Featured News Headlines

JUP Price- Key Support Levels to Watch After 10% Dip

JUP Price– Jupiter (JUP) saw a sudden 10% price drop in the last 24 hours, sparking concern among investors. The sharp decline is mainly driven by a wave of liquidity exiting both spot and derivatives markets, signaling short-term uncertainty.

Technical Signals Point to a Possible Quick Recovery

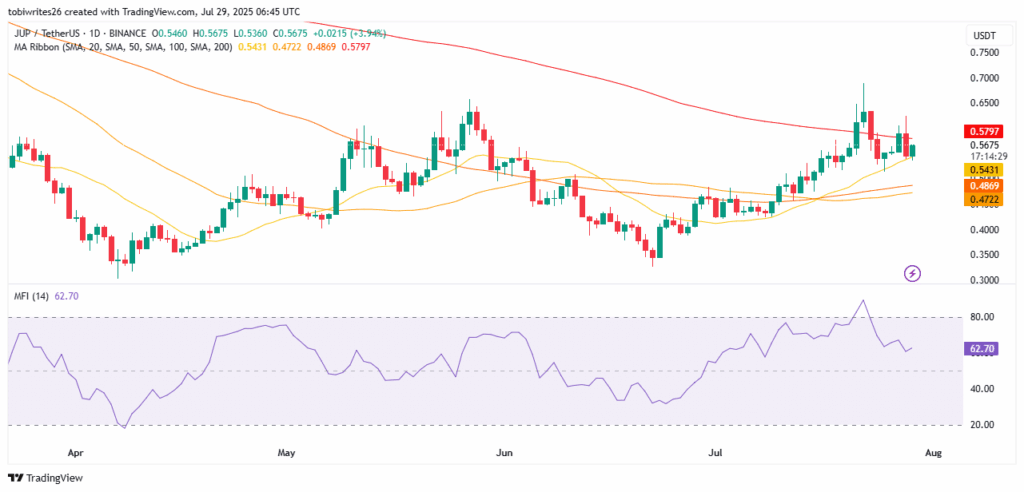

Despite the drop, JUP might bounce back soon. The token recently tested its 20-day Moving Average (MA) — a key technical level that often acts as strong support or resistance. At the time of writing, JUP trades just above this level at $0.5675, with bullish momentum visible through a green candlestick.

The Money Flow Index (MFI) supports this optimistic outlook, currently reading 62.7, which suggests strong buying interest. Typically, an MFI above 50 moving toward 80 signals robust liquidity inflows and potential price rallies.

Mixed Signals from the Derivative Market

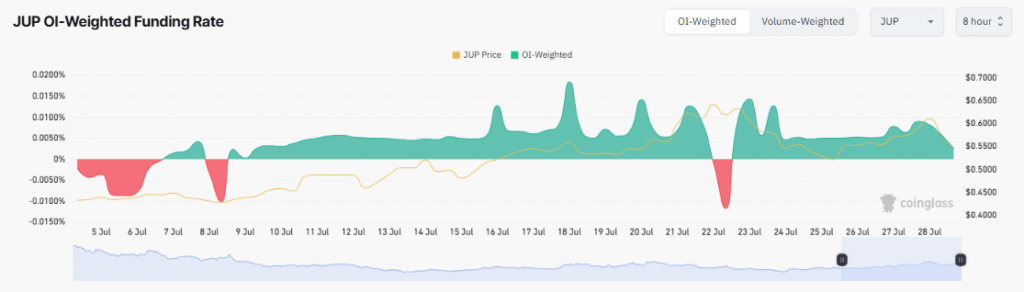

However, the derivative market shows a more complex picture. Open Interest dropped sharply by nearly 15%, with over $25 million in JUP contracts closed recently, indicating that many buyers may be strategically exiting positions.

Still, the Open Interest Weighted Funding Rate remains positive at 0.0027%, pointing to bullish sentiment among traders holding long positions — although this rate is trending downward, so caution is warranted.

Spot Market Pressure Adds to Downside Risk

Meanwhile, spot market traders have intensified selling, unloading $1.18 million worth of JUP in just 48 hours. This significant outflow reflects a shift in sentiment from long-term confidence to short-term caution, as traders brace for further declines.

Comments are closed.