Featured News Headlines

ETH Golden Cross- Is Ethereum Poised for a Massive Institutional Buying Wave?

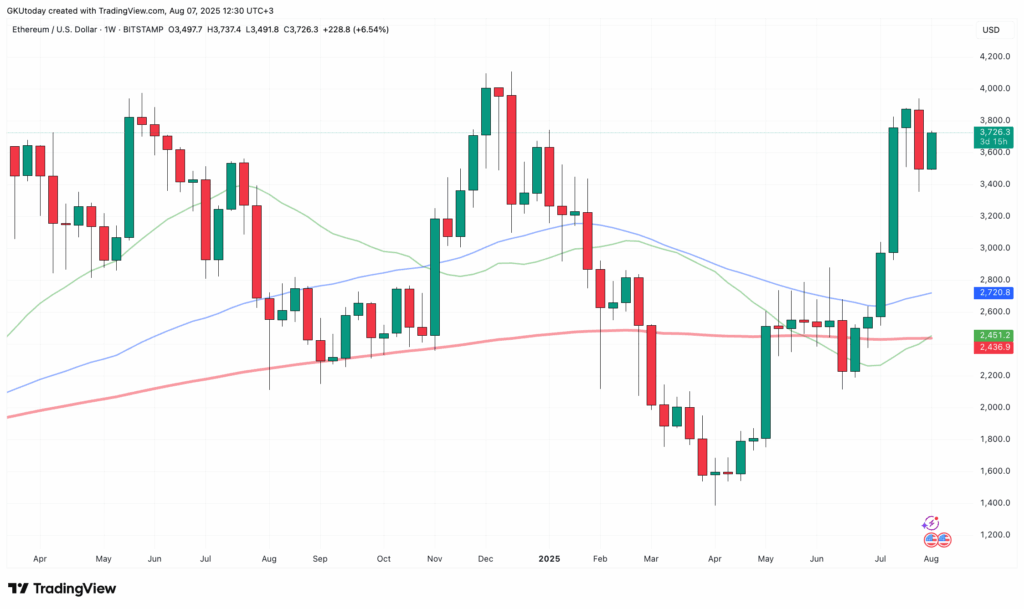

ETH Golden Cross– Ethereum (ETH) just triggered a rare golden cross on the weekly chart, signaling a potential bullish surge. But beyond the technicals, something even bigger is unfolding: corporate giants are quietly accumulating ETH at unprecedented levels.

$7.6 Billion in Reserves — And Counting

New data from DropsTab reveals publicly listed companies currently hold $7.59 billion worth of Ethereum. Yet, these firms have set their sights far higher, targeting a combined total of $30.4 billion in ETH reserves. That leaves a staggering $23 billion demand gap waiting to be filled — a sign that institutional interest in Ethereum is only accelerating.

Big Players Are Going All In

Leading the pack is Bitmine (BMNR), aiming to acquire a massive 5% of Ethereum’s total supply, which translates to a $22 billion target. Other companies like SharpLink Gaming and BTCS Inc. are also scaling up their holdings, targeting $3.6 billion and $2 billion respectively — well beyond their current positions.

Supply Crunch Ahead?

This isn’t hype-driven speculation; it’s real balance-sheet demand. With Ethereum’s supply potentially tightening as institutions prepare to buy, we could be on the cusp of a new market phase. The golden cross confirms this shift — price charts show green, but it’s the positioning that truly matters now.

ETH’s Next Bull Cycle May Be Here

With fundamental demand and macroeconomic factors finally aligning, Ethereum appears primed for a fresh bull run. The question isn’t if ETH will rise, but how high and how fast institutional buying will push it.

Comments are closed.