Featured News Headlines

Ethereum Price- Traders Eye $5,000 as Key Resistance Nears

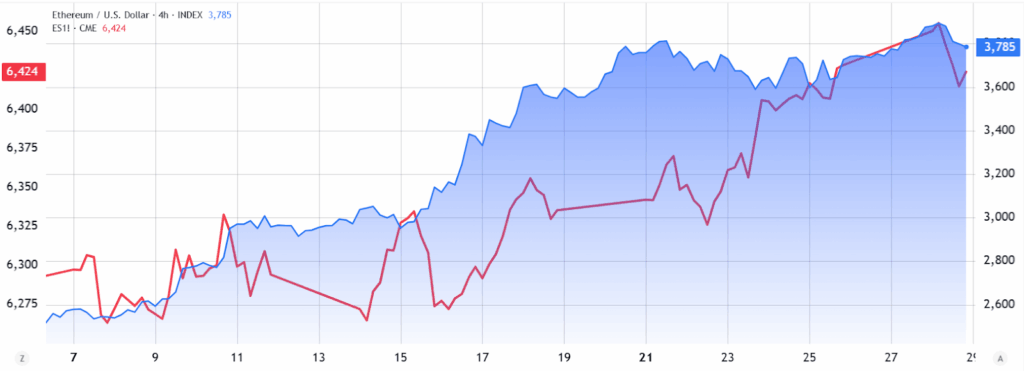

Ethereum Price– Ethereum (ETH) briefly touched $3,940 before pulling back 4% to around $3,855—but don’t be fooled. This drop wasn’t unique to ETH. It mirrored the broader crypto market correction, signaling no ETH-specific weakness. In fact, some indicators suggest this could be the calm before a big move.

Derivatives Show Quiet Confidence

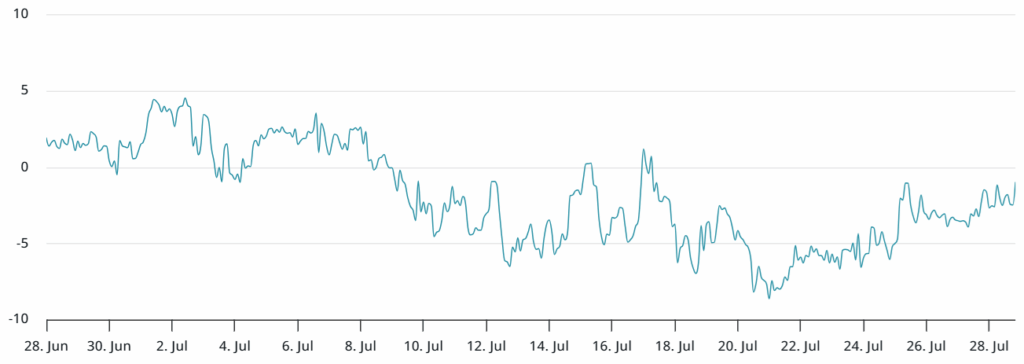

Despite the dip, Ethereum’s futures premium has quietly climbed to 8%—its highest point in five months. Normally, this metric sits between 5% and 10% in neutral markets. This uptick shows that traders aren’t panicking—they’re holding steady, possibly preparing for a breakout past $4,000.

Add to that: ETH has jumped 55% in just three weeks. Yet, leverage remains underused—leaving room for bulls to push harder.

Corporate Reserves Are Stacking Up

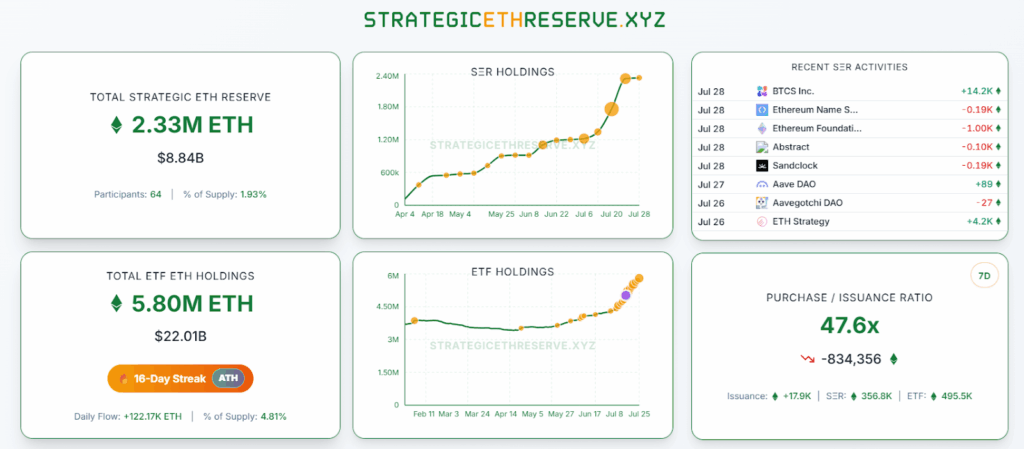

Over 40 companies now hold more than 1,000 ETH in their reserves. That’s at least $3.8 million each. Notable holders include Bitmine Immersion Tech and SharpLink Gaming, with combined ETH reserves worth a staggering $8.84 billion.

This trend is accelerating fast, especially when compared to Bitcoin. Outside of Bitcoin giants like Michael Saylor’s Strategy, only eight companies hold over $1 billion in BTC.

What Comes Next?

With global markets watching the upcoming U.S.–China tariff deadline (Aug. 12), many investors are shifting to safer assets. But Ethereum’s strong position in both corporate reserves and derivatives markets tells a different story.

Bottom line? If ETH clears $4,000 with conviction, a rally toward $5,000 is firmly in play.

Comments are closed.