Financial Institutions Could Face Major Penalties Under Trump Banking Order

An executive order urging banking authorities to look into debanking allegations made by conservatives and the cryptocurrency industry is allegedly on the table for US President Donald Trump. The task of looking into potential violations of antitrust, consumer financial protection, or fair lending practices would fall to bank regulators. Fines or other legal action may be imposed on those found in violation of the laws. It has been rumored that Trump will sign the order this week, but the White House may alter or postpone the plan.

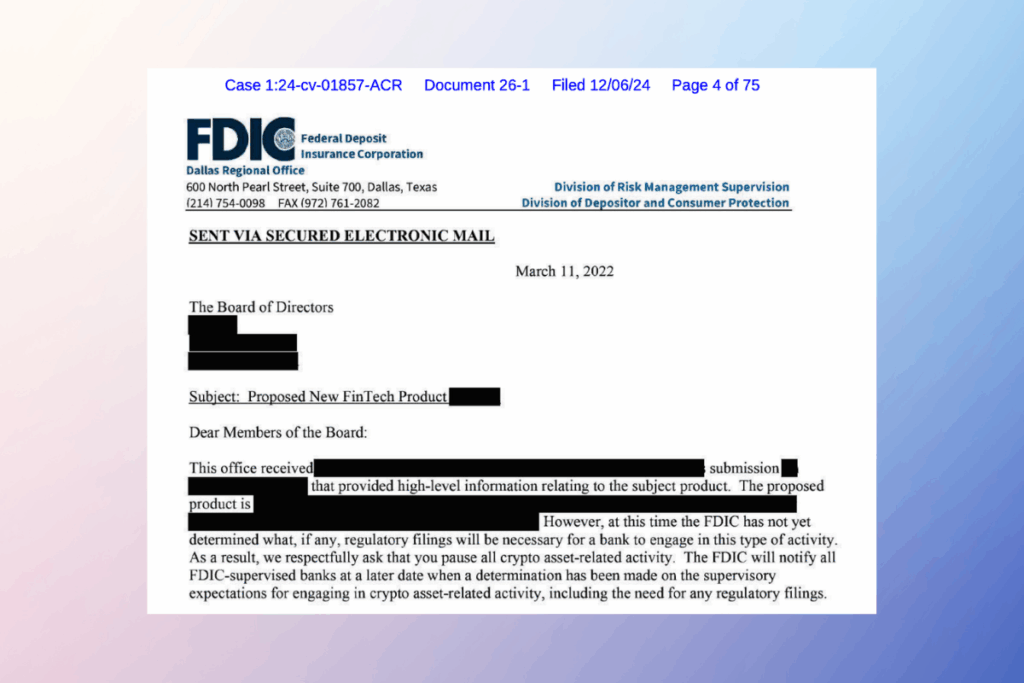

Justice Department Could Probe Banks Over Rules Targeting Crypto Firms

According to the alleged draft directive, bank regulators are instructed to revoke any rules that would have caused banks to lose clients, including cryptocurrency companies. The Small Business Administration of the US government is also instructed to examine banking procedures that support the agency’s small business loans. To facilitate the Department of Justice’s investigation, the directive requests that regulators forward certain potential infractions to the attorney general.

Trump Pushes Back Against De-risking in Banking Industry

According to reports, the order would also look into banks’ alleged denial or cancellation of services to political conservatives. No particular banks were mentioned in the text. The financial institutions that are alleged to have assisted federal authorities in their investigation into the disturbances at the US Capitol on January 6, 2021, were criticized, nevertheless.

On the basis of their political views, conservatives have also said that banks have refused them services. The approach is known as derisking in the financial sector. Regardless of whether the account holder presents a risk to the company’s finances, reputation, or legal standing, financial institutions have the authority to terminate accounts.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.