Featured News Headlines

Tether CEO Paolo Ardoino on Audit Challenges and MiCA Compliance

Tether CEO Paolo Ardoino recently gave the crypto world a rare peek into the company’s expanding investment bucket, showcasing a diverse portfolio spanning over 120 companies. Unlike many expectations, these investments are not funded by stablecoin reserves but from the company’s own profits, highlighting a strategic shift well beyond just issuing stablecoins.

Ardoino explained that Tether’s profits, projected at $13.7 billion in 2024, come mainly from yield on its massive $130 billion US Treasury holdings. The portfolio includes notable names such as Bitdeer, Northern Data, Holepunch, Synonym, Quantoz, and others involved in areas like digital infrastructure, decentralized communications, AI, and fintech.

Tether Ventures: Expanding Influence in Crypto Ecosystem

This investment spree shows Tether’s ambition to become a central player in the crypto ecosystem, moving far beyond its role as a stablecoin issuer. According to Ardoino, the goal is to strengthen USDT’s position amidst tightening global regulations and create new revenue streams. Industry insiders like Tran Hung, CEO of Web3 infrastructure firm UQUID, praised Tether as “a giant of the 21st century, building far beyond stablecoins.”

European Market Challenges: MiCA Regulations Hold Back Tether

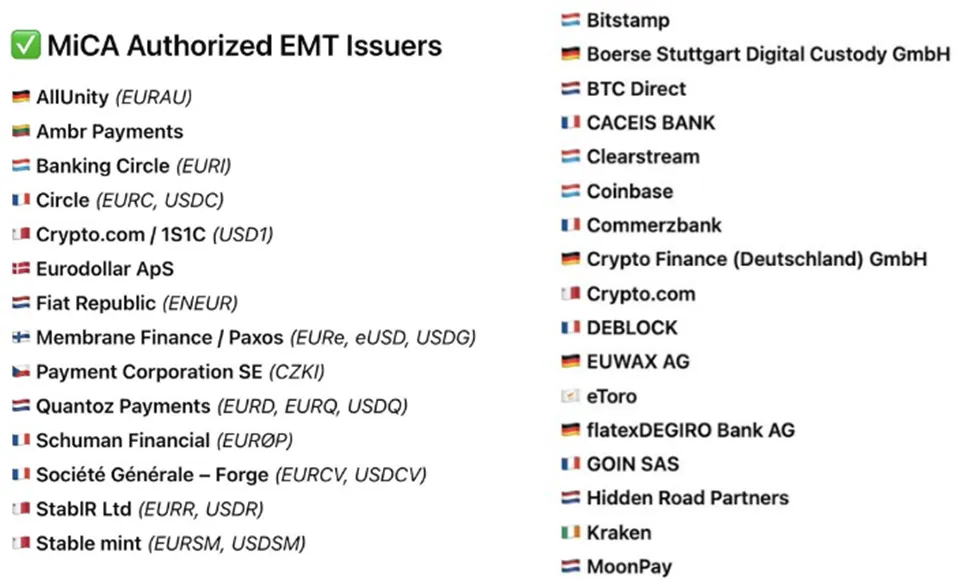

Despite its global ambitions, Tether faces significant hurdles entering Europe due to the strict new MiCA (Markets in Crypto Assets) regulations. While the EU recently approved 53 crypto firms under MiCA, Tether and Binance notably did not make the list. MiCA demands include full reserve backing, strict transparency, and holding a substantial portion of reserves in EU-regulated banks, creating a tough compliance environment.

Ardoino expressed reluctance to engage under these conditions, stating Tether won’t enter Europe until the regulatory landscape becomes safer for consumers and issuers. He also revealed challenges in securing a top-tier audit firm due to the crypto industry’s tarnished reputation from recent scandals.

Audit Concerns and Regulatory Outlook

Tether has faced criticism for its continued failure to produce an independent audit of its reserves, a key requirement under MiCA. Consumer advocacy groups have flagged this as a major risk for USDT’s future regulatory acceptance.

The next big milestone will come in September 2025, when the EU will release a status update on MiCA’s implementation, potentially shaping Tether’s European plans.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.