Featured News Headlines

Bitcoin Price- Powell’s Pause Shakes Markets

Bitcoin Price– The Federal Reserve’s decision to keep interest rates at 4.25-4.5% sent a clear message: no immediate easing despite inflation concerns. Bitcoin [BTC] responded by hovering just below the $120,000 resistance level, showing signs of consolidation but little momentum.

Long-Term Holders Begin to Trim Exposure Amid Uncertainty

While Bitcoin’s price appears stable on the surface, on-chain data reveals a subtle shift. Long-term holders (LTHs) have sold over 207,000 BTC in the past month, signaling growing caution ahead of potential macroeconomic headwinds. This strategic de-risking hints that savvy investors might be preparing for tougher times ahead.

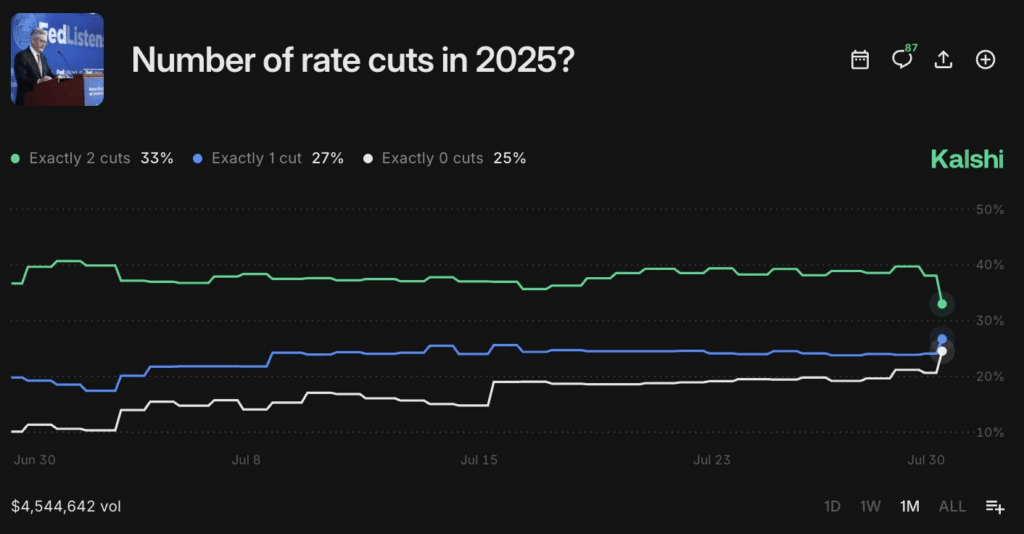

Powell’s Pause Triggers Market Repricing

Fed Chair Jerome Powell’s ambiguous stance on a possible rate cut in September caused a swift recalibration. The odds of a September cut dropped sharply from over 90% to 41%, and expectations for easing throughout 2025 have diminished. This dampens hopes for a Q4 Bitcoin breakout, compressing its upside potential.

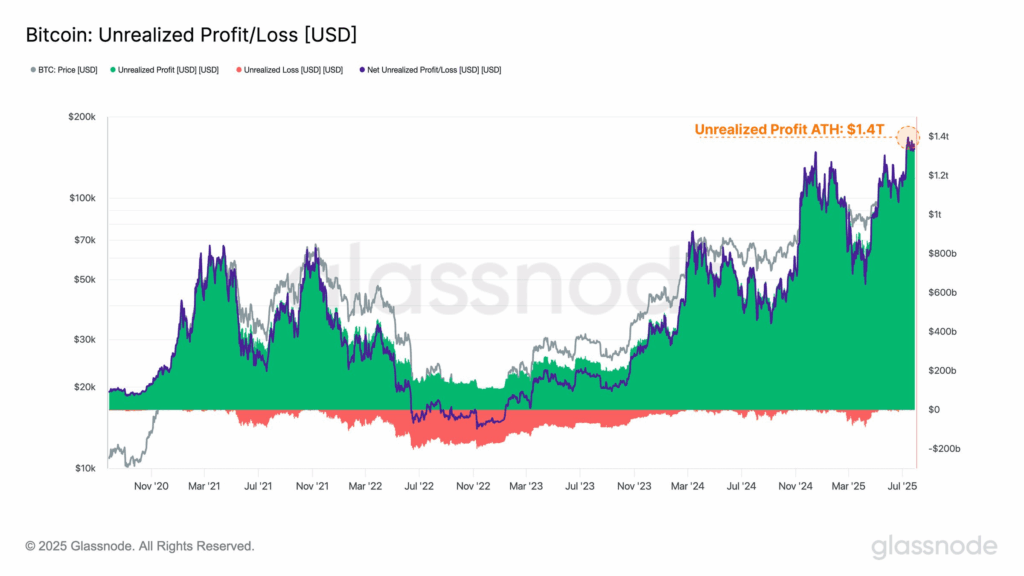

Bitcoin’s Record Paper Gains Mask Waning Conviction

Despite Bitcoin’s total unrealized profit reaching a historic $1.4 trillion, the Fear & Greed Index suggests that traders’ risk appetite is waning. Without fresh catalysts, this massive latent supply could soon pressure the market as some investors take profits.

Comments are closed.