Macro Headwinds Hit Crypto Market: Fed Rate Cut Odds Fade

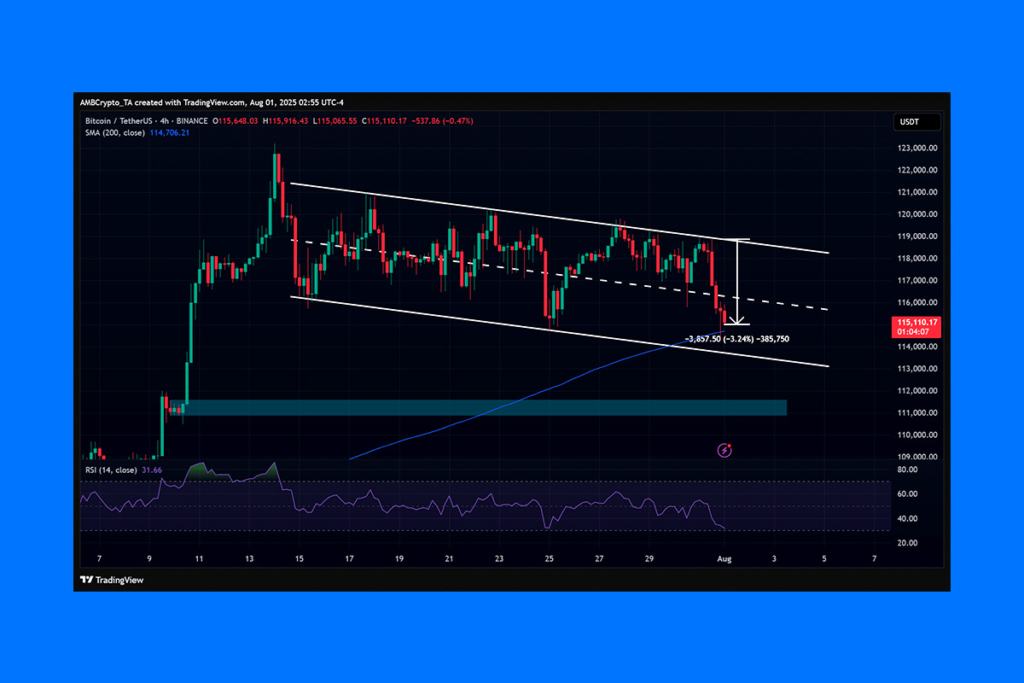

Crypto market sell-offs were sparked by macro headwinds associated with increased tariffs and sticky inflation, as the likelihood of a Fed rate decrease in September continues to decline. Amid further economic headwinds brought on by inflation and tariff concerns, the markets for cryptocurrencies and US stocks fell. As of this writing, Bitcoin had dropped 2.30% below $115 before rising back to the same level. Similarly, Google Finance data shows that the S&P 500 Index (SPY) fell 37 basis points.

New U.S. Tariffs Spark Global Trade War Fears

President Donald Trump‘s tariffs have been formalized by an executive order, the White House recently revealed, and Canada will now be subject to a more severe 35% charge instead of the present 25%. This negative risk emerged subsequent to the announcement. Overall, a number of international trading partners have raised their new tariff rates by 10% to 40%. To allow for talks, they will take effect seven days after the order is issued.

These modifications shall be effective … on or after 12:01 a.m. eastern daylight time 7 days after the date of this order.

Part of the order

Therefore, any tariff decisions and negotiations that take place over the next several days may cause market fluctuations.

Core PCE Rises Again: Fed’s Inflation Fight Far From Over

The increase in core PCE (Price Consumer Expenditures), the Fed’s preferred inflation indicator, was another source of pressure. After excluding the cost of food and energy, the indicator increased by 0.3% in June from 0.2% in May. The year-over-year core PCE rose to 2.8%, above the anticipated 2.7%, even if the month-over-month change was within the economists’ prediction of 0.3%. This damaged the rate-cut prognosis for September and meant that inflation was still sticky and higher than the Fed’s target of 2.0%.

The sharp rise in core goods inflation will do little to ease the Fed’s concerns about tariff-driven inflation.

Capital Economics assistant economist Harry Chambers

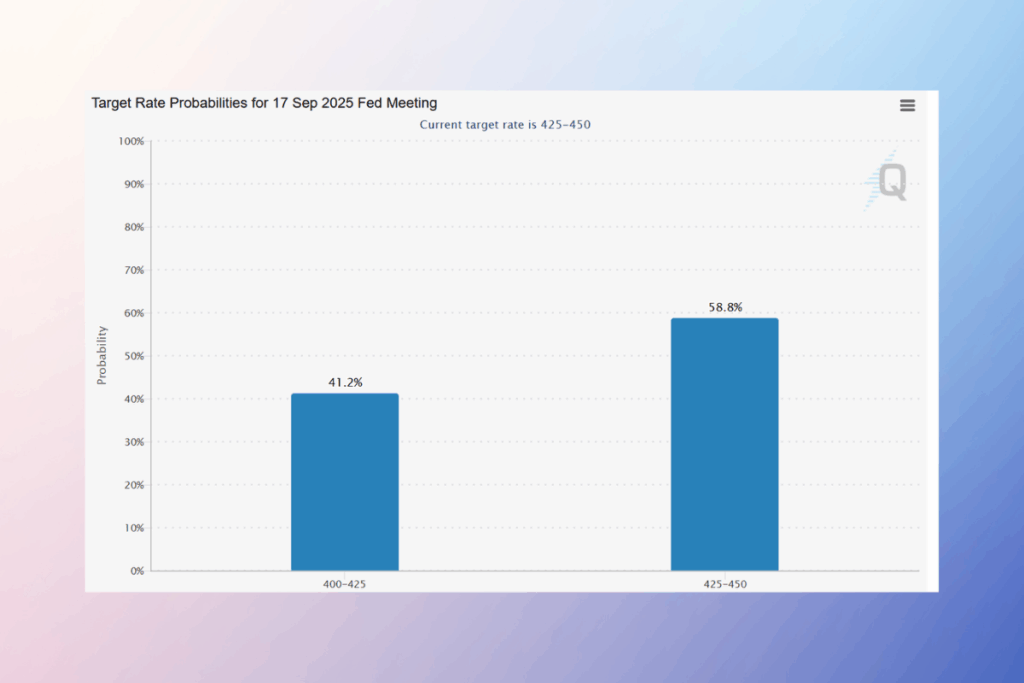

The likelihood of a September rate cut of 25 basis points has dropped from nearly 60% to 43% in the last three days. As markets recalculated expectations for the end of Q3, the odds fell even further to 41% following the most recent inflation report. The traders were now factoring in a greater likelihood of a rate pause in September at 58%. Additionally, risk-on markets may be stalled.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.