase reflects Block’s cautious but confident approach to integrating cryptocurrency into its financial ecosystem.

Impressive Q2 Revenue and Profit Growth

According to the latest 10-Q filing submitted to the U.S. Securities and Exchange Commission, Block reported total revenue of $6.05 billion in Q2. This marks a 1.5% increase from the $5.96 billion posted in Q1. Gross profit also rose significantly by 8.2%, reaching $2.54 billion compared to $2.33 billion last quarter. These figures highlight the company’s strong operational performance alongside its bitcoin investments.

Bitcoin Sales Drive Revenue Through Cash App

A notable portion of Block’s revenue, approximately $2.14 billion, was generated from Bitcoin sales via Cash App. This segment produced a gross profit of $66 million from the world’s largest cryptocurrency, reinforcing the growing demand for bitcoin-related services within the company’s product lines.

Strategic Bitcoin Investment and Gains

The latest Bitcoin purchase came with a cost basis of $11 million, adding to the total bitcoin investment of approximately $1.15 billion at current market prices near $117,000 per BTC. The company also reported a substantial $212.2 million gain from the remeasurement of its Bitcoin holdings during Q2, a major turnaround from a $70.1 million loss recorded in the same quarter last year.

Sustainable Approach to Corporate Bitcoin Adoption

Experts like Charmaine Tam, head of OTC trading at Hex Trust, emphasize Block’s measured accumulation strategy as a sustainable blueprint for corporate Bitcoin adoption, contrasting it with higher-risk models. Block’s incremental buying, combined with integrating crypto services such as enabling Bitcoin payments via Square and developing Bitcoin mining hardware, showcases a pragmatic way to adopt digital assets without excessive capital exposure.

Market Reaction and Future Outlook

Following the Q2 report, Block’s shares surged by 6% in after-hours trading. Recently added to the S&P 500 index, the fintech company appears poised to strengthen its role in the evolving crypto landscape. As Tam notes, real-world product utility remains the key to long-term success beyond treasury adoption.

Comments are closed.