Bitcoin Price Outlook: Smart Money Bets on Big Q4 Rebound

Bitcoin Price – Bitcoin’s recent 7% drop from its $123.4K all-time high to around $114K may look alarming at first glance. But on-chain metrics suggest a bullish re-accumulation, not a breakdown. According to data from Swissblock, momentum started flipping bullish even before BTC hit $112.3K, a signal that smart money may be buying the dip.

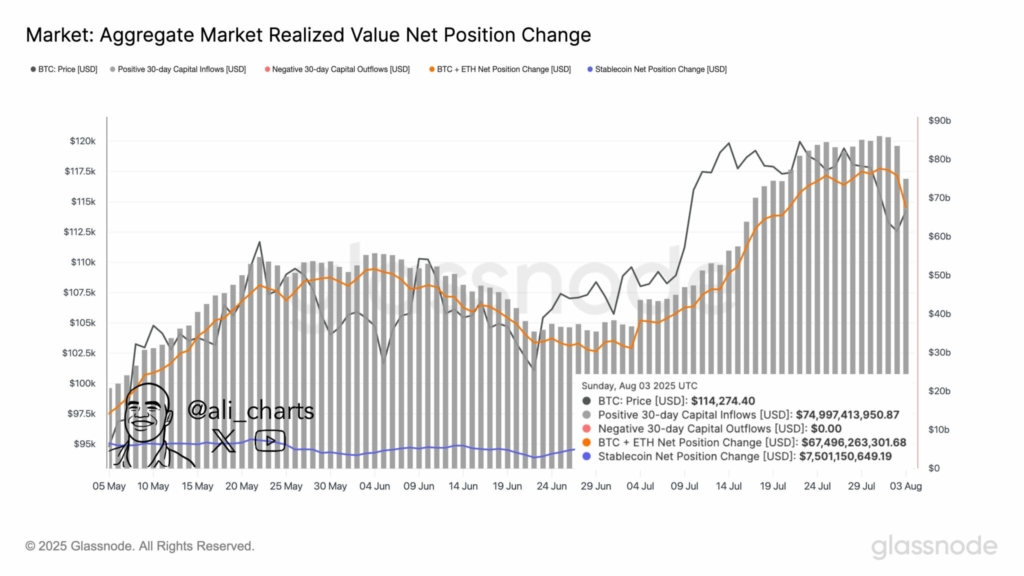

Despite a $10 billion capital outflow, Bitcoin [BTC] showed impressive resilience, holding above the crucial $110K support level. Analysts point out that the absence of mass panic selling during this drop reflects conviction among long-term holders.

Binance Reserves Hint at Big Moves Ahead

A key bullish indicator is the rising Binance ERC20 stablecoin reserves, now hovering above $32.3 billion. Historically, such spikes often precede significant capital inflows into Bitcoin and large-cap tokens. In other words, whales are waiting—and ready.

Why Q4 Could Be Bitcoin’s Best Shot at $200K

Historically, Q4 is Bitcoin’s strongest quarter, particularly when institutional investors return after summer. Net inflows are steady at $75 billion, with BTC and ETH position changes positive by over $67 billion.

If this momentum continues, fueled by ETF inflows, treasury allocations, and improving macro liquidity, Bitcoin could realistically aim for $200K by late Q4. This recent correction might just be the shakeout needed to clear leverage and reset the bullish structure.

Comments are closed.