Featured News Headlines

- 1 Crypto Market Warning? Heavy Shorts Signal Market Caution Amid Crypto Volatility

- 2 Heavy Shorts and Selective Longs Define Wintermute’s Portfolio

- 3 What Wintermute’s Shorts Say About Altcoins and Market Sentiment

- 4 Contrasting Market Signals: Derivatives Traders Stay Bullish

- 5 Retail Traders Beware: Wintermute’s Small-Cap Shorts May Spell Trouble

Crypto Market Warning? Heavy Shorts Signal Market Caution Amid Crypto Volatility

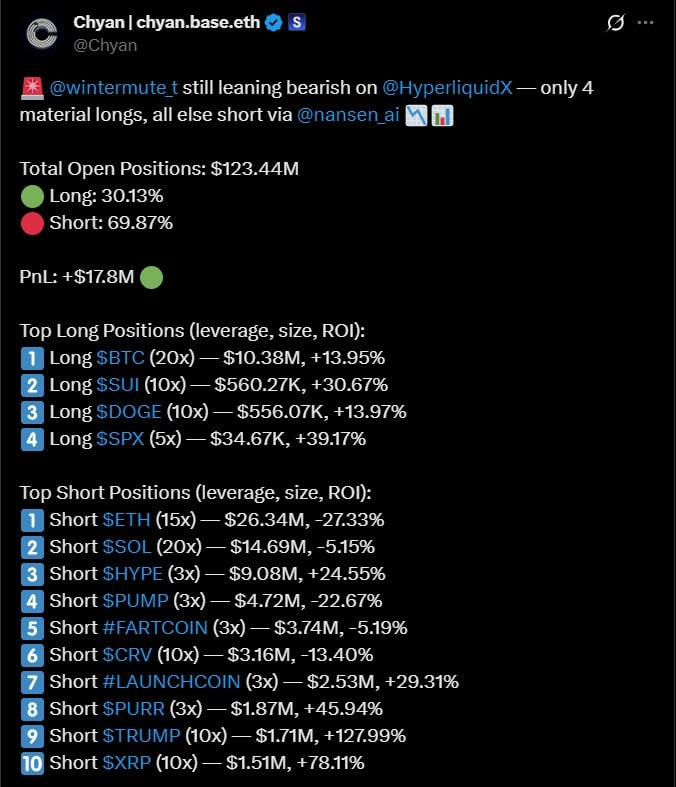

Crypto Market Warning?– Market maker Wintermute is quietly recalibrating its strategy as volatility rattles crypto markets. With $123 million under management, the firm has pivoted heavily toward short positions, signaling cautious sentiment in these turbulent times.

Heavy Shorts and Selective Longs Define Wintermute’s Portfolio

Nearly 70% of Wintermute’s portfolio is positioned bearish across ten key assets. Their notable longs? Bitcoin (BTC), Sui (SUI), Dogecoin (DOGE), and the S&P 500 (SPX), but these are relatively modest compared to the aggressive short bets. Their largest long—Bitcoin with $10.38 million at 20x leverage—has delivered solid 13.95% gains. Meanwhile, shorts on assets like Official Trump (TRUMP) and Ripple (XRP) have returned a whopping 128% and 78%, highlighting Wintermute’s sharp eye for downside plays.

What Wintermute’s Shorts Say About Altcoins and Market Sentiment

The firm’s large short positions in Ethereum (ETH), Solana (SOL), and Curve DAO (CRV) reveal deep skepticism toward near-term altcoin rallies. A $26.3 million short on ETH alone reflects strong conviction despite a -27.33% return so far. Small-cap tokens like FARTCOIN and PUMP are also in Wintermute’s crosshairs, showcasing a clear risk-off stance focused on volatile, low-liquidity assets.

Contrasting Market Signals: Derivatives Traders Stay Bullish

Despite Wintermute’s defensive posture, most derivatives traders remain optimistic. Positive funding rates for BTC and ETH across major exchanges suggest continued bullish bets. However, Solana tells a different story—with negative funding rates and plunging open interest, plus Wintermute’s $14.7 million short, SOL could be the canary in the coal mine signaling further downside.

Retail Traders Beware: Wintermute’s Small-Cap Shorts May Spell Trouble

Wintermute’s heavy shorts in smaller tokens with high open interest—like TRUMP and FARTCOIN—point to potential retail traps. Sharp open interest surges here could reflect reactive retail buying, which smarter traders might exploit. Timing entries carefully around these moves will be crucial for savvy investors.

Comments are closed.