Ethereum ETFs Smash Records: BlackRock Tops $18.2M as Daily Inflows Continue

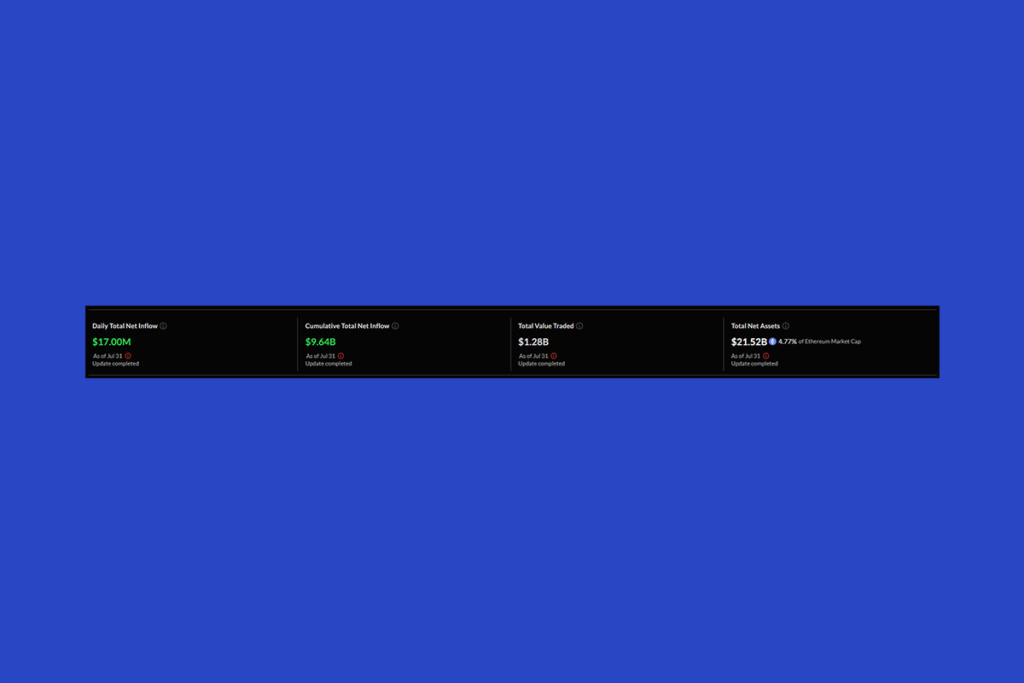

On Thursday, spot Ethereum exchange-traded funds recorded their longest run of positive flows since launch, with net inflows for the 20th day in a row. According to SoSoValue data, the spot ether ETFs witnessed a $17 million daily net inflow yesterday. With $18.2 million, BlackRock’s ETHA led net inflows, followed by $5.62 million into Fidelity’s FETH. Grayscale’s ETHE experienced net outflows of $6.8 million in response to this.

Ethereum ETF Bull Run Smashes May’s Record With $5.4B Surge

Both the length and volume of inflows during the most recent 20-day run are longer than the previous 19-day streak from May 16 to June 12. The cumulative inflows during this 20-day inflow run were close to $5.4 billion, compared to $1.37 billion during the preceding streak. Only nine days of net outflows occurred from spot ETH ETFs over the last three months. The ETH ETFs currently have $21.52 billion in total net assets, or 4.77% of the entire Ethereum market capitalization, thanks to the steady flow of net inflows.

BTC ETF Outflows Surge, Fueling Ethereum’s Bullish Rotation Trend

As previously stated, the market is presently undergoing a natural rotation from Bitcoin to Ethereum, according to Presto Research Analyst Min Jung. Investors who feel they lost their opportunity to purchase Bitcoin during its surge beyond $123,000 last month are the ones driving this change. Spot Bitcoin ETFs saw worse inflows on Thursday, with net outflows of $114.83 million, which is consistent with this trend.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.