Featured News Headlines

Crypto Market Dips: Is This the Start of a New Downtrend?

Crypto Market Dips – The crypto market cap has just posted its first red weekly candle after four consecutive green weeks, signaling a potential slowdown in bullish momentum. The 5% drop, from nearly $4 trillion to $3.78 trillion, has triggered widespread liquidations, particularly among over-leveraged short-term traders.

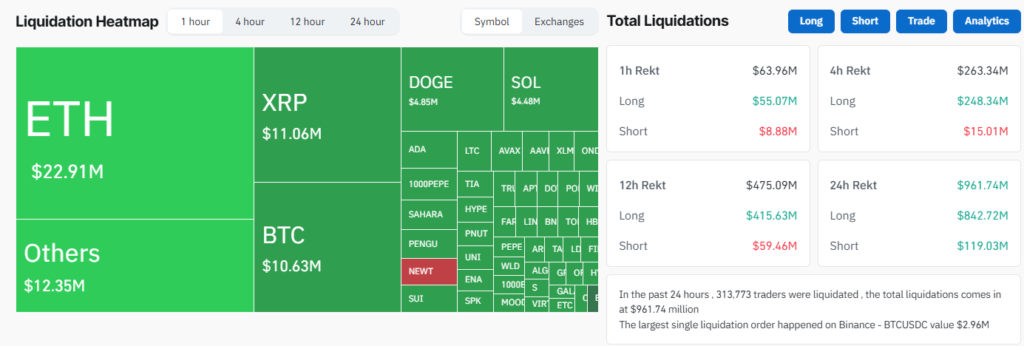

Nearly $1 Billion Liquidated in 24 Hours

Data from CoinGlass revealed that nearly $1 billion worth of crypto positions were liquidated over the past 24 hours, affecting more than 314,000 traders. A staggering $840 million of that came from long positions, reflecting a mass misjudgment by those expecting further gains.

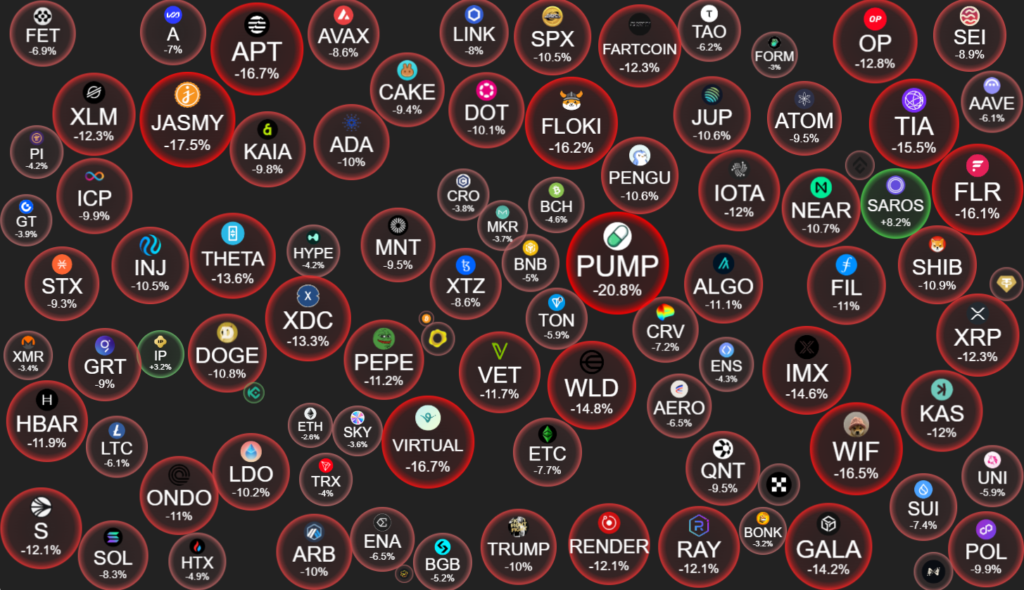

While Bitcoin saw only a mild pullback, the altcoin market cap (TOTAL2) plunged nearly 10%, falling from $1.57 trillion to $1.4 trillion. Data from CryptoBubbles showed most altcoins were hit hard, with some dropping more than 20% in a single day.

Asian Traders Drove the Rally—But Are Now Feeling the Pain

According to a 10x Research report, Asian trading hours were the biggest driver behind the recent market rally. Bitcoin’s 16% rise in the last month was largely fueled by Asian buyers, who contributed a +25% gain during their trading hours. In contrast, Europe (-6%) and the US (-3%) saw net selling, likely due to profit-taking.

A similar trend was seen with Ethereum, which rose 63% in July—with nearly 96% of that gain also occurring during Asian hours.

Ironically, news from Western markets that sparked Asian buying enthusiasm may now be prompting the very sell-off that’s hurting those same traders.

Analysts Say This Is Just a Healthy Pullback

Despite the sudden dip, market sentiment remains in the “greed” zone, with no signs of panic. Crypto investor Kaleo described the correction as a “sensible sell-off,” while Binance founder CZ simply called it “a dip again.”

Many see this as a normal profit-taking phase, not the end of the uptrend—suggesting that altcoins may bounce back even stronger in the coming days.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.